Buy And Hold Investing Vs Market Timing

Post on: 16 Март, 2015 No Comment

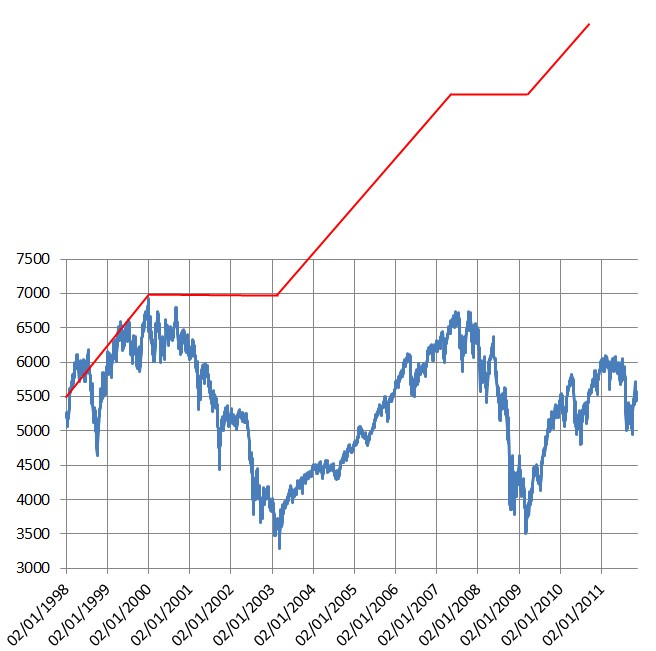

In the financial market there are numerous strategies for investors to invest their money. There has been a long drawn debate of the Buy-and-Hold Investing Vs Market Timing strategies. The good old buy-and-hold strategy is where the investors buy the shares and then keep on holding on to them till without considering the prices of the shares going up or down in the market. The market has gone up a lot and hence the long-term shares should have ideally earned profits to the investors.

On the other hand, the market timing technique is much more complicated and complex. It need high alertness and complete follow-up of the market trends. The ability to identify the best time buy and sell a share regularly is a must for investors thinking of adopting this strategy. The strategy is not for the slow and steady, it was for the people who want to make profits quick and fast.

Let us now understand the pros and cons of each strategy in detail:

Buy-And-Hold Strategy

Though there are very less risks in general with the buy-and-hold or the long-term strategy. It is because if you are investing for about ten years then you are bound to make profit. The long duration of holding the shares allows the investor to easily tide through the periods of losses or lows in the market.

But, there is a flipside to this strategy. The investors need to have a lot of patience and huge amount of money or capital to sustain that patience. One needs to ignore the upswing in the prices to ear handsome profit at the end of few years. Although, the investors need to smart and sure about their shares and do a solid background research on the reliability of share before investing it through a long term strategy. If the prices of the shares tumble down constantly the investors need to be alert enough to see and exit.

Market Timing

Market timing or timing the market is an investment strategy where the investors need to identify the correct time to buy and sell the stock. The investors need to be smart enough to interpret the market trends and invest before the prices in the stock market shoot up and sell before the prices begin to tumble down. This strategy entails higher risks because it very difficult to time the market. The stock market is the most unpredictable market and even expert market analysts fail to interpret the market trends many a times. The investors stand a higher chance of losing their money or an opportunity to make higher profits.

The benefits of using this market strategy include higher gains in short periods of time. Short-term investors who have limited resources gain from the day-to-day buying and selling. This strategy is also good for investors who have less capital but a sharp knack for interpreting the market correctly. But, this strategy is best followed by professional investors who can keep emotion out of business and not end up selling their stock at the wrong times.

Stock market is very unpredictable and it is important that without being drawn into the Buy-And-Hold Investing Vs. Market Timing one should use his best common sense to write his own success story.