Capital Asset Pricing Model (CAPM) Excel

Post on: 16 Март, 2015 No Comment

Capital Asset Pricing Model (CAPM)

The Capital Asset pricing model is one of the cornerstones of modern financial theory and one of the pillars on which modern portfolio theory is based. The concepts introduced in the Capital asset pricing model are relatively simple and the mathematics are not too complicated.

The Capital Asset Pricing Model states that the expected return on a security (or portfolio) equals the rate of return on a risk-free security plus a risk premium. This statement can be summed up by the equation :

where

r̄a. Expected Return on asset

rf. Risk free Return

β. Beta

r̄m. return market

If we break down the definition so far. the capital asset pricing model has introduced several concepts :

- Risk Free Rate

- Risk Premium

- Beta

The risk free rate (rf ) can be defined as the rate of return an investor can earn without any risk of loss to their investment. No risk implies that there is no volatility of returns – hence the volatility is 0.

So if you know you can earn a risk free return on an investment, you will want to be compensated for any extra risk on a security. Imagine that the risk free rate is 4% p.a. Now imagine that there is a security which has an expected return of 4%, but also has a volatility of 20% p.a. Would you choose to invest any money in that security? It would be a pretty safe bet to say that you probably would not invest in this security. Why would you take on the extra risk without any chance of a reward in the form of extra returns? After all you can earn the same return at absolutely no risk.

This is where the risk premium comes into the capital asset pricing model. The extra return that an investor would demand for the extra risk is known as the risk premium. Intuitively this makes a lot of sense if you take on extra risk you will want some sort of reward to compensate you for that extra risk.

The risk premium in the formula is represented by the term. β (r̄m – rf ). What this means is that if the market had an expected return of 8% and the risk free is 4%, with an asset that has a beta of 1, it would have an expected return of 8%. Calculated by plugging the values into the formula for Capital Asset Pricing Model (CAPM):

4% + 1(8% 4%) = 8%.

If the Beta was 0.5 the expected return would be lower :

4% + 0.5(8% 4%) = 6%

If the Beta was 1.5 the expected return would be higher :

4% + 1.5(8% 4%) = 10%

So in essence this is a really simple formula and if you look at the Risk premium portion you will see that the most important aspect of the formula is actually the Beta. The Beta acts as a scalar for the difference between the expected market return and the risk free rate. In fact the most complicated bit of the Capital asset pricing model is the calculation of the beta and the beta is very similar to other statistical measures we have looked at in this blog previously like historical volatility and covariances etc.

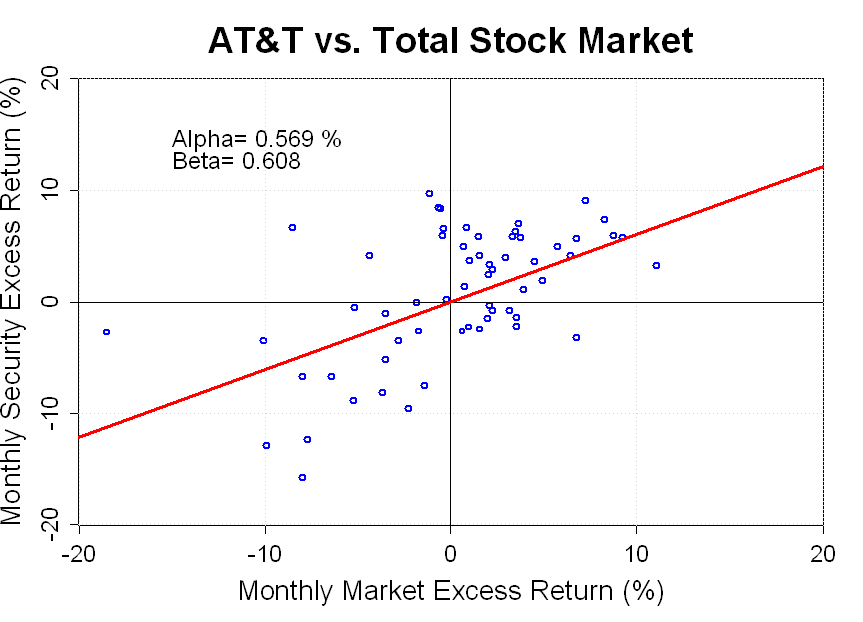

Capital Asset Pricing Model. Beta

The beta measures the volatility of an asset in relation to the volatility of a benchmark index. So in the case of a stock like Vodafone ( a UK stock) you would want to measure it against an index like the FTSE 100. The key here is to use a representative market index for a security you are looking at. So Microsoft you may decide to benchmark against the Nasdaq Index and so on.

The formula for the beta is :

Beta Formula

where ra is the returns of the asset and ri is the returns of the benchmark index.

A Beta of 0 indicates that the returns of the portfolio or asset change independently compared to that of the market. A positive beta generally means that the asset’s returns will follow the returns of the market. A negative beta means that the asset’s returns will generally move in the opposite direction to that of the market.

Beta is distinct from correlation in that correlation is more indicative of direction, while beta is also incorporating magnitude. If we say a market is up 15% always and the stock is always up 30%, then the correlation will be 1. However as beta gives us both the direction and the magnitude we would get a beta of 2.

Beta is also used by investors to achieve a target Beta for the portfolio. A fund tracking an index may want to maintain a Beta of close to 1 to the target benchmark as that is what their investment mandate authorizes them to do. The Beta of a portolfio is very simply the individual beta of the asset times its weight in the portfolio:

Beta Portfolio

One point to note about adding a new security to a portfolio is that the lower the Beta the lower will be the required average return as seen before. This is clear in the equation as a low Beta would lower the risk premium that would be demanded. This is because the Beta of the asset is low. meaning that it has a low correlation (covariance) to the rest of the portfolio. Therefore the incremental risk to the portfolio from the addition of the new asset is low.

If you want to see how to set up an excel spreadsheet to calculate Beta, then you download one below. We show you how to calculate Beta from a time series of market data. We have also included a custom VBA function that will output an array of Betas if you give it a market index and a range of time series for the market data. The spreadsheet is pretty simple to follow and will show you exactly how to set up everything to get the various metrics that you want. You can also look at the VBA code and use as a guide define your own VBA functions. The spreadsheet here contains all the topics covered so far namely historical volatility. decay factors for historical volatility. Portfolio volatility , correlation and of course Beta.

Video on how to calculate Beta using Excel

You can also download the excel spreadsheet by clicking on the button below. Note that the Excel file also has a VBA (Visual Basic for Applications) function in it which will calculate Beta very simply in a one step process for you highlight the range of stock prices and the function will do the rest. Please note that the file is only available to registered members, if you are not a member already you can join easily by signing up or using your Facebook or Twitter login to access the file.

[download id=2]