Buying High Selling Low

Post on: 17 Апрель, 2015 No Comment

Advertisement

Investors have been migrating away from stock funds and shifting to bonds. The wariness may seem inevitable at a time of economic uncertainty. But the pattern of fund activity is very different from what prevailed in the past. For most of the last three decades, investors poured into stock funds during bull markets and made withdrawals after downturns. Then following the financial crisis, investors stopped in their tracks. Although the Dow Jones industrial average nearly doubled from the trough in March 2009, shareholders continued making withdrawals. From the beginning of 2008 through August 2011, funds recorded $328 billion in withdrawals, according to the Investment Company Institute.

The outflows were unprecedented. Before 2008, the biggest annual outflow came during 2002 when $27 billion left funds. Morningstar analyst Kevin McDevitt predicts that the outflows will not stop any time soon. After seeing two serious bear markets in 10 years, people are spooked, he says.

While shareholders are retreating from stock markets, some top managers of balanced funds are taking the opposite approach. The funds hold mixes of stocks and bonds, and lately the managers have been dumping bonds and shifting to stocks. Are the managers making the right move? Probably. At a time of puny yields, bonds look expensive, the managers say. In comparison, the S&P 500 seems reasonably priced with a forward price-earnings ratio of 12.

Cautiously Mixed

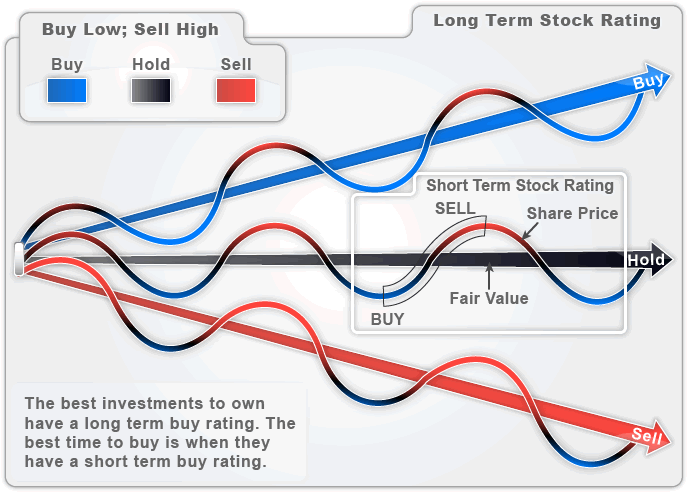

For cautious clients, these top funds can make intriguing holdings. Most often the funds have made deft calls, moving to stocks when they reached bargain levels and emphasizing bonds in downturns. As a result, the funds have limited losses in bear markets and delivered solid long-term results.

A top choice is Thornburg Investment Income Builder (TIBAX), a global fund that aims to deliver income by holding a mix of dividend-paying stocks and bonds. The fund has 75 percent of assets in stocks, up from 58 percent in 2009. Portfolio manager Brian McMahon says that stocks look cheap based on their dividend yields. McMahon says that for much of the past 50 years, stocks yielded less than bonds. But since bonds have rallied in recent years, their yields have shrunk. Now many stocks yield more than comparable bonds. McMahon points to AT&T. The stock yields around 6 percent, a bit more than most of the companys bonds. Stocks are out of fashion, says McMahon.

The lack of confidence in stocks is not limited to U.S. markets. McMahon says that phone companies around the world are undervalued. As a result, they are paying rich yields. To take advantage of the bargains, Thornburg holds a broad collection of telecom companies, including China Mobile and UK-based Vodafone.

A fund that has excelled in up and down markets is T. Rowe Price Capital Appreciation (PRWCX). Portfolio manager David Giroux is a diehard contrarian, buying stocks when others are selling. Early in 2011, the markets were buoyant, and the fund had 60 percent of assets in stocks. Then as markets sank in the spring, Giroux began spotting more bargains. While investors fretted about debt problems in Europe and the U.S. he gradually raised his stock allocation to 70 percent.

Such moves have produced solid results in the past. With stocks climbing in 2007, Giroux lowered the equity exposure to 57 percent and began buying bonds. That cautious stance enabled the fund to limit losses when the S&P 500 collapsed in 2008.

Lately Giroux has been buying industrial stocks, which have been pummeled as investors worried that the economy would slip into recession. A favorite holding is Cooper Industries, which makes electrical equipment for utilities and industrial companies. The shares dropped 50 percent recently when the company missed earnings estimates. The market has been overreacting to the problems that the company faces, Giroux says.

Investors who seek a bargain-shopping fund should consider Templeton Global Balanced (TINCX). The Templeton team estimates a companys earnings and cash flows for the next five years, and then buys when the shares sell for a substantial discount to their fair values. During the past year, the fund has raised its equity allocation from 55 percent to 65 percent.

Portfolio manager Lisa Myers is particularly keen on technology stocks. Since the Internet bubble burst in 2000, the sector has been out of favor, Myers says. She favors blue-chip software companies, including Oracle and SAP. Struggling to cope with a weak economy, corporate customers are spending on software to increase productivity. Oracle and SAP have reported sharp revenue growth in the last several quarters, but the shares trade at historically low valuations, Myers says.

Loomis Sayles Global Equity and Income (LGMAX) can keep from 30 percent to 70 percent of its assets in equities. The fund currently is near the top of its limit. The portfolio managers figure that interest rates will rise in the next several years. That will hurt bond prices. Over the next three years, equities will outperform, says portfolio manager Warren Koontz.

Koontz says that corporations around the world are reporting solid profit margins and balance sheets. That will help to boost equity prices. Koontz favors Cisco Systems, which has a pristine balance sheet. The giant maker of networking equipment missed earnings estimates several times. But the company is refocusing on its best lines and expanding many of its businesses, says Koontz.

Weitz Funds, a value specialist, aims to pay 60 cents for assets that are worth a dollar. After markets tumbled in August, the company began finding many tempting targets, says Brad Hinton, who is portfolio manager of Weitz Balanced (WBALX) and co-manager of Weitz Partners Value (WPVLX). The stock allocation of the balanced fund climbed from 54 percent in 2009 to 65 percent now.

Hinton likes high-quality companies that are unappreciated by the markets. A holding is Laboratory Corporation of America, which provides clinical testing. The shares have languished because investors have worried that sales would be hurt by new government regulations and the sluggish economy. But Hinton says that the earnings can grow in the high single digits. This is a terrific business that only sells for 12 times next years earnings, he says.