BuyAndHold Investing V Timing

Post on: 19 Апрель, 2015 No Comment

Investopedia 1/23/2015 Michael Schmidt

Provided by Investopedia

If you were to ask 10 people what long-term investing meant to them, you might get 10 different answers. Some may say 10 to 20 years, while others may consider five years to be a long-term investment. Individuals might have a shorter concept of long term, while institutions may perceive long term to mean a time far out in the future. This variation in interpretations can lead to variable investment styles.

For investors in the stock market, it is a general rule to assume that long-term assets should not be needed in the three- to five-year range. This provides a cushion of time to allow for markets to carry through their normal cycles. However, what’s even more important than how you define long term is how you design the strategy you use to make long-term investments. This means deciding between passive and active management.

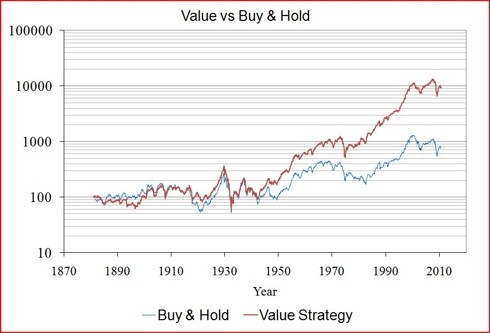

Investors have different styles of investing, but they can basically be divided into two camps: active management and passive management. Buy-and-hold strategies — in which the investor may use an active strategy to select securities or funds but then lock them in to hold them long term — are generally considered to be passive in nature. Figure 1 shows the potential benefits of holding positions for longer periods of time. According to research conducted by Charles Schwab Company in 2012, between 1926 and 2011, a 20-year holding period never produced a negative result.

Source: SchwabCenter for Financial Research Figure 1: Range of S&P 500 returns, 1926-2011

This is some very compelling data to convince investors to stay in for the long run .

Active Management

On the opposite side of the spectrum, numerous active management techniques allow you to shuffle assets and allocations around in an attempt to increase overall returns. There is, however, a strategy that combines a little active management with the passive style. A simple way to look at this combination of strategies is to think of a backyard garden. While you may plant different crops for different results, you will always take the time to cultivate the crops to ensure a successful harvest. Similarly, a portfolio can be cultivated along the way without taking on a time-consuming or potentially risky active strategy.

A good example of this method would be in tax management for taxable investors. For example, a security or fund may have an unrealized tax loss that would benefit the holder in a specific tax year. In this case, it would be advantageous to capture that loss to offset gains by replacing it with a similar asset, as per IRS rules. Other examples of advantageous transactions include capturing a gain, reinvesting cash from income and making allocation adjustments according to age.