Borrowing from Your 401k Advantages & Disadvantages

Post on: 2 Апрель, 2015 No Comment

Posted by Zachary Zawarski in 401k Articles on January 26, 2009 | Comment

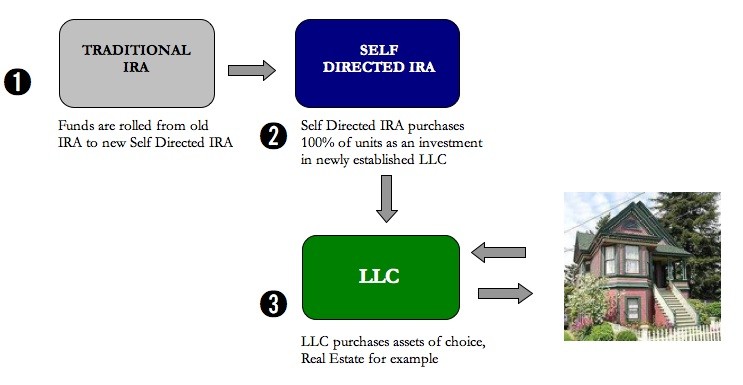

Financial advisors will never advise you to borrow money from your 401(k) retirement plan, afterall this is the nest egg that you will need when you stop working upon retirement. Other financial advisors will tell you borrowing a 401k loan from your own retirement account is more like an act of robbery! While it is encouraged not to ever borrow from your 401(k), there are advantages of doing so on the flip side; this is what we will explore in this article. Infact, according to a study conducted by the Employee Benefits Research Institute (EBRI), 18% of all 401(k) investors had outstanding loan balances at the end of 2006. Since 18% is a significant number, there must be some advantages to borrowing 401(k) loans that these people saw. Lets look at some advantages of borrowing 401k loans, and how not to dig a deep hole in your retirement savings. The diagram on the left describes 401(k) loans in a nutshell. In the left side of the diagram, you are borrowing a loan from your local bank, that gets its funds from investors in the stock/commodities markets. This money in the stock market ultimately comes from mutual funds that hold 401(k) retirement money of milllions of employed Americans. On the right side of the diagram, you are borrowing directly from your own 401(k) plan thereby eliminating the need for borrowing from your bank and the financial markets.

When Should You Borrow a 401(k) Loan?

When you need liquid cash urgently for a serious short-term need, a 401(k) loan from your retirement savings would sound probable. Short-term need is defined as less than 12 months. Also, a serious cash need is something that is really urgent, and not the purchase of a 47-inch Panasonic television. A 401(k) loan from your retirement savings is a quick, cost-effective way of borrowing, and it does not create a taxable event unless the limits placed on the loan are violated and the loan is not repaid on time. Also, if you pay back the short-term 401(k) loan on time, it will not significantly impact the total growth of your nest egg upon retirement. Infact, sometimes it may even have a positive impact on your total nest egg.

Basics of 401(k) Loan Borrowing

401k loans are not actually loans because there is no lender, and there is no examination of your credit rating. A 401(k) loan is the ability to reach in to your retirement nest egg and withdraw up to $50,000 or 50% of your total retirement savings, whichever is lesser. After that, you must pay back this money within 1 year to restore your 401(k) to its original level. The feature that really stands out in this transaction is that this whole process is tax-free, thus when you withdraw the $50,000, you will not be taxed on it, thus treating it as a tax-free cash withdrawal! Another cool feature of 401(k) loans is the Interest. For the 1 year period that you borrow the loan, you will have to pay interest fees, however these interest fees are added back to your original 401(k) nest egg. Thus, this is not a borrowing cost, infact you are paying yourself back. This feature is a lot more attractive than having to borrow money from banks and paying their outrageous 10%+ interest rates.

4 Reasons to Borrow from Your 401(k) Plan

i) Repayment Flexibility: Most 401(k) plans allow a 5 year amortization repayment schedule, however your loan can be paid off faster with no prepayment penalties. You can setup automatic payroll deductions from your check with a percentage of it being taken off to repay your loan. After every biweekly payroll deduction, be sure to take a look at your month statements to make sure you have been credited for the deductions.

ii) Speed of Loan Request: Borrowing a loan from your 401(k) retirement savings requires no credit check to be done on you, nor is your credit rating checked. Your employer usually should have an online application form requesting funds from your 401k plan. If the management of your companys 401(k) plans are outsourced to a financial services company such as JP Morgan, Manulife Financial or ICICI, then you should visit that banks website and log in to your account.

iii) Save on Fees: When you borrow from your 401k(k) plan, there are no costs associated other than the interest that you repay yourself. You do not have to pay the extremely high Credit Card APRs, late payment fees, overdraft interest, etc. When you log in to your financial services companys website you specify from which investment you want to withdraw money from, and that investment is liquidated for your specified amount. Thus, you will be losing any positive gains you would have made if you had left your money intact in the investment, this is the disadvantage. However, you also avoid any losses that that investment might have made. You will realize there is an opportunity cost associated here. The cost of borrowing from your 401(k) plan versus borrowing from a credit card is:

401(k) Loan Cost Advantage = APR Charged on Credit Card Withdrawal Investment Gains on Withdrawn 401(k) loan

For instance, if you borrow a loan from your credit card company at 15% APR, versus if you borrow from your 401k plan where you are currently returning 9% a year, the cost advantage is:

401(k) Loan Cost Advantage = 15% 9% = 6%

Thus, you are saving 6% in interest fees and costs if you borrow from your 401k plan versus if you borrow from your credit card.

iv) Time for Payback: When you repay your 401(k) loan, you will have to pay slightly more than what you borrowed. This is the interest charged on your borrowing, and the best advantage of it is that instead of paying a credit card company, you are repaying yourself.

Media & Their Say on 401(k) Loans

The media always criticizes borrowing from your 401(k) loan as a legal robbery or raid on your retirement savings. They say this assuming:

i) The investment returns you gain from your 401(k) funds invested in the stock market generate strong returns. With the recession of 2009 in hand, and the Dow Jones hitting below 6000 points, you can actually forget about generating any returns on your investment! Infact, you should be worried about strong negative returns on your 401k funds.

ii) They do not take into account the extremely high Annual Percentage Rate (APRs) that banks and credit card companies charge on money borrowed from credit cards. Thus, if you refrain from borrowing 401(k) loans but rack up credit card debt and pay the extremely enormous interest rates, then it is time to think about a change.