Carry Trade what is it

Post on: 19 Август, 2015 No Comment

Carry Trade: what is it?

What is the Carry Trade?

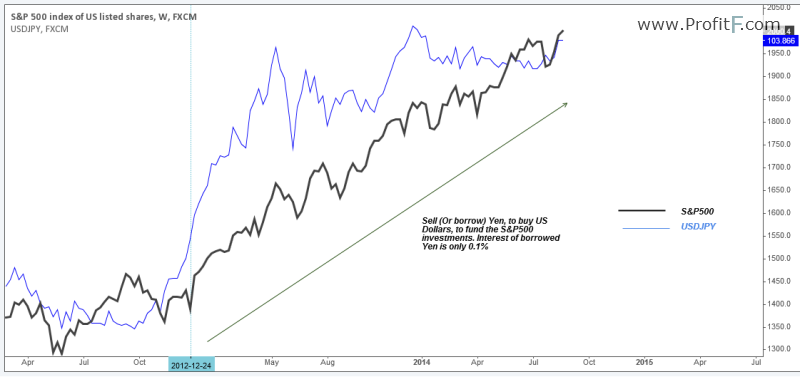

The carry trade is basically an interest arbitrage speculation. Investors (speculators ) borrow money in a country with low interest rates, and then invest that borrowed money overseas in countries that pay higher interest rates. For example, an investor (speculator) could borrow money in Japan at low interest rates, and then invest that money in Brazil at higher interest rates. By keeping that money in a faster growing deposit account, the investors hopes to make more profit than could be made at home. Then, at the end of the time period, they will take the money out of the foreign account, bring it back home, and pay off the local bank. In this example, paying back the Japanese bank from which they originally borrowed the money.

Risks to the investor:

The risk, obviously, is that the currency exchange rates may change. If the value of the Japanese Yen were to suddenly appreciate. then the amount you owe (account payable) would grow, meaning that you would suddenly owe more money than you anticipated. On the other hand, the currency that you invested in (Brazilian Real in this example) might suddenly depreciate. making your gain smaller.

Effect of this trade on FX rates:

If enough investors do this carry trade , then the sheer volume of trades can move the exchange rates of countries. How? Because when you borrow yen to invest in foreign currency, that also means that you must sell yen in the foreign exchange market (and purchase the foreign currency). You sell Yen and purchase Brazilian Reais in order to invest in the Brazilian Real-denominated deposit account. By the simple laws of supply and demand, that act of selling Yen will put downward pressure on the value of Yen (depreciation of the Yen will result, along with appreciation of the foreign currency).

When does this trade make sense?

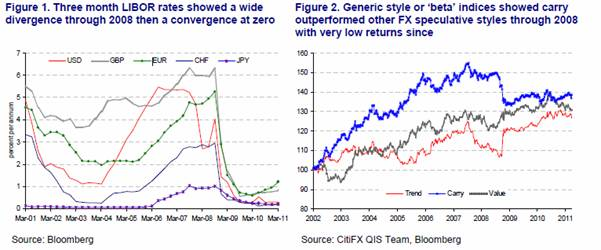

Investors (speculators) only take advantage of this type of carry trade as long as both of two conditions are met; (a) foreign exchange rates need to be relatively stable, and (b) investors must have a willingness to take on the necessary risk to conduct this trade.

As long as investors think the value of the Yen will remain low (and will not suddenly appreciate ), then they will be more willing to borrow Yen to invest abroad. But, if expectations increase that the Yen will appreciate, you will find many investors suddenly running to unwind or un-do their speculation in this carry trade.

Perhaps the most critical element that must exist in order for this trade to exist is for traders to have a healthy appetite for risk . If, on the other hand, investors suddenly loose their appetites for taking on risk (speculation on currencies is extremely risky), then you will see investors walk away from (or unwind) their carry trade positions.

Credit Crisis leads to an unwinding of the carry trade:

As a direct result of the (never-ending) credit crisis in the United States (and now globally), we have seen a trend whereby investors have decreased their appetites for risk. and have taken the flight to safety, wherever they can find it. There has been the global decision to try and preserve cash and to avoid risk. With this targeted reduction in risk, there has been a shift away from risky trades (such as borrowing Yen to invest in foreign currencies).

What if the carry trade un-winds?

An unwinding of thecarry trade positions could have the reverse effect on global currencies . Instead of borrowing money in Japan to invest overseas, we would see investors bring money back to Japan to pay off their borrowing. So, rather than selling Yen to purchase foreign currencies, we would see investors sell foreign currencies to purchase Yen.

So what is the effect? Japanese Yen appreciates. foreign currencies (that were involved) depreciate . This happens with all currencies that were being used as a carry trade. Some examples could include Brazil. New Zealand, Iceland, etc.any of the high-yielding currencies that were a carry trade partner with the Japanese Yen.

How would this effect foreign trade?

The real question to ask with all of this is.so what? What does all of this mean to your average company in any of these countries? The answer is that it has a huge effect. In the case of Japan, if the carry trade were to unwind, and if investors were to stop selling Yen to purchase other currenciesand instead began buying Yen.that would cause the currency to appreciatemaking Japanese exports less competitive globally.

On the other hand, currencies that have been on the other end of the carry tradeand have therefore unfairly been overly appreciated as a resultcould see their currencies depreciate as a result of the unwinding of the carry trademaking their exports more competitive in the global markets. This would have a sharp impact on global currency markets, which effects the comparative advantages of companies all over the globe, from Japan to Brazil etc

For further reading, please visit: