Budgeting Basics Setting Up A Budget

Post on: 14 Апрель, 2015 No Comment

Now you know why having a budget is so important. It can help you:

- Make long- and short-term projections about your financial situation.

- Avert a financial crisis.

- Get the most from your money.

- Plan for major financial changes

- Achieve peace of mind

If you’ve never had a budget, you may be feeling daunted by the prospect of setting one up. In this section, we’ll show you how to set up a budget. We’ll provide a sample budget and give you a downloadable Excel template to use if you’d rather not design your own.

First, let’s discuss the various systems you could use to track your money:

- Notebook and Pen: This least-expensive option is within anyone’s means. It doesn’t require a computer or the additional software expense. You can easily carry it with you and access it at any time, and electronic failure won’t cause you to lose your data. However, notebooks can be misplaced, and meticulous record keeping can be ruined by the swift tip of a nearby glass of water. Perhaps most importantly, it’s easier to make mistakes by hand, and it’s more difficult to track your long-term spending and savings patterns with a notebook.

Simple Steps To Using Your Budget

Once you’ve chosen the system that’s best for you, how do you start using it?

1. Keep Track of Every Expense, Including the Small Ones

It’s easy to remember how much you spent on rent or your mortgage payment, but for other expenses, you’ll want to save your receipts. If that drives you crazy, put all your purchases on the same debit or credit card to make record keeping easy. Keep in mind, though, that the transaction descriptions on your credit card statement aren’t always crystal clear, and you may be left wondering what exactly is that $19.17 purchase. Don’t forget too, that you may be charged for each transaction, and if you don’t pay off your credit card on time, you’ll be accruing interest as well. (For more about mortgages, see our Mortgage Basics tutorial.)

Another option is to use cash for the small expenses, but only withdraw a certain amount each week or month and enter this in your budget as miscellaneous. While this method may prevent you from overspending, it will not give you the clearest picture of where your money is going.

2. Update Your Budget — Daily

Tracking your money this way will take minimal time, and you’ll be less likely to forget something.

3. Use Accurate Descriptions

Write down your expenses by what they are rather than where you purchased them so you’ll be able to figure out later how much you spend in particular categories. For example, if you shop at a big box store like Wal-Mart ( NYSE. WMT ) or Target ( NYSE. TGT ), you might make a purchase that includes groceries, clothing and household cleaning supplies. If you list the purchase under Wal-Mart, you won’t really know where that $150 went.

4. Budget by the Month, Not the Paycheck

This forces you to think slightly longer-term than your bimonthly paycheck, but not so long-term that you’re likely to get derailed. Also, you’ll get a fresh start every month. If you have a bad month, it’s in the past after 30 days. If you have high expenses one month, you can look forward to the following month when, for example, your car insurance isn’t due.

5. Plan for Both Fixed and Variable Expenses

Fixed expenses are items like rent and health insurance, and variable expenses are things like utilities and gas. Some costs, like groceries, can fall into either category depending on how much self-control you have.

6. Plan for Occasional Expenses

Budget for expenses that only happen a few times a year like gifts, car insurance and doctor visits. If you have enough room in your budget, you can pay for these as they occur. If you’re on a tighter budget, set aside additional savings ahead of time. There is no excuse for going into debt because you didn’t realize that Christmas happens every year or that you would need a bridesmaid dress or a tux when your best friend gets married a year from now.

Your budget can be more or less detailed depending on your level of self-control. Can entertainment be grouped under miscellaneous, or do you tend to spend so much on movies, restaurants and concerts that this needs to be its own category?

In addition, budgeting is a little different if you have a steady income versus an irregular one. If you’re paid hourly or on commission, are self-employed, work seasonally or are a student, you probably won’t know how much you’re going to make until the month is over. Irregular pay makes budgeting a little trickier, but it’s still feasible. You will still have to cover certain expenses no matter what, and if you’ve been in the same line of work for awhile, you probably have a good idea of the minimum amount of money you’re likely to make. Budget around that minimum and you might be pleasantly surprised at the end of the month if you make more.

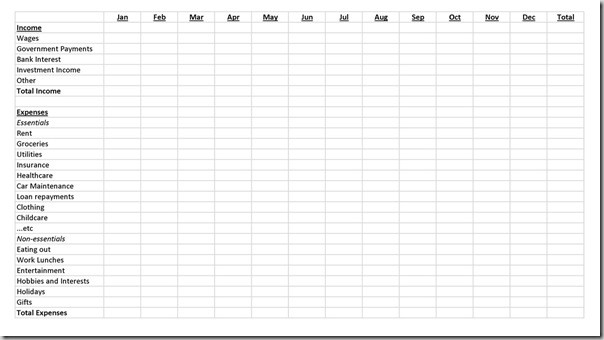

Budget Example

Our budget spreadsheet is easily adjustable to accommodate different budgeting needs and styles. Here’s an example: