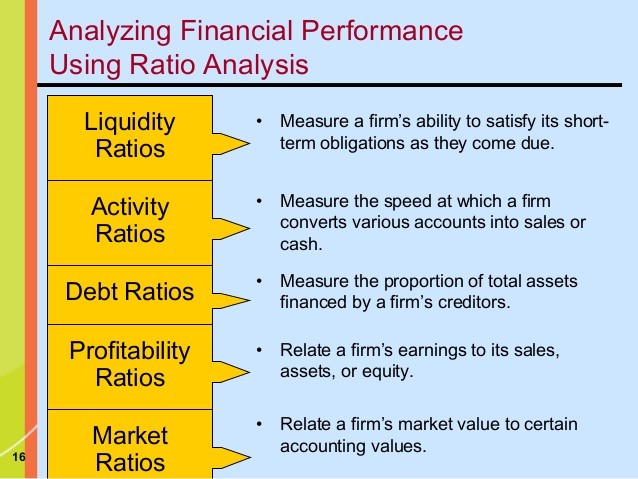

Business Financial Analysis Using Ratios

Post on: 16 Март, 2015 No Comment

Analyzing The Financial Statement

Previously, we indicated that financial statements are

prepared so management can make informed,

intelligent decisions affecting the success or failure of

its operations. In the business world, outsiders -

creditors, bankers, lenders, investors and

shareholders — have varying objectives in mind when

they look at a company’s statements. The type of

analysis and the amount of time spent on it depends

upon the objectives of the analyst. An investor

interested in a publicly owned company might spend

less effort than a banker considering a loan

application. A supplier considering an order from a

small business might spend less time and effort than

the banker. The degree of information available on a

business varies according to the requirements of the

business under review. For example, a banker

considering a sizable loan application would normally

require not only a detailed statement of condition and

income for several years, but inventory breakdowns

and aging schedules of receivables, accounts

payable, sales plans and profitability projections.

When a banker, credit manager or investor receives

the financial information desired, an analysis is started

and the leading tool most analysts use is ratio analysis.

Ratios are a means of highlighting relationships

between financial statement items. There are literally

dozens of ratios which can be complied on any

business. Generally, ratios are used in two ways: for

internal analysis of items in a balance sheet; and/or

for comparative analysis of a company’s ratios at

Profitability Ratios — used to measure how well a

company performs.

Solvency Ratios — Quick Ratio

The quick ratio, sometimes called the acid test or

liquid ratio measures the extent to which a business

can cover its current liabilities with those current

assets readily convertible to cash. Only cash and

accounts receivable would be included, as inventory

and other current assets would require time and effort

to convert into cash. A minimum ratio of 1.0 to 1.0 ($1

of cash receivables to $1 current liabilities) is

desirable.

Solvency Ratios — Current Ratio

The current ratio expresses the working capital

relationship of current assets to cover current

liabilities. A rule of thumb is that at least 2 to 1 is

considered a sign of sound financial strength.

However, much depends on the standards of the

specific industry you are reviewing.

Solvency Ratios — Current Liabilities to Net Worth

Current liabilities to net worth ratio indicates the

amount due creditor within a year as percentage of

the owners or stockholders investment. The smaller

Solvency Ratios — Current Liabilities to Inventory

Current liabilities to inventory ratio shows you, as a

percentage, the reliance on available inventory for

payment of debt (how much a company relies on funds

from disposal of unsold inventories to meet its current

debt).

Solvency Ratios — Total Liabilities to Net Worth

Total liabilities to net worth shows how all of the

company’s debt relates to the equity of the owners or

stockholders. The higher this ratio, the less protection

there is for the creditors of the business.

Solvency Ratios- Fixed Assets to Net Worth

Fixed assets to net worth ratio shows the percentage

of assets centered in fixed assets compared to total

equity. Generally the higher this percentage is over 75

percent, the more vulnerable a concern becomes to

unexpected hazards and business climate changes.

Capital is frozen in the form of machinery and the

margin for operating funds becomes too narrow for

day to day operations.

Efficiency Ratios — Collection Period

Collection period ratio is helpful in analyzing the

collectability of accounts receivable, or how fast a

business can increase its cash supply. Although

businesses establish credit terms, they are not always

observed by their customers for one reason or

another. In analyzing a business, you must know the

credit terms it offers before determining the quality of

its receivables. While each industry has its own

average collection period (number of days it takes to

collect payments from customers), there are observers

who feel that more than 10 to 15 days over terms

should be of concern.

Efficiency Ratios — Sales to Inventory

Sales to inventory ratio provides a yardstick for

comparing stock-to-sales ratios of a business with

others in the same industry. When this ratio is high, it

may indicate a situation where sales are being lost

because a concern is understocked and/ or customers

are buying else where. If the ratio is too low, this may

show that inventories are obsolete or stagnant.

Efficiency Ratios — Assets to Sales

Assets to sales ratio measures the percentage of

investment in assets that is required to generate the

current annual sales level. If the percentage is

abnormally high, it indicates that a business is not

being aggressive enough in its sales efforts, or that its

assets are not being fully utilized. A low ratio may

indicate a business is selling more than can be safely

covered by its assets.

Efficiency Ratios — Sales to Net Working Capital

Sales to net working capital ratio measures the

number of times working capital turns over annually in

relation to net sales. A high turn over can indicate

over trading (an excessive sales volume in relation to

the investment in the business). This ratio should be

reviewed in conjunction with the assets to sales ratio.

A high turnover rate might also indicate that the

business relies extensively upon credit granted by

suppliers or the bank as a substitute for an adequate

margin of operating funds.

Efficiency Ratios — Accounts Payable to Sales

Accounts payable to sales ratio measure how the

company pay its suppliers in relation to the sales

volume being transacted. A low percentage would

indicate a healthy ratio.

Profitability Ratios — Return on Sales (Profit

Margin)

Return on sales (profit margin) ratio measures the

profits after taxes on the year’s sales. The higher this

ratio, the better the prepared the business is to handle

downtrends brought on by adverse conditions.

Profit Ratios — Return on Assets

Return on assets ratio is the key indicator of the