Calculate Return on Investment (ROI)

Post on: 1 Июнь, 2015 No Comment

The money you put into your property is your investment. It’s money that you have to pay back to the lender or else it’s your own savings that you want to replace. You want to do that with your profit from the rent. But will the rent you decided on give you a profit?

Follow these steps to determine your cash flow:

Look at a year’s worth of bills for utilities, water, sewer, garbage collection, and any other ongoing expenses. Add them up. They are your annual operating expenses. Now factor in an additional percentage for increases in energy costs. Call your utility companies to find out how much they forecast prices will rise in the coming year.

Figure out how much you’ll pay for a year on your insurance, property taxes, and mortgage (or home-improvement loan).

Factor in 5 to 10 percent of the rent for repairs that you might have to make in the next year. Use the higher percentage for property that the previous owner didn’t keep up.

Add 10 percent more to cover possible vacancies. If a tenant leaves, your unit will be empty while you search for someone new.

Add up the totals. That gives you a good estimate of what your total expenses will be for the coming year.

Take the annual rent amount you have come up with based on market research, and subtract from it the expense total from step 5. That gives you the amount of income the rent will generate or, as landlords call it, your net operating income.

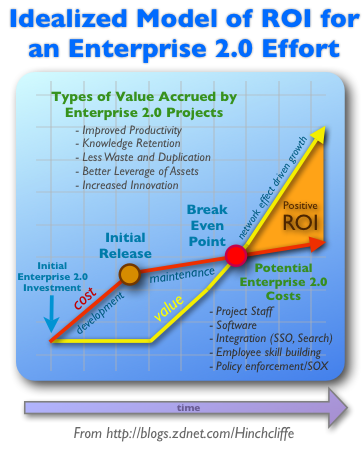

Keep in mind, however, that most fledgling businesses don’t have a positive cash flow in the early years. Can you afford to put more of your own money into the building until it starts paying for itself? Some landlords say that it takes five to seven years to realize a profit.

If you haven’t saved last year’s receipts for your home, use your checkbook register or the invoices and receipts from a previous year to calculate how much it costs to run your home. If you are buying a duplex, look at the owner’s books, records, and receipts for the property. They might not be an accurate gauge of what you will have to spend in the coming year, but they’ll serve as a starting point.

From your calculations, you will be able to determine the minimum amount of rent to charge. Now figure out what you need to establish as a rental rate that will allow you to set some money aside each month for some of the more expensive items that you want to get for the apartment perhaps a new refrigerator, a dishwasher, or a new furnace. After that you can determine the return on your investment your profit.

To calculate the ROI, use this formula:

Net operating income (see the steps above) 100 = percent return on your investment