Calculate Stock Beta with Excel

Post on: 20 Апрель, 2015 No Comment

This Excel spreadsheet calculates the beta of a stock, a widely used risk management tool that describes the risk of a single stock with respect to the risk of the overall market. Beta is defined by the following equation

What Does Beta Mean for Investors?

A stock with a beta of

- zero indicates no correlation with the chosen benchmark (e.g. cash or treasury bills)

Tobacco and utility (e.g. gas & electricity) companies, traditionally regarded as stable and dividend-paying, have low betas while technology companies have higher values. Stocks with a beta of above one should have returns greater than the benchmark index, otherwise it is not regarded as a good investment.

If the benchmark returns 5%, then a stock with a beta of 1.5 should return 1.5 times 5% = 7.5% or more. If not, other investments should be considered instead.

Investments with negative betas have counter cyclical volatility with respect to their benchmark. In an economy thats decreasing, gold, bankruptcy advisory firms and companies involved in continuing education often have a beta of less than zero.

There are, however, significant dissadvantages to beta.

- Its calculated from historical data (and hence does not capture future changes in the market), and of course depends on the chosen time period.

- Beta does not discrimnate between upwards volatility and downwards volatility.

- It assumes that volatility is described by a normal distribution this isnt always the case

In summary, beta should only be used in conjunction with other tools when you decide what to invest in.

You can get a list of stocks ordered by their beta at Yahoo Finance. but well now describe how you can calculate it in Excel.

Historical Stock Returns

We first need a stock and a nominated benchmark index Ill pick BP and the FTSE. Then we need historical stock prices for both. I used this spreadsheet for downloading historical stock data from Yahoo to get daily closing prices for BP and the FTSE index between 3 rd January 2011 and 1 st July 2011.

Then we simply calculate the fractional daily returns, as described in the picture below.

Note that cell range E8:E108 contains the stock returns and the cell range F8:F108 contains the index returns

Beta Calculation

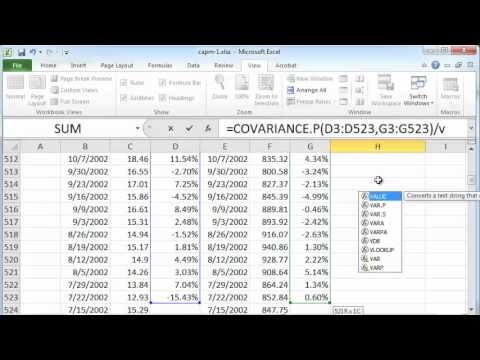

There are two ways of calculating beta with Excel – the first uses the variance and covariance functions, while the second uses the slope function.The corresponding formulae are given below.

You could also calculate beta simply by plotting the benchmark returns against the stock returns, and adding a linear trendline. Beta is then simply the slope of the trendline.

Here we see that BP has a beta of 0.29. This is low, and implies that BPs stock price does not vary significantly when the FTSE swings up and down.