Buying on Margin Here’s the Risk

Post on: 26 Июнь, 2015 No Comment

(Columnist Jon Markman is away this week. Mandeep Rai, editor of the Top Stocks Under $10 portfolio, is filling in.)

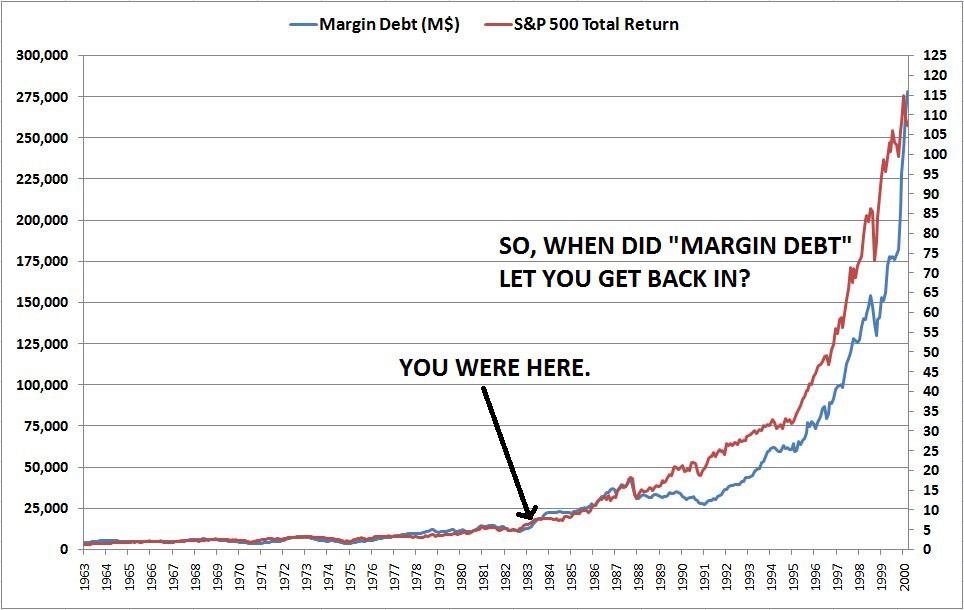

What do you do when you hear about a hot stock but don’t have the ready cash to buy it? Well, you can borrow from a buddy, or you can borrow from your broker — that is, buying on margin. According to research (chart below), more people than usual are choosing their brokers for funds at this time. In fact, so many that it’s reaching troubling levels, matching those just before the previous two market crashes.

This is how it works: Let’s say an investor wants to purchase 100 shares of Apple Inc. (AAPL) at $100 for a value of $10,000. Suppose he does so and the stock goes up by 10 percent over six months; he has grossed $1,000 before commissions, a 10 percent gain on your investment.

However, if he purchased the stock on margin, most brokerages will allow you to borrow up to 50 percent of the purchase price. So that person could buy half of the position with cash, spending $5,000 instead of $10,000, and borrow the money from the brokerage for the other half of the position, perhaps at a 6 percent interest rate. The same percentage rise in the stock would then boost your return, after paying the interest on your investment, to about 17 percent. Borrowing costs are artificially low, given the Fed’s stimulus efforts, likely encouraging more speculative margin buying.

Before you go out and try to pull off this scenario, remember that if the stock doesn’t go in your favor, and instead declines, you will still owe that interest payment and must repay the loan. And if you get a margin call (brokerage asks you to come up with more money to raise your collateral because the value of your investment declined), you will have to throw more money into the account if you want to keep the trade open, or risk having the brokerage liquidate your position.

Buying on margin — sometimes at 80-90 percent — helped exacerbate the selling and crash on Wall Street in 1929.

That is why this strategy is so risky — there is an unusually high reward profile, but alas it comes with unusually high risk, and that is why investors bail on these positions, sometimes with a huge loss, in a heartbeat if a correction is imminent.

Remember the Great Depression? Speculative buying in those days, sometimes with 80-90 percent margins, helped cause a dramatic fall in equity prices and brokers selling investor accounts to recover their margin loans, only to compound the declines with more selling. As a result, margin trading was suspended for many years.

We are not there yet, and likely won’t be, but as you can see from this chart (the NYSE provides this data on a one-month lag), we are, again at all-time highs in the markets. But just as you can see, there’s a lot of margin debt here as well — also at all-time highs. And not only that, as the red line indicates, investors are taking on risk at a faster pace — most likely to catch up on performance as this unprecedented rally has left them behind.

As you can see, the last two times margin debt levels spiked higher, a drastic drop in equity prices ensued — followed by a recession.

I am not timing the market for a decline right now, but instead I suggest being careful as periods of high risk-taking ultimately don’t last forever, and if margin debt levels are any indication of risk-taking, it could get interesting sooner than later.

Have you ever bought stocks on margin? What has been your experience? Is it a good idea? Should you just invest what you can afford to lose? Click here to share your views.

Best wishes,

Mandeep Rai

P.S. Today at noon Eastern Time, Martin will be hosting an urgent video briefing. (To join, click here a few minutes before the hour.)

The investment strategy and opinions expressed in this article are those of the author and do not necessarily reflect those of any other editor at Weiss Research or the company as a whole.