Business Dividendpaying stocks gain favor

Post on: 16 Март, 2015 No Comment

Dividend-paying stocks gain favor

Experts say companies are coming under increasing pressure to pay out more of their profits to shareholders. An improving economy also is a good omen for dividends.

By HELEN HUNTLEY

Published August 3, 2003

Looking for income? Stocks might be just the ticket.

Although income investors naturally turn first to bonds and bank accounts, many are buying stocks for the dividend income and hoping for a little growth along the way.

Even some regular stocks like General Electric pay a decent dividend these days, and you know you’ve got a quality company, said Palm Harbor investor Robert White, 73, a retired business owner.

In fact, last week General Electric was offering a better yield on its stock (2.7 percent) than it was on its new two-year notes (2.3 percent). Many banks have stock dividend yields higher than the rates on their short-term CDs.

Paltry returns on fixed-income investments and renewed signs of life in the stock market are responsible for much of the current interest in stocks. It also helps that dividend income now qualifies for preferential tax treatment. Under the new tax law, an investor who pays a 25 percent tax on CD interest will be taxed only 15 percent on dividend income. Low-income investors get an even better deal. If their regular tax rate is 15 percent, dividends will be taxed at 5 percent, then become tax-free after 2007.

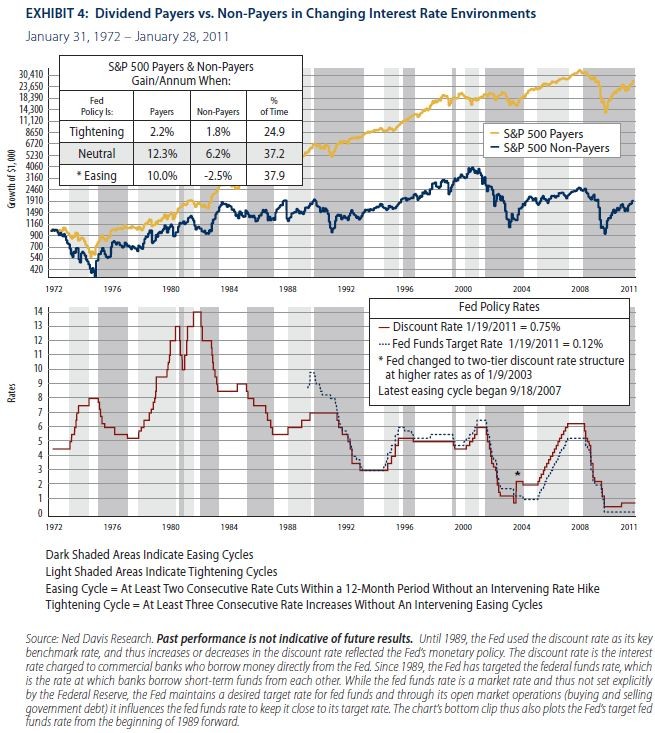

And unlike bonds and CDs, which offer a fixed rate of return to maturity, dividends often increase, providing a growing stream of income. So far this year, 163 of the 500 companies in the Standard & Poor’s 500 Index have raised their dividends and 12 began paying dividends for the first time. In two recent cases of note, Wells Fargo & Co. raised its dividend 50 percent and Citigroup hiked its payout 75 percent.

Citigroup said the new tax law makes it more attractive for companies to pay higher dividends.

Clearwater financial planner Ray Ferrara of ProVise Management Group said he expects the managers and directors of public companies to be under pressure to pay out more of their profits in dividends rather than hoard the cash as they did in the past. Dividends will become a more valuable component of any stock that you buy.

An improving economy also is a good omen for dividends. Dividends are a way for companies to share their profits with their owners, the shareholders. When companies have higher earnings, they can afford to pay bigger dividends.

However, dividends can go down as well as up, as TECO Energy shareholders learned when the Tampa company cut its dividend nearly in half.

