Business Funding Secrets Venture Capital Considerations

Post on: 6 Апрель, 2015 No Comment

Venture Capital Considerations

by Brad MacLiver, authorship and profile at: Google

Venture Capital — is risk capital, or money used for high risk investments typically in the form of equity. Venture Capital firms are only willing to take a risk after extensive due diligence. They also expect high returns on their investment.

Venture Capital (VC) is best used for established businesses poised for rapid growth and exceptional profits. Investors are looking for niche markets with unusually high entry barriers and exceptional management teams. Company objectives need to be consistent with the Investor’s. The Clients need an exciting product, or business. The management team has to be exceptionally talented. The package submitted for the Investor’s review has to be professional and provide compelling information based on sound financial reasoning. The documentation and personal presentation must be able to excite the potential investor.

VC involves selling an interest in the Client’s company. This form of financing will mean relinquishing a portion of the ownership and control of the business to the Investor. How much ownership and control is exchanged for the investment is determined by the specific circumstances of the transaction.

VC deals are considerably more difficult to complete than debt financing (business loans). The task of finding the right investor can be demanding and expensive. Clients need to have cash available for the “acquisition of capital.” A Client should also be prepared for the process to take 9 months, or longer, to structure a deal once an Investor has shown interest.

VC is usually considered an equity position instead of debt, although some debt instruments may be used in the structuring the deal. Due to the transaction being an equity position, personalities and business philosophies of the Venture Capitalist (Investor) and Client must be compatible. The Venture Capitalist will become a partner and have a voice in the development of the firm. If the personalities of the two firms don’t match, the investment won’t happen.

VC is not for the types of businesses that can’t offer the higher returns required for the Investor. VC firms are also not looking to fund 100% of the company. The Client needs to be willing to risk substantial more than their ego.

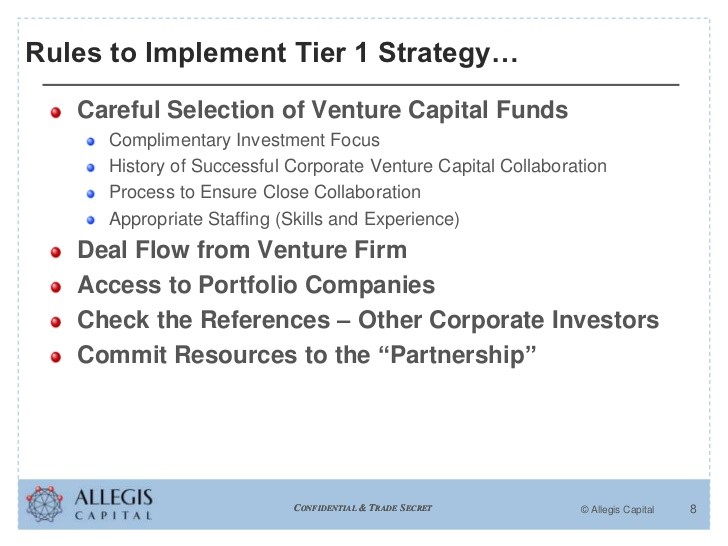

Most Venture Capitalists invest within specific market segments where they have a vast understanding of the market. An Investor who is targeting equity positions in printed circuit board businesses is not going to fund a day care. Businesses looking for funding from a Venture Capitalist need to approach the appropriate investor.

When an Investor has been found there are a number of factors that will be addressed. The needs of both the Venture Capital firm and the Client will vary depending on the stage of business development the Client is at, the perceived risk of the transaction, and the matching of business philosophies between the two firms.

Considerations of the Venture Capitalist include,

but are not limited to:

1. Basic finance — risk and return. The higher the risk the higher the return must be.

2. The Investor having sufficient influence on the business development.

3. Sufficient financial investment from the Client.

4. Structuring a transaction that minimizes the tax consequences of the Investor.

5. Attractive Balance Sheet that will appeal to suppliers and debt financing.

6. Retention of key employees.

7. The rights of the initial investors to participate in later stage funding.

8. Providing a management class of stock to the management for motivation purposes, but with stipulations the stock can be retained by the company should the person leave the firm.

9. A contractual clause stating, the Venture Capitalist who usually invests considerably more money than the entrepreneur did, will not lose money on the investment, while the entrepreneur makes money.

10. A set time line for an exit strategy. Investors typically invest for limited periods and then look for an exit. Companies at this stage are expected to go public, be sold, or merge. At this point the managers and the investors may have different objectives. Contractual arrangements, so the Venture Capital firm can achieve liquidity (get their money back), are important aspects that are dealt with at the inception of the investment.

11. Company control must be addressed. Venture Capitalists don’t typically want to run the day-to-day activities of a business, but with their substantial investment they want to ensure the company is managed appropriately. Day to day activity and voting control will be defined. Investors will want the ability to change management if they deem it is best for the company and their investment.

Structuring the deal requires a “win win” attitude. The process will need to meet the concerns of both parties.

The VC may use a range of financing (security) instruments in structuring the deal including:

1. Senior Debt — used for long term financing for lower risk companies, or later stage funding.

2. Subordinated Debenture — debt that is secondary to financing from other financial institutions.

3. Preferred Stock — which provides the holder preference over common stockholders.

4. Common Stock — is the most expensive for the Client because it carries the highest risk.

Involving debt instruments in the structure provides some preference in the event of liquidation. However, VC is often used to attract debt from other sources, so the use of debt needs to be limited because excessive debt will affect the debt ratio and strain the company’s credit. Equity instruments do not provide the protection of debt instruments, so it requires a higher return and thus is expensive for the Client. It is in the best interest for the Investor and the Client to use equity instruments, allowing the company to pursue debt instruments as the company grows.

The financing structure can be a combination of financing instruments to meet the needs of the situation. Financial instruments can be modified into unique hybrids allowing for flexibility in structuring a transaction. Therefore, there is no set formula for structuring a VC deal. The objective is to satisfactorily meet the needs of both parties.

VC is used in high-risk investments and therefore needs to be structured appropriately. The deal cannot be structured to the advantage of a small player who could obstruct growth, management, or the next stages of funding. The structure needs to define terms allowing a constructive relationship and the best chances for success of the funded business.

Tips About Venture Capital:

Many Clients are looking for Venture Capital but have misconceptions concerning VC.

They want to consider VC a loan (debt instead of equity), with the exception of no monthly loan payments. Many Clients also want 100% financing, while maintaining total control of the company – not realistic.

Clients make the mistake of thinking when they don’t qualify for a bank loan that some person of wealth will just write a check and not complete standard due diligence .

Both Consultants and Clients need to have an unimpaired understanding that Venture Capitalists are sophisticated investors. As a Professional Consultant don’t allow the Client’s misconceptions of VC, to waste your time, or the valuable time of your funding sources.

Consultants need to ask prospects some qualifying questions. When a prospect funding needs are unrealistic, don’t ruin your reputation by trying to “sell” the un-fundable deal. A transaction, which is not based on sound financial reasoning — isn’t a deal. Your funding sources are potentially many deals.

Respect the Funding Source and their process, or you will soon have one less Source.

***********************

When either a Consultant or a Client wants to have a potential Venture Capital deal reviewed, start by providing some basic information in an Funding Request.

For more information on obtaining funds from the capital marketplace please visit www.businessloansandventurecapital.com