Callable Bond Embedded Call Option

Post on: 21 Май, 2015 No Comment

CALLABLE BOND DEFINITION

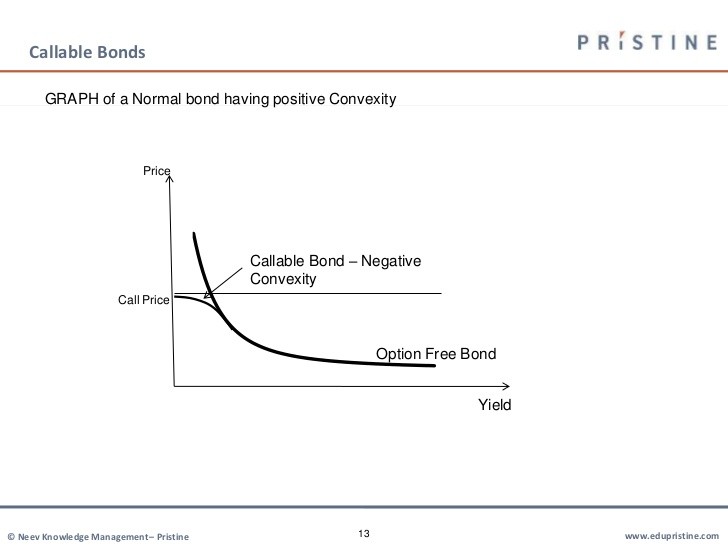

A callable bond. or redeemable bond, gives the bond issuer the right to purchase the bond back from the bond holder before the maturity date of the bond through an embedded call option. Issuers will compensate the bond holder with an option premium to allow themselves the opportunity to purchase the bond back if they are paying the bond holds a higher coupon than the market bears.

A callable bond can be redeemed at any time after the lockout period. Typically issuers will provide 30 days of notice before calling the bond away. Issuers will call the bonds back if they no longer need funding or if they can re-issue the bonds at a more favorable rate. In addition to having an embedded call option; callable bonds can also come with refunding protection. This somewhat protects the holder of the bond against the bond getting called away when interest rates become favorable to the issuer. Refunding protection prevents the issuer of a callable bond from redeeming a bond in the situation where they issue new debt at a lower cost to them in order to fund the purchase of the older, higher yielding bonds. However, this is the only source of funding which is prohibited; corporations can use other sources of funding such as secondary stock issuance’s or their own net operating cash flow to call a bond.

Callable bonds can be unsettling for many investors as they think they have locked in a high interest rate for years ahead, only to have the bond repurchased by the issuer when market interest rates drop. Municipal bonds and corporate bonds can be subject to a call while the treasury bonds are no longer issued with any call provisions, therefore, carefully check the bond prospectus of any munis or corporate bonds that you are looking to buy.

TYPES OF CALL OPTION PROVISIONS

A callable bond will have a call option that will be one of three types: American, European, or Bermudan. These three different options will stipulate different conditions as to when the bond may be called up until.

Lockout Period

The lockout period is a period of time that must pass before the bond can be called. For example, if a bond is a 5NC2, this means the bond is a five year bond that is not callable for 2 years. In this case, 2 years is the lockout period. As you see from the descriptions below, Lockout periods apply with Bermudan and European call options.

Option Types

An American call option allows the bond issuer to repurchase the security at any time during the term of the bond and therefore cost the issuers the highest option premium.

Bermudan call options are a little less flexible than the American option in that they give the issuer the right to repurchase the bond on specific dates after the lockout period. These specific dates usually fall in line with coupon payments.

European call options are the least flexible type of call option providing a one time option to the issuer to repurchase the bond. This decision is usually made at the end of the lockout period. This type of callable bond has the least option premium.