Business Plan Risks

Post on: 29 Март, 2015 No Comment

Changing Hearts and Minds Through Entrepreneurship in the Middle East

December 11, 2004

Q: I would like to include a risk analysis in my business plan. I dont know how to show risks without sending investors into an anxious frenzy.

A: Any start-up idea will have enough risk to fill a dozen business plans. No investor expects a risk-free plan. Angels and VCs know start-ups are incredibly risky. If they dont, dont take their money—they dont know what theyre doing! Most projects fail for reasons that could have been (and sometimes were) predicted far in advance. Since entrepreneurs are optimistic folks by nature: They tend to brush off predictions of doom and charge ahead assuming they will find a way to overcome. You can often avoid the most dire scenarios with intelligent upfront risk planning.

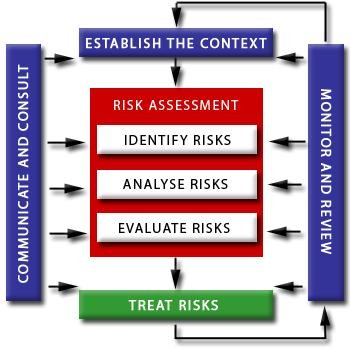

The risk analysis in your plan is to show that youve thought through risks, that you know how to plan for probable risks, and that your plan can survive when things go wrong.

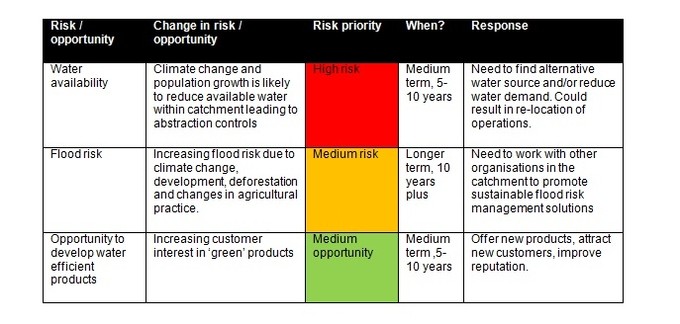

Your plan can address several kinds of risk. You dont need to address every kind of risk in the book, but pick the risk categories that are most relevant to your company and include a paragraph or two about each:

- Product risk is the risk that the product cant be created. Biotech firms often have a high degree of product risk. They never know for sure they can produce the drug they are hoping to produce.

- Market risk is the risk that the market will develop differently than expected. Sometimes markets take too long to develop, and cash runs out while a company is waiting for customers.

- People risk is big in companies that depend on having certain employees or certain kinds of employees. I was with a company that had hired one of the world experts in a certain type of 3-D modeling. It was possible that without this man on board and happy, the company wouldnt be able to create their product.

- Financial risk is the risk that a company will run out of money or mismanage their money in some way. Finance companies may have huge financial risk, since bad lending policies combined with poor investment policies can sink them.

- Competitive risk is the risk that a competing product or service will be able to win. Many Web-based businesses have high competitive risk since they can be started with little money and have no way of locking in customers.

What investors want is to know that you are prepared to respond to risks. To the extent possible, outline what your response is to the risk you anticipate. After all, assuming you get funding, those risks may really come to pass. And you will really have to do something about it. By showing investors some of the alternatives youve thought through, you raise their confidence that youll be able to deal if things dont go according to plan.

For example, consider the risk to a restaurant that people wont come back. What are the reasons you believe that would happen? What can you do to keep that from happening in the first place? It amazes me how many restaurants have a lousy menu selection or bad food and go under without ever asking customers, Did you enjoy your meal? What could we do to make it better? An at-the-table survey may be how you propose to avoid having the wrong menu. If things go wrong, you may decide to proactively invite critics to the restaurant for specific feedback on how to make the experience better.

The key is acknowledging that things can go wrong and demonstrating some creativity in finding a solution. You certainly neednt respond to every risk imaginable. Your goal is to provide enough to help your investors feel secure that you have anticipated and dealt with major risks, and they can count on you to handle things that come up once the business is under way.

Stever Robbins is a consultant specializing in mastering overwhelm, power and influence. The author of It Takes a Lot More Than Attitude. to Lead a Stellar Organization , he has been a team member or co-founder of nine startups, an advisor and angel investor, and co-developer of Harvards MBA program. You can find his other articles and information at SteverRobbins.com .

This article originally appeared on Entrepreneur.com in 2002.