Capital Gain Allocations

Post on: 10 Июль, 2015 No Comment

Tax treatment of capital gain allocations from mutual funds.

Mutual funds that receive capital gains have a choice. In nearly all cases they pay the capital gains out to their shareholders: a capital gain dividend. But they may retain the capital gain, pay a tax, and make a capital gain allocation .

Which Is which?

It’s easy to tell which one you received. Capital gain dividends are reported in box 2a of Form 1099-DIV, Dividends and Distributions. If the mutual fund chooses to make a capital gain allocation, the allocation won’t appear on Form 1099-DIV. Instead, you’ll receive a special form: Form 2439, Notice to Shareholder of Undistributed Long-Term Capital Gains .

Where is it?

This form may arrive at a different time than other tax forms. Mutual funds and other companies are supposed to provide Form 1099-DIV by the end of January. But they have 60 days after the end of their tax year (which isn’t necessarily December 31) to provide Form 2439. If your shares are held by a nominee, it may arrive later.

What to do

When it arrives, you need to do four things:

- Report the capital gain on your income tax return for the year.

- Claim a credit for the tax paid by the mutual fund.

- Attach copy B of Form 2439 to your completed tax return.

- Adjust the basis for your shares in the mutual fund.

Overall, this tax treatment is neither good nor bad. It puts you in about the same place you’d be in if you received a capital gain dividend in cash, paid tax with part of that cash, and then bought additional shares with the cash that was left over.

Reporting the capital gain

Report the gain on line 11 of Schedule D. If your allocation contains any special categories of capital gain, check the Schedule D instructions for details on how to report these items.

Note: If you receive a capital gain allocation and subsequently incur a short-term capital loss on a sale of mutual fund shares you held six months or less, see Short-Term Capital Losses for a special rule.

Credit for Tax Paid

Now for the good part. You get to claim credit for the tax paid by the mutual fund. That tax is paid at the rate of 35%, and that’s almost always higher than the amount of tax you pay because of the capital gain allocation. So receiving a Form 2439 usually means paying less tax with your return, not more. If this additional credit means you have an overpayment, you can use it to claim a refund.

Add the amount from box 2 in every Form 2439 you receive and report the total on the appropriate line of Form 1040. When you complete Form 1040, you’ll get credit for this amount just as if it were an additional amount of tax you paid to the IRS.

Attach Copy B to your return

You should receive two copies of Form 2439, called Copy B and Copy C. (The mutual fund sends Copy A to the IRS.) When your income tax return is completed, attach Copy B to your return. Retain Copy C for your records.

Basis adjustment

There’s one more piece of business that’s easy to overlook. And it’s an important one: if you overlook it, you’ll pay too much tax when you sell your shares.

When you receive a capital gain allocation on Form 2439, you get to increase the basis in your mutual fund shares by 65% of the amount of the allocation. Why 65%? That’s the amount that’s left after you get credit for the 35% tax mentioned above. Be sure to record this basis adjustment in your records for this mutual fund. It’ll save you money when the time comes to sell your shares.

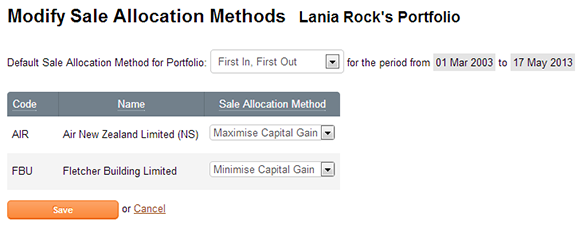

If you’re using the single-category averaging method to determine your basis, the basis adjustment is simple. Take the total amount from box 1a of Form 2439, multiply by 65%, and add the result to the total basis of your shares.

If you’re using any other method to determine your basis, you’ll need to take a few more steps:

- Start with the total capital gain allocation in box 1a of Form 2439.

- Multiply by 65% (.65).

- Divide that result by the number of shares to which it applies. This tells you the amount of the adjustment per share.

- Use this per-share basis adjustment to increase the basis of each separate group of shares you hold.

Be sure to retain Copy C of Form 2439 in your tax records as proof that you’re entitled to this basis adjustment.

Related

- Capital Gains, Minimal Taxes (book covers material discussed in these pages)

- Your Investments (easy access to related IRS forms and publications:)

- Capital Gains and Losses (discussion forum)