Bull Market Gold Misery (MCD FB GDX GLD) Normandy Research

Post on: 30 Апрель, 2015 No Comment

Bull Market = Gold Misery (MCD, FB, GDX, GLD)

Posted on November 3, 2014 by Normandy Research

We’re not sure if it was an early practical joke – if someone over at Barron’s got November 1st confused with April 1st – but we sure got a kick out of it.

Well, it seems that precisely as last week’s drop in gold was occurring – preceded, of course, by the requisite drop in the stocks of gold miners – none other than that above-mentioned august repository of knowledge on investments was offering its readers the following fare:

You betcha.

Barron’s decided (with assistance from the stock aficionados at Morningstar) that it might be time to diversify your portfolio with a gold mining ETF, which – get this! – “has an R-squared (a measure of performance correlation) of just 4 with the MSCI All Country World Index.”

Just 4?!

Can you believe it?

They further wrote that

“…if a much-talked about global slowdown turns into a recession and the global stock markets tank, that exposure to the miners might start looking good, along with bullion…. [Gold mining] stocks look fairly inexpensive to Morningstar’s equity analyst team right now.”

Oh, Lordy…

The ETF they were referring to, of course, was the Market Vectors Gold Miners ETF (NYSE:GDX), precisely the issue that fellow scribbler Matt McAbby over at our weekly Bourbon and Bayonets publication was PANNING that selfsame day .

Wouldn’t you know it…

The technicals for this West African virus of a stock are downright sickening.

As McAbby stated last week, once long-term support for GDX was broken (red line), there was no more reason to hold the stock. And indeed, volume (in black) picked up in the subsequent trading sessions, precisely as he warned.

Additionally, RSI readings (red circle) are low at this point, but should the selling continue, they could still carry deeper for several more days before an oversold sub-20 indication is triggered.

Prognosis: Bad

Of course, both Barron’s and Morningstar are correct. Diversification is amply achieved by owning the gold miners.

As the overall stock market rises, GDX falls.

We note, too, that both gold and silver bullion are coming off their worst three-day performance in over sixteen months. And it doesn’t appear to be over.

Give us a smile, Roberta…

The good news is that we are finally seeing some expanding volumes associated with the selloff, an indication that we might soon reach the capitulation stage. As of today, however, it’s too early to tell whether we’ll get there sooner or later. After three years of declines, the washout could take months to play out, and could bring the PMs to very surprising levels.

This is gold bullion proxy SPDR Gold Trust (NYSE:GLD) for the last six months –

Here, too, volumes are encouraging. We have 18 million shares turning over on a stock that normally sees about six. A one-day surge, of course, so take it for what you will. But we don’t count it as significant just yet.

On top of that, we see that the stock has mined new bear market lows (in blue), digging below former support at $114 with room to run before RSI registers a deeply oversold sub-20 read (in black).

All told, bullion (like the miners) is in the bucket, and outside of playing a near term retracement, there’s no point even thinking about taking on long positions any time soon.

Don’t give me no sass…

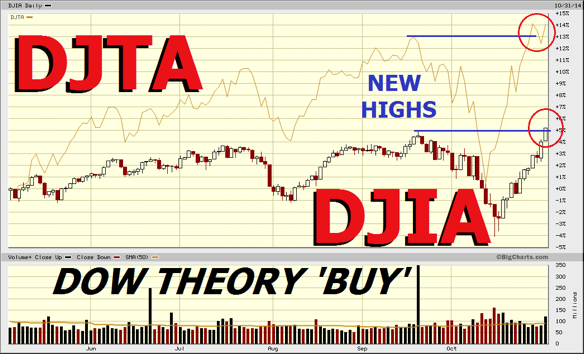

As stated above, the Morningstar analysts are correct: as the market climbs, gold and the miners sink. And we should expect lots more R-squared going forward, as we have a brand new Dow Theory BUY signal registered as of last week!

That’s right, the Transports logged all time highs on Tuesday last, while the Industrials wasted no time catching up and surpassing their former peak on Friday afternoon.

That’s a classic Dow Theory BUY, and no one with any sense of justice or compassion for their hard earned cash should take a short position on the market today.

Look here –

We repeat – Dow Theory may be not the last word on investing, but the vast majority of serious players use it to get their bearings, and it would be foolish in the utmost to run contrary to the big money.

We should add that the NASDAQ and S&P 500 have also logged new bull market highs.

Good luck.

Two Trades to Report

As we open the new week, we’ve got two pieces of news to report, one good, the other better.

The first involves our trade on Macdonald’s (NYSE:MCD) from our letter of September 15th, TransFat Profits. There, we bought and sold a CALL and a PUT for a $0.04 credit and on expiry everything remained out-of-the-money. In short, you kept your credit.

Sometimes it’s just a four dollar take, folks.

The other was our action of two weeks back, in a letter called Climbing Behind the Virus. In that missive, we urged you to take a long position on Facebook (NASDAQ:FB), poster child of the current bull market and friend of dictatorial regimes everywhere. We did it with a CALL purchase and the matching sale of a PUT.

And what happened?

Last week, in Launch the Dirigibles. we recommended you sell the CALLs, as Facebook shares had spiked very handsomely and the CALLs had gained in value from their original purchase price of $4.00 to $5.30.

At the same time, we urged you hold your short FB PUTs (from which you earned a credit of $1.90) until the end of the week, at which time we were confident they would expire worthless.

And that’s precisely what they did.

Your initial outlay for the trade was $2.10 (4.00 – 1.90). And you brought home $5.30. a net profit of $3.20 on $2.10 spent, or 152% .

And that smells nice.

Wall Street Elite recommends you enjoy the profits from the above two trades and have a great week!

Want to make sure you never miss out on 152% profits again?

Make sure to sign up for Wall Street Elite today!