Can Active Investing Beat The Market

Post on: 21 Апрель, 2015 No Comment

Investing, it seems, is no longer something very boring that you do so that you can retire comfortably. If you open any financial newspaper you will see breathtaking articles about this stock and that, which are guaranteed to rally and return excess returns above the market. Rarely will you, dear reader, find an article on old, boring, index funds. This leads us to one of the age old debates in investing — whether active investing through valuation of companies and/or conducting technical analysis can yield a superior return over the long run above and beyond the average return in the market.

I believe that the facts are clear, i.e. 1) active investing cannot beat the market, 2) individual investors are better off buying ETFs based on market indices, and 3) the only way to beat the market is by leveraging the market itself. In this article I will present the case for my position.

First, a bit of history.

Back in 1863, a French economist named Jules Regnault observed that stock prices move in a random manner and hence are unpredictable. His work was used 40 years later by another French mathematician named Louis Bachelier who used a mathematical modeling technique called stochastic processes to demonstrate that stock prices follow a random pattern called Brownian motion. Bachelier used Brownian motion to simulate future stock prices and created the first mathematical model to evaluate stock options. Another 50 years passed, when an young University of Chicago economist (and later Nobel Laureate) named Eugene Fama formalized this in a framework called the Efficient Market Hypothesis. which claimed that

Financial markets are informationally efficient. In consequence of this, one cannot consistently achieve returns in excess of average market returns on a risk-adjusted basis. given the information available at the time the investment is made.

How has this Efficient Market Hypothesis (EMH) worked out in practice?

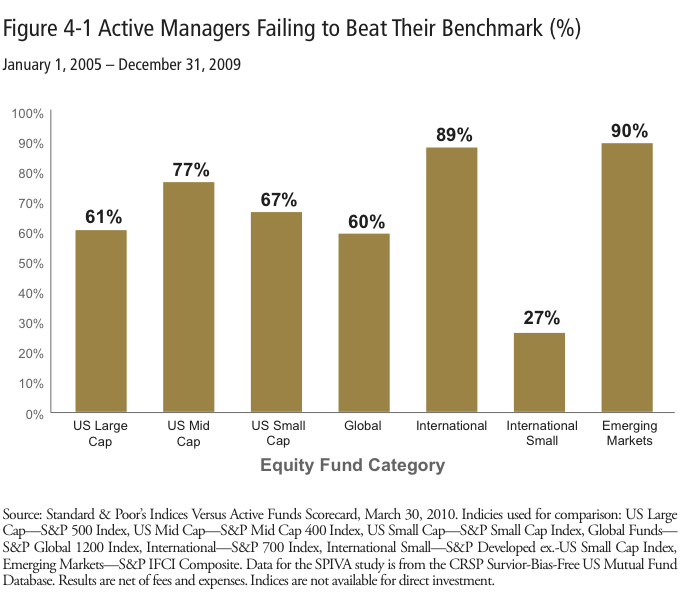

As students of logic and statistics know, one cannot prove a hypothesis, one can only disprove it. For the EMH to be false, there has to be a cadre of active investors who beat indices time and time again, over long periods of time (shorter periods are likely due to randomness). So, how do the performance of active fund managers compare to market indices? The de factor official scorekeeper for this is the SPIVA report. As the prospectus says:

S&P Indices Versus Active (SPIVA®) measures the performance of actively managed funds against their relevant S&P index benchmarks. These regional scorecards compare fund managers’ results across the spectrum of S&P large-cap, mid-cap, small-cap and sector indices.

I picked up a copy of the mid year 2012 US SPIVA report (the latest published). The results are rather damning.

Over the last five years, the majority of active equity and bond managers in most categories lagged comparable benchmarks. Within the U.S. equity space, with the exception of large-cap value, the active equity managers in all the categories failed to outperform, the corresponding benchmarks. 65.44% of the large-cap active managers lagged behind the S&P 500®, 81.57% of mid-cap funds were outperformed by the S&P MidCap 400® and 77.73% of the small-cap funds were outperformed by the S&P SmallCap 600®.

This period includes a stunning market crash in the US markets. This is precisely when active fund managers are supposed to beat passive investing through indices, which do not have the option of going to cash, or finding alternative investments to counter the market drop, and must stay fully invested. When only some 20-35% of active fund managers outperform the market in this period, that casts serious doubts on whether it is indeed possible to beat the market over a long period of time, like 30+ years.

But it gets worse.

As we know, the US equities market has been growing handsomely for the past 3 years. How has active investors fared against the corresponding market indices in this period? As the report shows, over the past 3 year only about 20% of fund managers have beaten the corresponding index, and over the past year, only about 10% has.

It is important to put these numbers in context. The market is the average. One would expect roughly half of active fund managers to beat it by sheer serendipity. Yet, on average only 20% do, which means active investing actively destroys value.

What about hedge fund managers? These are supposed to be the best of the best, the true mavens who can beat the market come hell or high water. It turns out that 88% of hedge fund managers trailed the market in 2012.

What does this tell us? At the minimum, it certainly fails to disprove EMH. It should be pretty clear that as a group professional fund managers practicing active investing are destroying major amounts of value. Quite actively, in fact.

What should an individual investor take away from this history lesson? Well, the logical conclusion would be one of two. The first, the one I took (not today, but about 12 years back during the 1999-2000 crash) is that if professionals can’t do it, it is rather unlikely that individuals doing it part time can do it either. The other conclusion, however, may be that professionals can’t do it precisely because they are professionals, and individuals can do it because they can afford to be more nimble.

That may be true. There is no documented performance records for individual investors. However, each individual investor can look at his/her portfolio and determine for themselves if they beat the market over a long period of time, and make the conclusion for themselves. I have a hunch what the numbers would show for an overwhelming majority of individual investors reading this article, checking their historical returns, and being honest about it, but I will let individuals decide for themselves. But, in general, I firmly believe that investors will do far better by investing in the broad stock market index, the S&P500 (NYSEARCA:SPY ).

That said, what about those that still want to beat the market? To determine the right strategy for that, I ran a quick screen on the Morningstar website. I chose US ETFs that has beaten the S&P500 return by 2x over 3 years, 1 year, and year to date. In other words, these ETFs have return average 22%+ return in 3 years, average 34%+ return in the past year, and 11%+ return year to date. Then, I eliminated those that have a bet on a single sector, like real estate, consumers, or healthcare.

The results are quite eye opening. They are all 3x leveraged ETFs on the corresponding market indices.