Capital Allocation and the Board of Directors

Post on: 25 Июнь, 2015 No Comment

Board Perspectives Series

It’s a good problem to have: Generating and holding record levels of cash—as many companies are today—creates more investment options. But in a period of weak global economic growth and low interest rates, it also means tougher decisions and greater scrutiny of the company’s use of capital. Pay dividends? Repurchase stock? Make a strategic acquisition? Invest in organic growth? With both traditional investors and activists sharpening their focus on how companies are deploying capital, and competitive pressures requiring more frequent shifts in strategy and spending priorities, the capital allocation process needs to be robust and well-oiled—and the board has a key role to play.

More than half of the 1,300 audit committee members we surveyed recently said (perhaps not surprisingly) that they want to hear about capital allocation in greater detail. With its focus on financial reporting (and often financial risk) and insights into the finance organization, the audit committee can serve as a catalyst for the board’s deeper dive into capital allocation—including how decisions align with the strategy and investor priorities and whether appropriate controls and metrics are in place to monitor capital investment and returns.

Continue reading or download the full article .

Get more like this delivered to your inbox. Join ACI – select ‘Audit Committee & Board Governance’ under Topics.

How can the audit committee and board add value to the capital allocation process? We recommend the following areas of focus:

How does the company’s allocation of capital align with and advance its strategic priorities? Clearly the company must have access to the capital required to adopt and commit to its strategic plan for both the short- and long-term. During the capital allocation process, how much is the long-term strategy taken into account? To what extent are relative returns on capital considered among the various allocation opportunities? Are capital allocations linked to strategic goals and consistent with the company’s risk appetite? Investors, and perhaps management, may argue for increased dividends or stock repurchases—which may make sense for any number of reasons, e.g. lack of profitable investment opportunities. Has management weighed the implications of dividends or stock repurchases on the company’s ability to execute its long-term strategy?

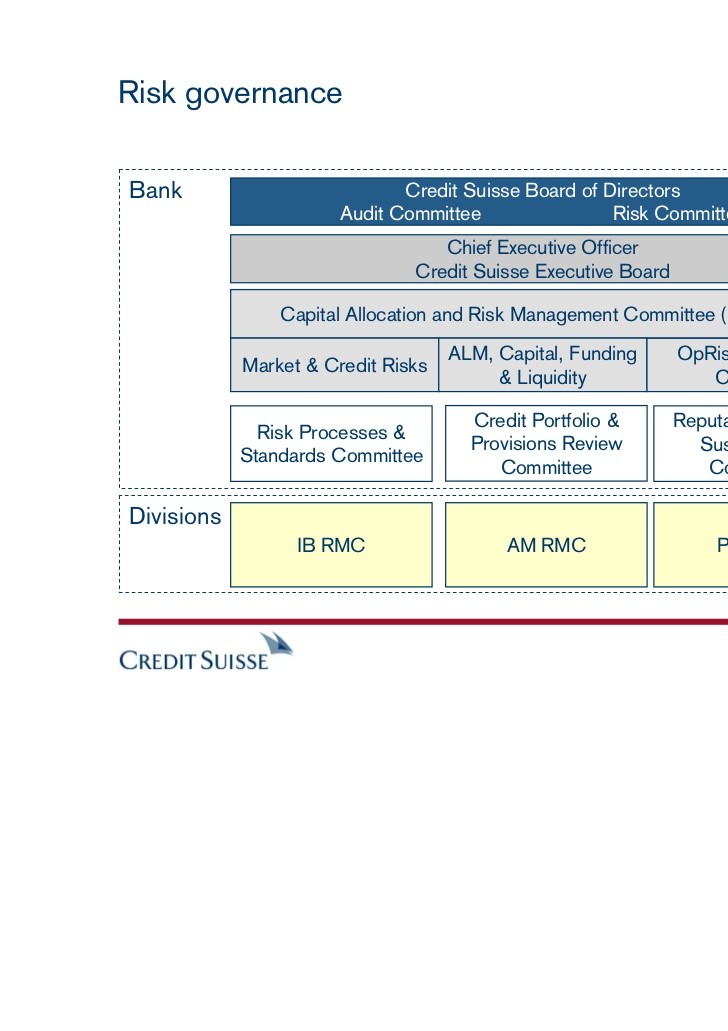

Does management have a robust capital allocation process, including the right leadership and talent to determine how best to deploy capital across the enterprise? As Credit Suisse recommends in a recent whitepaper, a good first step in assessing a company’s capital allocation process is to see how effectively management has allocated capital in the past. What is the company’s return on invested capital and return on incremental invested capital across its various businesses and geographies—and how does it compare with competitors? Have various acquisitions created value or destroyed it? Who is really making the investment decisions and how are they held accountable for subsequent returns? How does the capital allocation process actually work? How disciplined and transparent is the process?

Are we sensitive to possible biases in the capital allocation process? Corporate politics and compensation incentives can certainly inject bias into the capital allocation process. But recent research by McKinsey identifies another bias that directors should be sensitive to: inertia. Too many companies undermine their strategy by allocating the same levels of resources to business units year after year—in other words, last year’s capital allocation is viewed as a good anchor during the capital allocation process. According to McKinsey, companies with higher levels of capital reallocation have experienced higher levels of shareholder returns. Are we reallocating capital over the medium to long term consistent with strategy?

Do we have the right controls and metrics in place to enable the board to oversee management’s capital allocation decisions and monitor its performance? Is it clear what capital expenditure authorities different levels of management have? Are there clear thresholds for when board approval is required? Are we satisfied with the level of board participation in the capital allocation process—both in reviewing/approving major capital expenditures and in taking a holistic view of the company’s capital allocation strategy? Does the board receive independent input—unfiltered by management or investment banks—as to how investors view the company’s strategy and capital allocation priorities? Do we have the right metrics to hold management accountable for actual versus expected performance? Are the metrics applied consistently throughout the business? How is the company performing relative to its peers? Do we understand why the company’s return on invested capital differs from its competitors over multiple time periods and business cycles?

Given today’s slow growth and low interest rate environment, an effective capital allocation process is vital. A critical role for the audit committee and board is to help ensure that the company has a robust and disciplined capital allocation process, and that investors and analysts understand support how the company is using its capital to advance its strategic goals and build long-term value.