Business Basics in China

Post on: 16 Март, 2015 No Comment

With U.S.-China trade at record highs and China as the world’s second largest economy, the JofA asked Timothy J. Hilligoss, CPA, MST, partner in charge of Asia for Southfield, Mich.-based firm Clayton & McKervey PC, to share some basics on what U.S. companies face when investing in Chinese ventures.

LEGAL/REGULATORY

JofA: What are the available forms of organization for doing business in China (simplest to more complex)?

Hilligoss: There are three common methods for a U.S. investor to do business in China. Those being a representative office (RO), a wholly owned foreign enterprise (WOFE or WFOE) or an equity joint venture (EJV) in which the direct foreign investment is less than 100%. Both the WOFE and EJV are limited liability companies.

JofA: What are the advantages and disadvantages of each?

Hilligoss: The pros and cons:

RO: A RO is not a legal entity and is not allowed to directly participate in revenue generating business activities (for example, conclusion of contracts, buy and sell directly, issuance of invoice, etc.). ROs cannot directly employ local nationals, are allowed a limited number of representatives, and require annual license renewal. There are no minimum capitalization requirements. Currency controls are less restrictive. However, the establishing U.S. entity must have been in existence for two years. A RO is required to use the actual or deeming method to determine taxable income and pay China corporate income tax. (A RO may have income taxes without actual income.)

WOFE: A WOFE is a legal entity subject to China’s minimum capitalization rules. WOFEs are subject to restrictive currency controls, but they allow 100% foreign ownership and control, which may be beneficial for IP (intellectual property) protection. WOFEs require 10% of after-tax profits to be held in company reserve (until the cumulative reserve reaches 50% of the registered capital).

EJV: An EJV is a legal entity that requires a Chinese partner. WOFE rules apply to EJVs. The structure may expose IP to a Chinese partner, but the partner may share in liabilities and costs as well as provide easier entry to the Chinese market.

JofA: What statutory financial reporting is required, and what accounting principles need to be followed?

Hilligoss: Chinese tax authorities require entities with foreign ownership to submit an audited financial statement with their annual corporate income tax returns. The audit is required under Chinese or “PRC” GAAP. Audited financial statements are also required during the annual inspection of an RO, WOFE or EJV with foreign ownership.

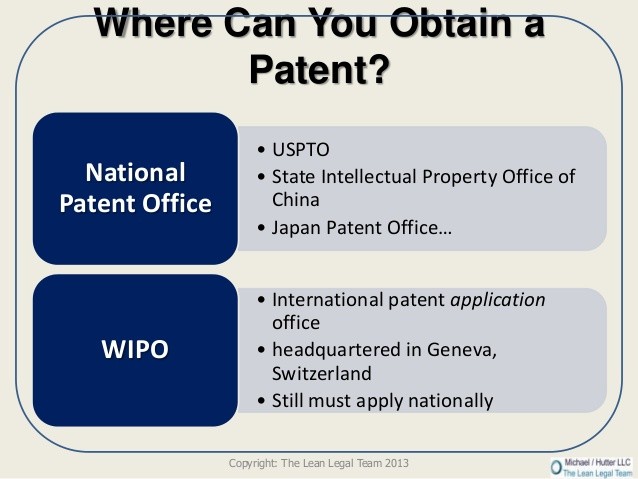

JofA: What do companies need to understand about protecting intellectual capital in China?

Hilligoss: While we are not attorneys, we certainly see this question come up a lot in our client base. Everything we have seen tells us you cannot stop someone from stealing your know-how. What you can do is limit or piecemeal what any vendor or supplier may be privy to and look to protect how you put all the pieces together. China, since joining the WTO (World Trade Organization), has implemented legislative changes setting general standards for IP protection and enforcement.

JofA: What are important aspects of labor?

Hilligoss: Focusing on the tax and economic factors, China is seeing double-digit growth in wages. Certainly, you expect some areas like Beijing and Shanghai to lead the way. However, because of heavy foreign investment, there is significant wage growth in Nanjing, Chongqing, Tianjin and Changchun. This fast growth can make it difficult to keep and find employees. From the cost/tax perspective, China has social taxes just like the U.S. They also have holiday and overtime pay, as well as severance pay requirements, which typically equate to one month pay for each year or portion thereof worked. Total costs of social security, health and unemployment taxes equate to about 40% of basic payroll costs.

JofA: Can you share some basics on Chinese currency laws?

