Bull Market or Bear Market Here Are 15 Expert Takes

Post on: 16 Март, 2015 No Comment

Market minds pore through macroeconomic data, sentiment and more — and they go both ways

There’s a lot of chatter out there right now about the state of the market now that the S&P 500 is seriously challenging 1,500 and at its highest levels since the end of 2007.

Are we headed higher? Sideways? Are we overbought and due for a natural cooling off or worse, is this rally a farce and are we set for a crash?

I won’t pretend that I have a crystal ball or some amazing, unique insights into the market. But what I do have is a voracious appetite for smart commentary and over the long weekend, there was plenty of great stuff that caught my eye.

Here are the experts I’m reading right now and their take on the current environment:

The Bulls

Joe Weisenthal of Business Insider found this gem of a quote from Societe General’s Kit Juckes, which disarms any bearish case in one simple sentence: “The reality is that we are short of things to worry about and long of liquidity which tends to weaken the resolve of any bear.” That’s important context for all of the following points. Because after all, many investment managers can’t go to cash and even if they could, many don’t really see a need to.

Here’s why:

Equities Return to Favor in Funds: Fund managers are getting in a groove. with fund flows picking up on the equity sign and seeing steady improvement since the bear market bottom in 2009. Horan Capital Advisors points out a recent survey that finds “asset allocators assigning more funds to equities than at any time since February 2011.”

Apple: Barron’s had a pretty good article last week about the chance of a secular bull market taking hold right now. In “Is a New Bull Market Here?” by Jacqueline Doherty, reasons to be bullish include an uptick in transports, anticipations of capital spending and, of course, a bargain pricing in Apple (NASDAQ:AAPL ).

Market Metrics Looking Good: This long list of bullish signs from technical trader Ralph Acampora made the rounds a few weeks ago, and is worth revisiting since most remain true including market breadth, cash on the sidelines, a bottom in yields and strength in a variety of global markets.

Macro Picture (Mostly) Improving: Fortune senior editor-at-large Geoff Colvin has a more in-depth macro roundup that is slated for the Feb. 4 issue of the magazine. He talks about job growth and recovery hopes last week. He points to fracking as an economic boon, stability in capital markets and improvement on the jobs front, among other things.

Especially Housing: Cullen Roche of Pragmatic Capitalism points out there is some recency bias here based on the housing market’s contribution both to the run-up and the crash of the last several years … but still, you can’t discount housing. And a recent study attributes the lion’s share of economic growth to the housing market and says real estate is “the best-forward looking indicator” we have. Housing seems to be recovering nicely on all metrics as have housing stocks, from PulteGroup (NYSE:PHM ) and its 160% returns in the past 12 months to the broad-based SPDR S&P Homebuilders ETF (NYSE:XHB ) that keeps moving higher.

Low Expectations: Back to my initial setup: Everyone is still so gloomy about things persistently high unemployment, Europe, the federal spending picture, and so on. But as Charles Crane of Douglass Winthrop Advisors recently told Matt Krantz of USA TODAY . “When expectations are low, thats when markets go higher. We have low expectations.” In other words, it won’t take much to make traders happy, and that’s a good thing.

The Bears

Since there was a big-picture setup for the bulls, here’s my intro for the bears: As a recent Credit Suisse report puts it, “the state of investor risk appetite is severely depressed” after massive deleveraging and pervasive pessimism. That signals it won’t take much to spark a crash, and the burden is very great to prove this rally is sustainable. In other words, whether the economy is slowly improving or not isn’t the point investors need to feel good about the economy and markets to truly push us into bull market mode, and that’s a very different measure.

Against the Ceiling: Bespoke Investment Group notes that the market is at the tiptop of its trading range which at best portends a pause, and at worst could mean a correction.

A Host of Risk Factors: Dr. Doom Nouriel Roubini points to a number of serious macro issues that investors continue to overlook from America’s debts to struggles in China and other emerging markets to geopolitical risks in the Middle East. His conclusion? “While the chance of a perfect storm with all of these risks materializing in their most virulent form is low, any one of them alone would be enough to stall the global economy and tip it into recession.”

Central Banks Losing Steam: A lot of folks place trust in central banks and a “you can’t fight the Fed” attitude. But Comstock Partners remains convinced that Washington dysfunction and a lack of any ammunition left at the Federal Reserve after years of loose policy means that fiscal policy will at best be neutral and at worst become a headwind.

