Buffett’s return credit crisis call ICE’s bad news Financial Express

Post on: 30 Апрель, 2015 No Comment

Comments 0

Summary Warren Buffett’s decision to help Dow Chemical Co. pay for its takeover of Rohm & Haas Co. is a departure from past practice in two respects: the industry and the dollar amount.

Warren Buffett’s decision to help Dow Chemical Co. pay for its takeover of Rohm & Haas Co. is a departure from past practice in two respects: the industry and the dollar amount. There isn’t a single chemical maker among the units or publicly disclosed stock investments of Berkshire Hathaway Inc, Buffett’s insurance and investment company. Consumer-product and financial stocks account for about 75 percent of the shares’ total value, according to data compiled by Bloomberg.

Berkshire has stayed out of the industry since selling a stake in Great Lakes Chemical Corp. a maker of pool chemicals, household cleaners and fire suppressants, in 2003. Great Lakes became a unit of Chemtura Corp. about two years later. By providing $3 billion of equity financing to Dow, the biggest U.S. chemical producer, Berkshire is returning in a big way. The Omaha, Nebraska-based company will become Dow’s biggest individual shareholder when the $15.4 billion deal is completed.

Buffett’s company will purchase convertible preferred shares of Dow, based in Midland, Michigan, just as it did with Salomon Inc, Gillette Co. and US Airways Group Inc. years ago. Salomon, Gillette and US Airways are among eight companies from which Berkshire bought at least $100 million of convertible securities since 1987. The price tag for the Dow holding exceeds the total for all those investments: $2.88 billion.

Estimating terms

The increase in scale is in keeping with the multibillion- dollar investments that Buffett has made this year on behalf of Berkshire, which had $44.3 billion in cash as 2008 began.

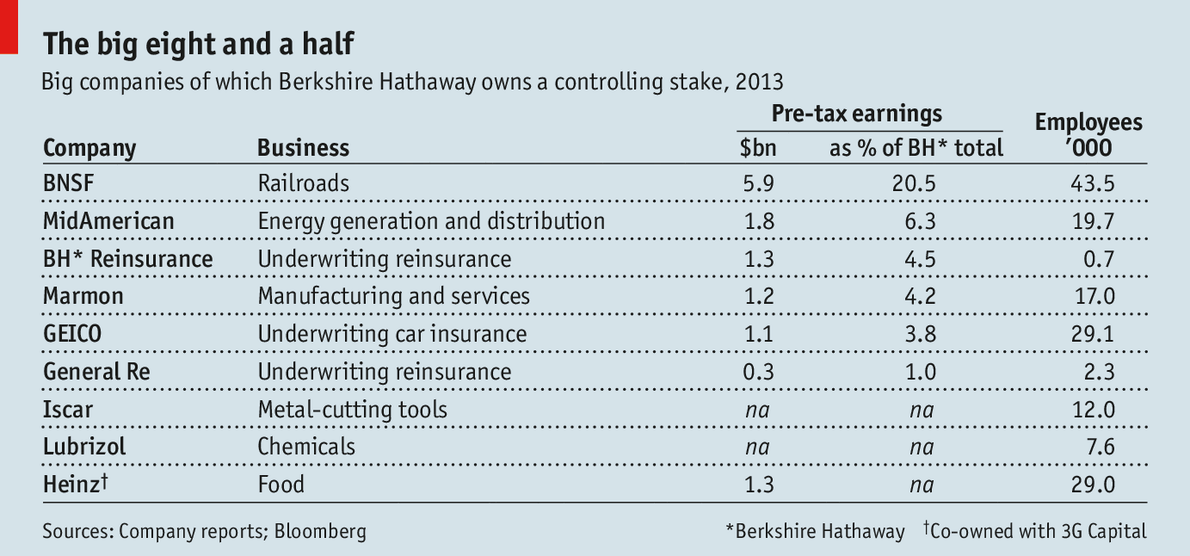

In April, the company agreed to provide $6.5 billion in debt and equity financing to Mars Inc. for its takeover of Wm. Wrigley Jr. Co. the world’s largest maker of chewing gum. The accord followed a $4.5 billion purchase of a 60% stake in Marmon Holdings Inc, consisting of 125 companies, in March.

While the exact terms of the investment in Dow weren’t disclosed, Chief Financial Officer Geoffery Merszei provided some key details on a conference call. The preferred has an annual dividend of 8.5 percent, just below the range for the eight convertible issues that Berkshire purchased in the past. The lowest rate for those securities was 8.75% on Gillette’s preferred.

Williams Cos, a pipeline owner, paid the highest at 9.875%. Berkshire will own the equivalent of 72.6 million shares, or a 7.1% stake, as the stock is convertible at $41.32 a share. Axa SA, Europe’s