Calculating Intrinsic Value

Post on: 16 Март, 2015 No Comment

By Sham Gad | More Articles

In the previous three articles in this Security Analysis series, I discussed the concept of margin of safety. explained why you should rely on intrinsic value to make investing decisions, and showed why you want to find great businesses with wide economic moats. Once you’ve taken those steps and found a business that looks attractive, you next need to determine the intrinsic value of that business, to find out whether a bargain of an investment opportunity exists.

Every business has an intrinsic value. According to John Burr Williams in his 1938 publication The Theory of Investment Value. that value is determined by the cash inflows and outflows — discounted at an appropriate interest rate — that can be expected to occur during the remaining life of the business.

This definition is painfully simple, but it works. Let’s apply it to a couple of businesses so you can see for yourself.

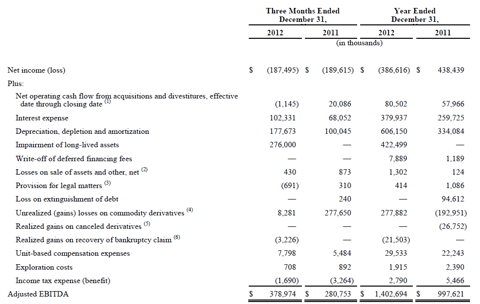

Solid, stable cement

CEMEX ( NYSE: CX ) is a Mexican producer and distributor of cement. Competing with the likes of LaFarge ( NYSE: LR ). it is one of the largest cement players in the world. It produced free cash flow — cash from operations less capital expenditures — of about $2.6 billion in 2005 and around $2.75 billion in 2006. Meanwhile, between 2004 and 2005, it grew free cash flow by around 50%, but that same figure was virtually flat from 2005 to 2006. That may give you an inkling that it makes no sense to try predicting a different rate of cash flow growth each year. Instead, when attempting to calculate intrinsic value, you should stick to one or two consistent conservative growth rates, although smaller companies starting with a lower base figure can be assigned higher rates of growth. When calculating intrinsic value, I use a 10-year forecast, because I think that’s an adequate time period to provide sufficient data, and I apply a 10% rate discount rate, which is equivalent to the S&P 500’s historical return.

Cemex, however, is a huge business, and while it may experience some years in which cash flows grow abnormally, it’s more logical when determining its intrinsic value to use a meaningful conservative figure. Always work with a margin of safety.

In this case, it’s reasonable to assume that Cemex can grow its free cash flow by 10% for four years. While this growth rate can continue for a longer period, I like to be extra cautious and predict that free cash flows stabilize at a 3% growth rate thereafter. Cemex is a very well-run company, and there will always be a need for cement in the world, so I think 3% free cash flow growth is very achievable.

Let’s look at the calculations. Dollar figures are in billions.