Individual Investors Still Skeptical: The American Association of Individual Investors measures sentiment. and its look at retail investors shows that bullish attitudes have retreated yet again recently from almost 47% to about 44%. True, it’s nice that about 44% are bullish vs. 29% neutral and 27% bearish. But in the past two years, there have only been three weeks where bullish sentiment crossed the 50% mark and they never lasted. It seems the bulls remain skeptical, according to the latest AAII data.

Institutional Investors Are, Too: Sell side analysts are the most bearish they have been since the late 1990s, according to a Bank of America Merrill Lynch survey. Of course, it’s worth noting that the sell side is frequently on the wrong side of the trade for instance, that late 1990s pessimism marked a great time to buy … and furthermore, these “experts” didn’t turn bullish until after 2001 when the market was ready to crash after the dot-com bubble. But the sentiment is still worth noting despite past missteps.

Don’t Confuse Short-Term Rally with a Sustained Rally: And when optimism heats up, that could be a contrarian argument. Lance Roberts of StreetTalk Advisors has an intrayear target of 1,560 for the S&P 500 but is worried about how things will shake out after that. His chart of sentiment shows that we are creeping back into irrational exuberance already, which means investors might be throwing money into the market without really thinking about proper valuations.

Consumer Troubles: On to specifics: Elevated energy prices are a common fear and it seems that gasoline and crude are moving higher. Coupled with a payroll tax change, that could be bad for consumer spending.

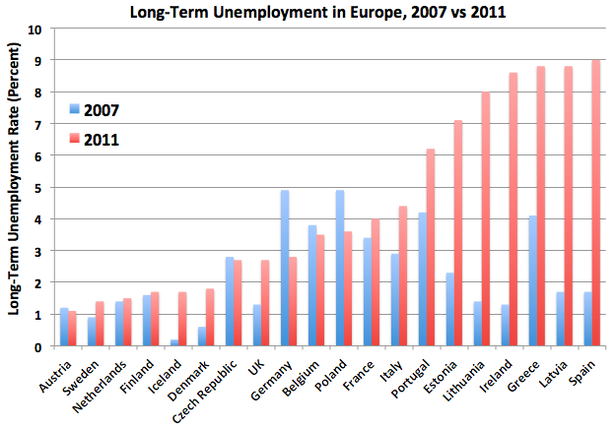

Global Jobs Trouble: We talk a lot about improvement in the jobs market at home, but the world is very interconnected and if you want to get a scary look at the state of global unemployment, check out this daunting chart from The Atlantic that shows how long-term employment (a year or more) has skyrocketed in Europe. There’s talk of stability in the EU, but it’s very difficult to imagine stability amid a labor market like this.

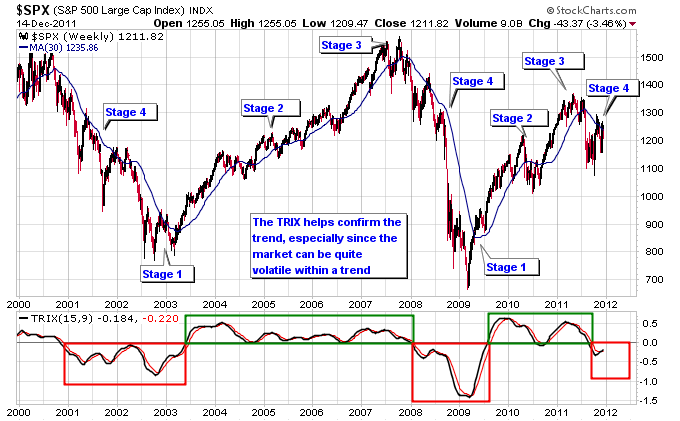

Irrational Exuberance? Volume is low, the VIX is ridiculously low and most bears have thrown in the towel. But that’s precisely why it’s time to look at the charts and start entertaining the possibility of a contraction.

I could post links forever, and there are a few more below. But what are you reading right now and what are your thoughts? Weigh in below in the comments section.

Related Reading

- Of course, some people think any macroeconomic theory is bunk … so who cares? (The Economist)

- A secular bull market and secular bear market in charts: Barry Ritholtz sketches out what the trajectory looks like. (The Big Picture)

- Bill McBride warns that Wall Street economic forecasters are always optimistic, while the blogosphere is always way too bearish. (Calculated Risk)

- This Rodney Dangerfield rally don’t get no respect! A bigger-picture look at the run since 2009 and how many investors have missed out. (USA TODAY)

Jeff Reeves is the editor of InvestorPlace.com and the author of “The Frugal Investor’s Guide to Finding Great Stocks.” Write him at editor@investorplace.com or follow him on Twitter via @JeffReevesIP . As of this writing, he held a long position in Apple.