Calculation of Shareholder Stock and Debt Basis in S

Post on: 22 Июнь, 2015 No Comment

Calculation of Shareholder’s Stock and Debt Basis in S Corporation

It is your responsibility to know your basis in an S corporation.

Do you know how to calculate it?

It is important for the shareholder of an S corporation to know his basis in the shares of stock that he owns as well as loans made to the company. What is basis? The Internal Revenue Service defines basis generally as the amount of one’s investment in a property for tax purposes. It is used to figure depreciation, amortization, depletion, casualty losses, and any gain or loss on the sale, exchange or other disposition of the property. Unlike a C corporation, each year the stock and debt basis of an S corporation may change based upon the S corporations operations and financing arrangements. Every year the S corporation is required to issue a shareholder a Schedule K-1. The K-1 reflects the S corporations income, loss and deductions allocated to the shareholder for the year. The K-1 does not state the taxable amount of the distribution. The taxable amount of distribution is contingent on the shareholders stock basis.

It is not the corporations responsibility to track a shareholders stock and debt basis; rather it is the shareholders responsibility. The certified public accountants of the shareholder need to calculate basis each year in order to prepare their personal tax returns. Why is this important? If a shareholder is allocated an S corporation loss or deduction flow-through, the shareholder must first have adequate stock and debt basis to claim that loss or deduction. It is recommended that shareholders, particulary those of closely held S corporations, receive some sort of tax planning before year end, including a review of their current basis in any S corporation stock. Failure to do so can have costly consequences.

For instance, I personally know of a situation where the outside CPA met with the shareholders of a closely held S corporation before year end as part of his tax planning services and he failed to inform them of their current basis. Subsequent to the tax planning consultation, the shareholders made major purchases of equipment to maximize their section 179 deduction so that they could reduce their tax liabilities on their tax returns, only to discover the following March that $30,000 in tax deductions were unavailable because of the lack of sufficient basis in their stock. If the tax accountant simply had informed them of their basis available at the beginning of the year, the shareholders could have transferred basis from their other companies to increase their basis enough in the S corporation in order to deduct all of its section 179 expenditures and defer $30,000 in taxes. Nevertheless, it is always the shareholder’s responsibility to know his basis, and he should always require from his outside accountant a complete, detailed computation of his basis as part of any annual tax planning. It is never the responsibility of the S corporation to fulfill this personal responsibility: the corporation may not have all of the data necessary to compute the basis, which is the primary reason that it is not included on the face of the K-1 schedule; and the basis in the stock pertains to the personal tax returns of the shareholder, from whom the Internal Revenue Service will require substantiation of basis.

How is basis calculated for stock in a S corporation? First of all, there is an ordering rule in computing stock basis. Assuming for simplicity sake that the basis calculation pertains to a small closely held S corporation, where there were no dividend distributions reported on Form 1099-DIV nor distributions in excess of basis and no depletion deductions, stock basis would be adjusted annually, as of the last day of the S corporation year, in the following order:

- Increased by all income (including tax-exempt income) reported on Schedule K-1;

- Increased by any capital contributions, including stock purchases;

- Decreased by cash and property distributions made by the corporation reported on Schedule K-1, box 16, code D;

- Decreased by nondeductible expenses;

- Decreased by all deductible losses and deductions reported on Schedule K-1 adjusted for any charitable contributions of property, by subtracting the excess of the property’s fair market value over its adjusted basis.

When determining the taxability of a non-dividend distribution the shareholder looks solely to his stock basis. For losses and deductions which exceed a shareholders stock basis, the shareholder is allowed to deduct the excess up to the shareholders basis in loans personally made to the S corporation (see item 4 below). Debt basis would be adjusted annually similarly to stock basis but there are some differences:

- Beginning of year loan basis;

- Increased by loans made to company, including interest capitalized (i.e. not paid);

- Decreased by payments on loan;

- Decreased by any losses or deductions in excess of shareholder’s stock basis.

Basis can never be reduced below zero. Losses are carried forward to future years. If there exists no debt, then the basis of the stock at the beginning of the year is zero, which is then adjusted by any losses or deductions from prior years.

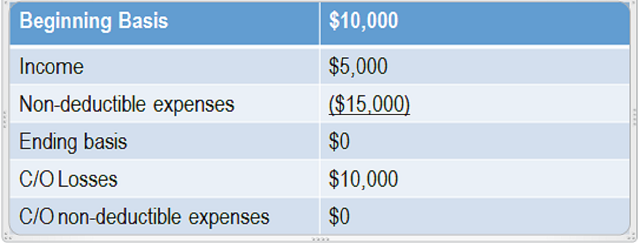

In order to illustrate the calculation of basis, assume a shareholder’s basis at the beginning of the year is $10,000, and his K-1 shows the following values for the tax year:

Ordinary business income