Broad Oak Magazine Boom or bust Cash shares property government promises or commodities

Post on: 23 Апрель, 2015 No Comment

Wednesday, June 06, 2007

Boom or bust? Cash, shares, property, government promises, or commodities?

The latest posting from The Daily Reckoning Australia includes this exchange:

We got this note the other day, You say in part, In markets today, to get along, you have to go long. And if you don’t, well you’re out of luck. Are you no longer worried about a melt down in the short term? How long is long? One year or two? Your past words of imminent doom had me very worried with its effect on my investment actions, (or inaction ) are you now changing your timeline? I am a daily reader of your investment letter and look forward to your response.

We answer that a melt-down must be preceded by a melt-up. Or in economic terms, a deflationary bust characterised by over production and capacity surpluses must be preceded by an inflationary boom.

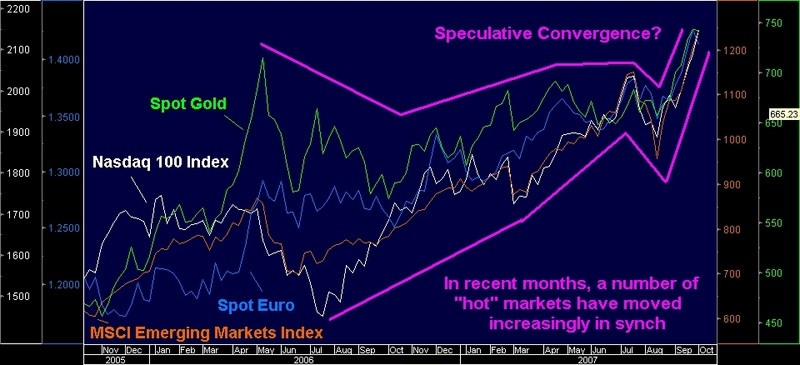

We are in the boom phase. And like it or not, related to real value or not, prices are going to rise as global money and credit creation booms. If you’re in the markets, you’ve got to make a choice with your money. So we’ll be choosing assets with tangible value that are in economic demand as well.

This is the quandary for a cautious investor. During the inflationary period, cash is not a store of value. In a fair world, if the money supply expands by 13%, then the interest rate on deposits should increase to, say, 16% (allowing for tax) — anything less, and your wealth is being sucked out by an irresponsible government. Which it is. Paradoxically, to be cautious about your wealth, you have to get away from exclusive reliance on cash.

This is because inflation is not transmitted evenly throughout the economy. For example, I estimate that in the last 6 or 7 years, the money supply as measured by M4 (bank private lending) has expanded by around 80% in the UK. Deposits have certainly not returned 80%, but house prices have doubled.

However, borrowing must be repaid sometime — with interest. If a crunch comes and everyone has to pay up, then there will be a desperate shortage of ready money. Even houses can fall in value — whatever you treat like an investment will behave like one. So in the long term, it looks as though the saver has had the last laugh. Cash will be king again.

But the paupers have votes. So democratically-elected governments have a very powerful incentive to print money to put into the voters’ hands — even if this means stealing the value of other people’s accumulated savings.

No-one knows the timetable for all this, except that it’s human nature to delay facing unpleasant situations, so we expect more fudging for a while yet.

Speaking of fudging, how does the government calculate inflation? Do its own inflation-linked products really store your wealth safely? Should you buy Treasury Inflation-Protected Securities (TIPS) in the US, or National Savings And Investments Index-Linked Savings Certificates in the UK? If the government gets your taxes and your savings and your investments, it’s pretty much got you altogether. Do you trust it that completely?

How about equities? What shares would you buy? If you went into business yourself, how would you try to run it in this very unpredictable situation? Would you borrow cash to expand, risking suddenly having to repay it just as your customers disappeared because of their own money problems? Other than making profits by exporting jobs to low-wage countries (and slowly impoverishing the West), what good business opportunities exist in our wildly gyrating economies?

The Australian bear quoted above is indicating commodities, since the demand for natural resources isn’t going to disappear entirely. Intrinsic value is an important consideration for him. If inflation continues, then presumably the price of commodities inflates; if deflation strikes, there will still be some money paid for commodities. Car companies can go bust, but iron and steel will only vary in price.

In a nutshell, it looks as though there’s no one type of asset to hold in all conditions. The question instead is, what mix should you have?