Hilligoss: China has strong control over the cash flow of foreign enterprises. It really is a process of permissions. I think the most frustrating aspect for a U.S. business is not being able to wire money whenever or wherever they want. China’s State Administration of Foreign Exchange regulates foreign currency transactions, which typically include: initial capitalization, cross-border transactions with vendors and customers, and dividend or other repatriations. Once a business is issued a business license, it must apply for a foreign exchange registration certificate in order to receive and remit foreign currency.

China’s regulations require “current accounts” for day-to-day transactions including interest and dividends. “Capital accounts” are more restrictive and typically involve equity investment or loans from foreign investors. It is key to understand that, when you apply for a business license in China, you must declare your initial capitalization of the business including your registered capital and shareholder loans. This seems simple until you run out of money to meet payroll or other operating expenses. You must reapply to commit more money. This process may take over four weeks.

Some capitalization basics include: You may take up to two years to complete your registered capital; however, the first installment, due within three months of your business license issuance, should be no less than 20% of the total. The registered capital may be contributed in cash, property (for example, machine or equipment), IP rights, etc. The total cash contribution should not be less than 30% of the total registered capital commitment. A shareholder loan is usually subject to a quote depending on the amount of capital. For a total investment less than $3 million, the shareholder loan cannot exceed 30% of the total investment.

TAX

JofA: Are there financial and tax incentives available for foreign investment?

Hilligoss: The government eliminated the tax incentives for foreign investors in 2008. However, there are incentives for industry attraction, including reduced tax rates for high-tech and new-tech enterprises and environmental and conservation projects. Most major Chinese cities have business development incentives designed to attract direct foreign investment. Our clients have seen incentives ranging from reduced income tax rates to rent subsidies.

JofA: Could you provide an overview of the tax compliance and reporting system?

Hilligoss: Generally, income tax estimates are due quarterly. The estimates are due by the 15th of the month following each quarter that the estimate applies, and an annual reconciliation return is due May 31st of the following calendar year. Business tax is due monthly on the 15th of the following month. Value-added tax (VAT) is due monthly on the 15th of the following month. I say “generally” because the local tax authority may provide alternative compliance requirements.

JofA: What is subject to withholding taxes? What are the rates, and are there treaty reductions available to the U.S. Do reduced treaty rates apply to only certain types of business entities?

Hilligoss: The U.S. and China have a tax treaty that sets the withholding rates specific to the nature of the payment being made. Typical payments that are subject to withholdings include royalties, interest and dividends. The general treaty rate is 10% withholding. However, royalties and interest may also be subject to China’s 5% business tax unless an exempt purpose is determined. China, like the U.S. has many tax treaties. Each treaty is unique, and some may offer reduced withholding rates. Treaty withholding is one component that impacts an investment in China. Anyone considering an investment in China really needs to understand the tax impact their investment will have on their U.S. operations and their U.S. employees working abroad and how ownership structure could impact overall tax costs and investment transferability.

JofA: What are other types of taxes—property taxes, value-added taxes?

Hilligoss: Turn-over taxes: Include business tax, VAT, consumption tax (luxury goods), and customs duty.

Income taxes: Corporate income tax, individual income tax, withholding income tax (royalties, dividends, interest and capital gain).

Property taxes: Property tax, urban real estate tax, land use tax, vehicle license fee, vehicle purchase surcharge, deed tax.

Activity taxes: Urban construction tax, stamp duty, land value-added tax.

TRANSACTIONS

JofA: Are there restrictions on dividends and other fund flows out of China?

Hilligoss: As mentioned previously, China has regulations regarding foreign currency transactions that impact cash leaving the country. Payments to a U.S. parent for services provided to a Chinese subsidiary may be subject to the 5% business tax. Payments to a U.S. parent for management fees may be subject to the 5% business tax and may not be allowed as a deduction by the Chinese tax authority. Payments of interest and royalties will be subject to withholdings. Payments of dividends are subject to withholdings and the following restrictions: Dividends cannot be paid until the original registered capital commitment declared in the business application has been paid, according to the committed schedule, and the Chinese subsidiary makes profits. For a WOFE, 10% of their annual after-tax profits must be reserved and remain in equity until the cumulative reserve reaches 50% of the registered capital. I think it is important to discuss another aspect of the Chinese business tax. In its simplest form the business tax is a tax on services rendered to a Chinese company. Generally, the rate is 5% with some exceptions. Why is this important? Basically, any U.S. attorney, architect, engineer or accountant that does business for a Chinese company could find their fees reduced by the Chinese business tax even if they never set foot in China.

JofA: What does a company need to understand about transfer-pricing regulations in China? What kind of documentation is required?

