Case Study The Collapse of Lehman Brothers

Post on: 22 Апрель, 2015 No Comment

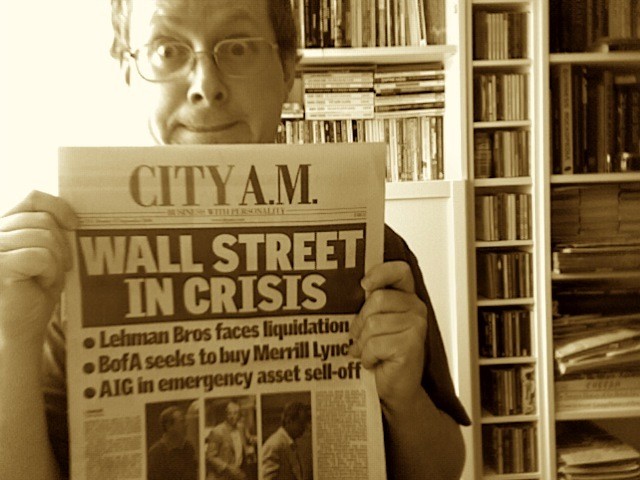

On September 15, 2008, Lehman Brothers filed for bankruptcy. With $639 billion in assets and $619 billion in debt, Lehman’s bankruptcy filing was the largest in history, as its assets far surpassed those of previous bankrupt giants such as WorldCom and Enron. Lehman was the fourth-largest U.S. investment bank at the time of its collapse, with 25,000 employees worldwide. Lehman’s demise also made it the largest victim, of the U.S. subprime mortgage -induced financial crisis that swept through global financial markets in 2008. Lehman’s collapse was a seminal event that greatly intensified the 2008 crisis and contributed to the erosion of close to $10 trillion in market capitalization from global equity markets in October 2008, the biggest monthly decline on record at the time. (For more information on the subprime meltdown, read Who Is To Blame For The Subprime Crisis ? )

The History of Lehman Brothers

The Beginning of the End

As the credit crisis erupted in August 2007 with the failure of two Bear Stearns hedge funds, Lehman’s stock fell sharply. During that month, the company eliminated 2,500 mortgage-related jobs and shut down its BNC unit. In addition, it also closed offices of Alt-A lender Aurora in three states. Even as the correction in the U.S. housing market gained momentum, Lehman continued to be a major player in the mortgage market. In 2007, Lehman underwrote more mortgage-backed securities than any other firm, accumulating an $85-billion portfolio, or four times its shareholders’ equity. In the fourth quarter of 2007, Lehman’s stock rebounded, as global equity markets reached new highs and prices for fixed-income assets staged a temporary rebound. However, the firm did not take the opportunity to trim its massive mortgage portfolio, which in retrospect, would turn out to be its last chance. (Read more in Dissecting The Bear Stearns Hedge Fund Collapse .)

Hurtling Toward Failure

Lehman’s high degree of leverage — the ratio of total assets to shareholders equity — was 31 in 2007, and its huge portfolio of mortgage securities made it increasingly vulnerable to deteriorating market conditions. On March 17, 2008, following the near-collapse of Bear Stearns — the second-largest underwriter of mortgage-backed securities — Lehman shares fell as much as 48% on concern it would be the next Wall Street firm to fail. Confidence in the company returned to some extent in April, after it raised $4 billion through an issue of preferred stock that was convertible into Lehman shares at a 32% premium to its price at the time. However, the stock resumed its decline as hedge fund managers began questioning the valuation of Lehman’s mortgage portfolio.

On June 9, Lehman announced a second-quarter loss of $2.8 billion, its first loss since being spun off by American Express, and reported that it had raised another $6 billion from investors. The firm also said that it had boosted its liquidity pool to an estimated $45 billion, decreased gross assets by $147 billion, reduced its exposure to residential and commercial mortgages by 20%, and cut down leverage from a factor of 32 to about 25. (Read Hedge Fund Failures Illuminate Leverage Pitfalls to learn more about the double-edged sword of leverage.)

Too Little, Too Late

With only $1 billion left in cash by the end of that week, Lehman was quickly running out of time. Last-ditch efforts over the weekend of September 13 between Lehman, Barclays PLC and Bank of America, aimed at facilitating a takeover of Lehman, were unsuccessful. On Monday September 15, Lehman declared bankruptcy, resulting in the stock plunging 93% from its previous close on September 12.

Conclusion

Lehman’s collapse roiled global financial markets for weeks, given the size of the company and its status as a major player in the U.S. and internationally. Many questioned the U.S. government’s decision to let Lehman fail, as compared to its tacit support for Bear Stearns (which was acquired by JPMorgan Chase) in March 2008. Lehman’s bankruptcy led to more than $46 billion of its market value being wiped out. Its collapse also served as the catalyst for the purchase of Merrill Lynch by Bank of America in an emergency deal that was also announced on September 15. (To learn more about the financial crisis, read The 2007-08 Financial Crisis In Review . )