Budgeting 101 3 Simple Steps To Building Wealth

Post on: 29 Март, 2015 No Comment

reprint from Investopedia by William Artzberger ,CFA

Building wealth its a topic that sparks heated debate, promotes quirky get rich quick schemes and drives people to pursue transactions they might otherwise never consider. Three Simple Steps To Building Wealth may seem like a misleading title, but it isnt. While these steps are simple to understand, theyre not easy to follow.

The Steps

Basically, building wealth boils down to this: To accumulate wealth over time, you need to do three things:

- You need to make it. This means that before you can begin to save or invest, you need to have a long-term source of income thats sufficient enough to have some left over after youve covered your necessities.

- You need to save it. Once you have an income thats enough to cover your basics, you need to develop a proactive savings plan.

- You need to invest it. Once youve set aside a monthly savings goal, you need to invest it prudently.

Getting on Track

Step1: Making Enough Money

This step may seem elementary, but for those who are just starting out, or are in transition, this is the most fundamental step. Most of us have seen tables showing that a small amount regularly saved and compounded over time can eventually add up to substantial wealth. But those tables never cover the other sides of the story that is, are you making enough to save in the first place? And are you good enough at what you do and do you enjoy it enough that you can do it for 40 or 50 years in order to save that money? (For related reading, see Understanding The Time Value Of Money and Delay In Savings Raises Payments Later On .)

To begin, there are two types of income earned and passive. Earned income comes from what you do for a living, while passive income is derived from investments. This section deals with earned income.

Those beginning their careers or in the midst of a career change can think about the following four considerations to decide how to derive their earned income:

- Consider what you enjoy. You will perform better and be more likely to succeed financially doing something you enjoy.

- Consider what youre good at. Look at what you do well and how you can use those talents to earn a living.

- Consider what will pay well. Look at careers using what you enjoy and do well that will meet your financial expectations.

- Consider how to get there (educational requirements, etc.). Determine the education requirements, if any, needed to pursue your options.

Taking these considerations into account will put you on the right path. The key is to be open-minded and proactive. You should also evaluate your income situation annually.

Step 2: Saving Enough of It

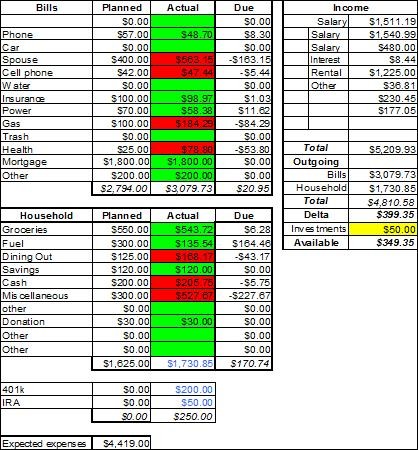

You make enough money, you live pretty well, but youre not saving enough. Whats wrong? Theres only one reason why this occurs: your wants exceed your budget. To develop a budget or to get your existing budget on track, try these steps:

- Track your spending for at least a month. You may want to use a financial software package to help you do this. If not, your checkbook is the best place to start. Either way, make sure you categorize your expenditures. Sometimes just being aware of how much you are spending will help you control your spending habits.

- Trim the fat. Break down your wants and needs. The need for food, shelter and clothing are obvious, but you also need to address less obvious needs. For instance, you may realize youre eating lunch at a restaurant every day. Bringing your own lunch to work two or more days a week will help you save money.

- Adjust according to your changing needs. As you go along, you probably will find that youve over- or under-budgeted a particular item and need to adjust your budget accordingly.

- Build your cushion you never really know whats around the corner. You should aim to save around three to six months worth of living expenses. This savings prepares you for financial setbacks, such as job loss or health problems. If saving this cushion seems daunting, start small. (Learn how to save for the unexpected. Read Build Yourself An Emergency Fund .)

- Get matched! Contribute to your employers 401(k) or 403(b) and try to get the maximum your employer is matching. Some employers match 100% of the participants contribution, and this can be a big incentive to add even a few dollars each paycheck. (To learn more, read Making Salary Deferral Contributions Part 1 and Part 2 .)

The most important step is to distinguish between what you really need and what you merely want. Finding simple ways to save a few extra bucks here there could include programming your thermostat to turn itself down when youre not at home, using plain unleaded gasoline instead of premium, keeping your tires fully inflated, buying furniture from a quality thrift shop and learning how to cook. This doesnt mean that you have to be thrifty all the time: if youre meeting savings goals, you should be willing to reward yourself and splurge (an appropriate amount) once in a while! Youll feel better and be motivated to make more money.

Step 3: Investing It Appropriately

Youre making enough money and youre saving enough, but youre putting it all in conservative investments. Thats fine, right? Wrong! If you want to build a sizable portfolio, you have to take on risk, which means youll have to invest in equities. So how do you determine whats the right exposure for you? (Confused about risk? Read Determining Risk And The Risk Pyramid .)

Begin with an assessment of your situation. The CFA Institute advises investors to build an Investment Policy Statement. To begin, determine your return and risk objectives. Quantify all of the elements affecting your financial life including household income, your time horizon, tax considerations, cash flow/liquidity needs and any other factors that are unique to you.

Next, determine the appropriate asset allocation for you. Most likely, you will need to meet with a financial advisor unless you know enough to do this on your own. This allocation will be based on the Investment Policy Statement you have devised. Your allocation will most likely include a mixture of cash, fixed income, equities and alternative investments.

Risk averse investors should keep in mind that portfolios need at least some equity exposure to protect against inflation. Also, younger investors can afford to allocate more of their portfolios to equities than older investors, as they have time on their side. (To read more, check out Asset Allocation Strategies . Five Things To Know About Asset Allocation and Achieving Optimal Asset Allocation .)

Finally, diversify. Invest your equity and fixed income exposures over a range of classes and styles. Do not try to time the market. When one style (e.g. large cap growth) is underperforming the S&P 500, it is quite possible that another is outperforming. Diversification takes the timing element out of the game. A qualified investment advisor can help you develop a prudent diversification strategy. (For more insight, see Benchmark Your Return With Indexes .)

Conclusion

Building wealth over time depends on the successful execution of three steps: 1) having enough income, 2) saving an adequate portion of that income and 3) investing what you save prudently. Getting on the path that leads to wealth begins with a thoughtfully constructed plan and diligent execution of that plan. An investor who stays on that course should in time find that he or she is successfully building wealth.

by William Artzberger