Although companies rarely reduce or eliminate a dividend after one bad quarter, an extended string of bad quarters or a fundamental change in the company’s business outlook puts a dividend in danger. In fact, anything that threatens the financial health of a company represents at least a potential threat to both the dividend and an investor’s principal.

A lot of people will chase the dividend yield without looking at the management of the company and the business the company is in, Ferrara said. You shouldn’t rush out and buy Altria (parent company for Philip Morris and Kraft Foods) without recognizing all the lawsuits that are out there.

Retiree White said careful research is a requirement for anyone considering buying individual stocks.

With utilities especially, you’ve got to stay with the highest quality you can find, he said. You have to look at how long the company has been around and see if it’s solid.

You also have to spread the risk, he said. That means diversifying — owning several stocks in each of several different industries to reduce the damage to your portfolio if one stock or one industry falls on hard times. White uses mutual funds to diversify in some sectors, including real estate investment trusts.

If you don’t buy at least three or four different REITs, you’re not diversified enough, he said.

Financial advisers are not suggesting that income-seeking clients trade all their bonds in for stocks. Rather, they say investors should consider a modest shift of assets.

For someone who is 100 percent bonds, as long as they have a time frame of four years or longer, the decision to put a portion of their portfolio in stocks is a no-brainer, said Richard Maroney, editor of Dow Theory Forecasts newsletter. Stocks and bonds don’t move together and they’re probably reducing the risk of the portfolio by getting some investments that are not completely hostage to the rate of inflation and prevailing rates in the bond market.

St. Petersburg money manager Robert Doyle, at Spoor, Doyle & Associates, said many investors’ portfolios are out of balance because bonds have increased in value while stocks have declined over the past three years. He said he is recommending that his clients restore balance by increasing the percentage of their portfolios devoted to stocks — as long as they can tolerate the stock market’s ups and downs.

Doyle said some clients are worried about stocks’ volatility, but that he is more concerned about the possibility of a debacle in the bond market. Bond prices and interest rates move in opposite directions, so if interest rates rise, bond prices will fall.

I cannot imagine bonds outperforming stocks over the next five years, he said. But I am not smart enough to know what the markets are going to do. Since I don’t know, I diversify. When a portfolio asset class is out of balance, we need to make a change.

However, it will take more time to convince some investors that it is safe to wade back into the stock market.

I’m a little hesitant right now, said Largo investor Tom Brown, 64, a retired firefighter. Things just seem too unsettled everywhere. I’m doing a lot of research and playing the waiting game.

- Helen Huntley can be reached at huntley@sptimes.com or 727 893-8230.

Tips for income investing

Want to buy stocks for income? Making smart choices involves more than picking the stocks that pay the biggest dividends. Here are some tips to guide you in your search:

1. Buy stocks of companies in several industries. A diversified portfolio is safer than one concentrated in a single industry.

2. The dividend yield is the projected dividend payout over the next four quarters divided by the current stock price. If the stock price goes up, the yield goes down even though the dollar amount of the dividend stays the same.

3. Compare dividend yields of stocks in the same industry. An above-average yield often is a sign of problems.

4. Find out the payout ratio by dividing the dividends per share by the net income per share. A company that is paying out more than it earns or nearly all of what it earns cannot sustain the dividend indefinitely.

5. Ask about special characteristics. Not everything that trades like a stock is a garden variety common stock. Some high yielders are preferred stocks, which sometimes can be called for redemption for less than their current price.

6. Scrutinize a company’s financial condition, comparing its debt to its assets. The lower the percentage, the better. How does the percentage compare with the debt load of other companies in the same industry?

7. Take a look at history. Does this company have a track record of increasing dividends? Has it had a dividend cut in the past? Is the stock price high or low relative to the company’s history and to stocks in the same industry?

8. Check up on the company’s prospects for the future. Is its business growing or declining? A growing business offers the best chance for growing dividends. If the company is having problems, are they temporary or could they prove to be fatal?

[Last modified August 3, 2003, 01:32:42]