Bullish and Neutral Options Strategies for (AMZN)

Post on: 23 Июль, 2015 No Comment

Amazon.com (NASDAQ:AMZN ) is in the business of selling Kindle e-readers, books, housewares, and just about everything in between (including the kitchen sink ). In addition to its peddling of tangible goods, the retailing giant also generates revenue through credit-card services and marketing agreements.

The online business has dominated the e-business space for years, and this has been reflected in the share price. AMZN shares have gained more than 250% in the past five years and are up roughly 30% on a year-to-date basis.

Earlier this week, Credit Suisse upped its price target on the shares to $165 from $145 while maintaining a neutral rating on the stock. Perhaps the firm was playing a bit of catch-up with the stock bearing down on the $180 level. In a note to clients, Credit Suisse noted that Amazon has a strong gross and operation margins outlook.

This is a somewhat mixed message, because while the price target was lifted amid optimistic reasoning, the new price is still below the current price. So what’s an investor to do? Trust the uptrend or believe Credit Suisse’s new target? For those interested in exploring the options-trading landscape, the profit/loss details for two alternatives – a cash-secured put and an iron condor – are outlined below.

These strategy descriptions are purely educational and are not intended as buy/hold/sell recommendations. All prices are as of Tuesday’s close, when AMZN shares were trading at $176.77, down $1.28 for the day.

Bullish Option Strategy: Cash-Secured Put

One way to express a moderately bullish outlook in Amazon would be through a cash-secured put. Some view this strategy as a way to get paid to wait for the stock to drop to a target price. For example, the out-of-the-money January 170 put can be sold for an initial credit of $4.55 per contract.

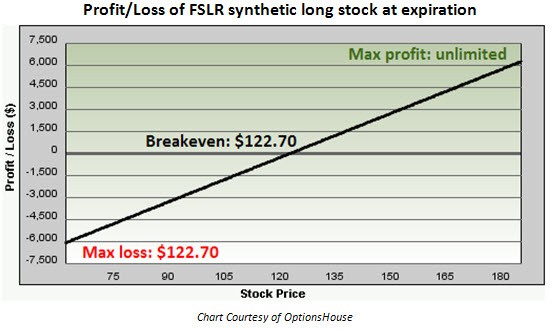

If AMZN is trading north of the 170 strike when the options expire, the investor keeps this credit as profit. If AMZN has dropped below this strike, the investor may be assigned and required to buy the shares for an effective price of $165.45 (the strike less the credit). This is almost 7% below the current stock price. If assigned, downside risk is equal to that of a straight stock purchase, or unlimited to zero. The profit/loss chart below was created in a virtual trading account. Sign up for your own virtual account here and start experimenting with new strategies.

When employing the cash-secured put strategy, investors typically opt to set aside cash to buy the stock ($16,545 for each put contract, which represents 100 shares). Securing the put with available cash reduces the risk of margin calls down the road.

Neutral Option Strategy: Iron Condor

Traders who think Amazon may tread water for a while could consider a neutral options strategy, which has more profit potential in a sideways-trending stock than simply holding the shares. A January-dated iron condor spread could be traded by executing the following legs:

- Buy the January 150 put

- Short the January 155 put

- Short the January 195 call

- Buy the January 200 call

An investor can currently collect a net credit of $1.30 for this four-legged spread. At expiration, if AMZN is trading between the short strikes (155 and 195), the investor keeps this entire credit as profit (this is the maximum potential profit).

Breakevens are $153.70 to the downside (short put less the credit collected) and $196.30 to the upside (short call plus the credit). Between these levels (a range of roughly 24%), the condor trade will be profitable at expiration.

Maximum loss, should AMZN be trading either below 150 or above 200 at expiration, is $3.70, which is equal to the difference in call/put strikes minus the initial credit. Return on risk is 35% in roughly 45 days.

Please refer to Characteristics and Risks of Standardized Options. copies of which can also be obtained by contacting our Customer Service Department at customerservice@optionshouse.com .