Hilligoss: The Chinese Tax Authority is getting more sophisticated. In January 2009 it issued transfer-pricing regulations. China requires annual reporting of transactions between enterprises and their related parties. The reportable transactions include: sales and purchases, services, financing, intangible and fixed assets, outbound investments and outbound payments. Transactions with related parties must be at arm’s length.

Documentation that should be maintained includes: organizational structure, overview of business operations, details of the related-party transactions, comparability analysis, and the transfer-pricing method applied. An advance-pricing arrangement can be requested with the tax authority. The U.S.-China tax treaty provides relief from potential double-taxation adjustments through the proper negotiation between the competent tax authorities of the two countries. China, similar to the U.S. has controlled foreign corporation provisions and thin capitalization interest expense limitations that may also impact related-party activity.

JofA: What are some basic strategies for managing exchange rate risk?

Hilligoss: About 40% of our practice straddles international borders. Most clients purchase foreign currency contracts to offset currency fluctuation risk. But I think China creates a more cautious approach for many businesses; rather than attempting to understand the complex economics and politics of the dollar/yuan relationship, many simply pursue contracts in U.S. dollars and initially ignore the risk of loss on their total investment. The general consensus is that the real risk is to Chinese investors in the U.S. losing value should the exchange rate change. I don’t think anyone would anticipate a rate change that would hurt a U.S. investor in China.

JofA: How difficult is it to sell a Chinese company?

Hilligoss: It is similar to a U.S. sale; however, the due diligence process may be less detailed. China does allow both stock and asset sales. Government approval is required. If we can circle back, just as treaties and structuring are critical to setting up an investment in China, they are equally critical to exit planning. Proper planning could eliminate or significantly reduce the tax withholding on the sale of a Chinese company. We have not had any clients sell their Chinese investments, but we have assisted with due diligence on an acquisition of a U.S. company with a Chinese subsidiary. Understanding the complex U.S. tax reporting and compliance of foreign investments and having written and verbal Chinese language capabilities in our firm was critical to evaluating the subsidiary because the documents were almost entirely Chinese.

BUSINESS ENVIRONMENT

JofA: What are some basics Americans need to understand about the Chinese business culture?

Hilligoss: Chinese business culture is relationship based. They are typically long-term planners and are loyal. I think most American entrepreneurs expect quick negotiations, 100% adherence to contract terms and, once a contract is signed, there is no further negotiation. This couldn’t be further from the truth in China. They are negotiating a relationship, not necessarily a contract, and the bartering is continuous. Think of a typical American “first” meeting, five minutes of small talk and 55 minutes of getting things done. A typical Chinese “first” meeting would involve 55 minutes of small talk and five minutes setting up the next meeting.

JofA: What is the commercial lending environment like?

Hilligoss: We have not had a client obtain direct lending in China for their investment in China. Typically, lending is coming from a U.S. parent and contributed as capital. Their lending system is very different from ours and often involves using your vendors as your financing source. Incidentally, in a move to manage inflation, China has raised its interest rate several times. We may actually see U.S. subsidiaries of Chinese companies pursue U.S.-sourced lending relationships if the rates are lower in the U.S.

JofA: How does trade credit work in China? What are standard terms and conditions of buying and selling?

Hilligoss: International trade is typically different, as many buying and selling relationships involve letters of credit. However, absent a letter of credit, terms across borders or within China are similar. Because their business culture is relationship driven, you can expect little or no credit terms early in a relationship. Expect upfront deposits or retainers and cash-on-delivery terms. However, experience will bring better terms. The key is to always negotiate.

JofA: Have your U.S. clients who have opened operations in China made the money they expected? Have they recouped their investments?

Hilligoss: I would say that depends. Most have not made the type of money they expected, and many have not recouped their investment. The global economy played a major role in dashing both their expectations and financial results. I think the economic uncertainty here at home put many foreign investment plans in a holding pattern, in particular those tied to the auto industry. Recently, it looks as though the optimism has shifted, and we have seen a steady increase in China investment activity over the last few months, especially from those in the auto and environmental industries.

Video: China’s Accounting Landscape

With a fast-growing economy powering demand for accountants, the Chinese government has made a commitment to spurring development in the accounting profession, says Winnie C.W. Cheung, chief executive and registrar of the Hong Kong Institute of Certified Public Accountants. That initiative is designed to build 10 large CPA firms and 200 midsize, homegrown accounting firms by 2015. She discusses the shortage of accountants to serve the mainland China market and hot topics for the profession in Hong Kong. Click here to view the video.