Can Market Valuations Be Effective MarketTiming Signals Alpha Architect

Post on: 26 Сентябрь, 2015 No Comment

Can Market Valuations Be Effective Market-Timing Signals?

We know that valuation metrics such as the CAPE, or Shiller P/E, ratio are correlated with long-term returns (notice we didn’t say predict long-term returns—that is debatable).

Here is a brief background on the measure:

A few recent articles from Jesse Livermore are posted below:

How does one utilize valuation metrics information in the real-world?

If the P/E ratio on the market is in the top 5%, do we simply sit on our hands for 5, 10, or 15 years waiting for “the bubble to break?” Example: Internet Bubble. Meb makes a solid argument that maybe we should. but I doubt any human being could actually follow that model.

Or what if the P/E ratio is in the bottom 5%—we believe returns over the next 10 years will likely be favorable—but what about the digestibility of the 50% drawdown we endure when the market P/E goes from 10 to 5? Example: Great Depression. Cash might be king when your worried about paying for your next meal!

The goal of this research piece is to identify a simple and PRACTICAL way to integrate market valuations into a market-timing framework.

We test how valuation signals compare to, and interact with, another popular timing device, the moving average (MA) signal.

- For the MA signals, we use monthly (1,12) MA rule on the total return for the SP500.

- If the price for last month is above the past 12 months average, stay in the market, otherwise, invest in the risk-free rate.

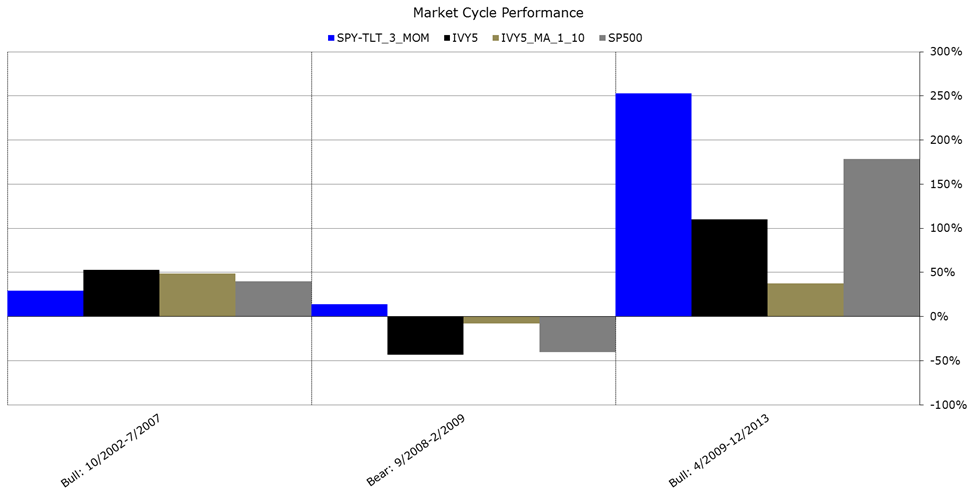

Summary Findings:

- Valuation-based trading rules add no value and underperform the simple (1,12) MA rule.

- Various combinations of MA and valuation rules cannot improve results relative to the (1,12) MA rule.

- MA rules starting in the late 1930’s are also questionable, albeit, at just about every other starting point they look more attractive. We start in 1938 because we need to burn 10 years of data establishing a benchmark valuation level (our data starts in 1927).

- The data suggest that market valuations have limited PRACTICAL use.

Strategy Background

- The valuation rules are the 4 following measures: (Higher—>Cheaper; Lower—>More Expensive)

- 1/CAPE = Inverse of Shiller’s Cyclically Adjusted PE ratio.

- Dividend Yield = Total Dividends for SP500 over the past 12 months divided by the SP500 closing price.

- Default Yield Spread = BAA Yield – AAA Yield.

- GNP/Marketcap = GNP of U.S. divided by the total market capitalization of U.S. Equity Markets.

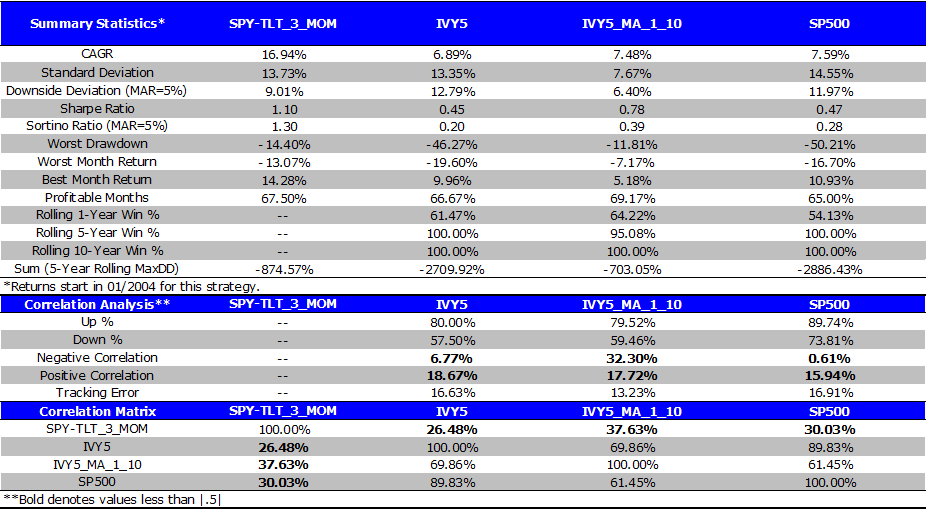

Statistics Summary

One on One (Full Sample): MA vs. 1/CAPE (15 percentile expensive cutoff)

- 1/1/1938 – 4/30/2014

- 1/CAPE signals into RF if in bottom 15% (expensive)

- (1,12) MA outperforms 1/CAPE; tied with buy and hold.

The results are hypothetical results and are NOT an indicator of future results and do NOT represent returns that any investor actually attained. Indexes are unmanaged, do not reflect management or trading fees, and one cannot invest directly in an index. Additional information regarding the construction of these results is available upon request.