Boosting Yield With Dividend Paying Stocks And Covered Calls

Post on: 16 Март, 2015 No Comment

Trading high dividend yield stocks can be lucrative. Some traders like to chase dividends by finding stocks with high yields and buying the stocks before they go ex-dividend. The problem with this approach is that the market will automatically drop the price of an equity by the amount of the dividend exactly at the time that the dividend is awarded. This defeats the purpose of buying the stock to cash in on the dividend.

However, a strategy does exist to lock-in a potential selling price and capture dividends that are declared on the ex-dividend date. Selling a deep in-the-money call option against your common stock or ETF shares will lock-in a selling price and ensure you have ownership on the ex-dividend date. The sale of the call option at a deep in-the-money price protects you from the automatic drop in the price of the shares on the ex-dividend date.

Here are the basics of this trade. Buy at least 100 shares of a stock before it goes ex-dividend. For each block of 100 shares, sell a call option with an expiration date that is after the ex-dividend date. The call option should be deep in-the-money, meaning that the strike price of the option is below the current trading price. Ideally, there would be some time value premium in the call option to help pay commissions. Then, simply hold onto the position and wait for the ex-dividend date to pass. After the ex-dividend date passes, you may wish to close the position out by selling the shares and buying back the call option, or you can hold until the expiration date.

There are some risks to this trade. Your shares may be assigned by the market maker in the call option trade, especially if the call is deep in-the-money. This means that the call option buyer will take possession of your shares before expiration, taking the dividend for themselves. This does not always happen.

As holder of the company’s stock there is also the risk that the stock plunges below your call option strike price. Picking stocks without significant political, market, or business risk will reduce the likelihood of this occurring.

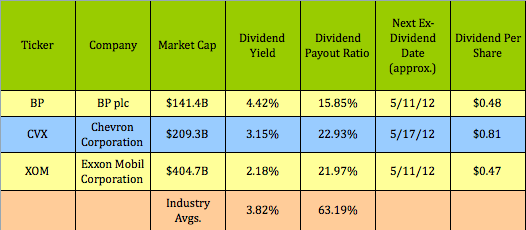

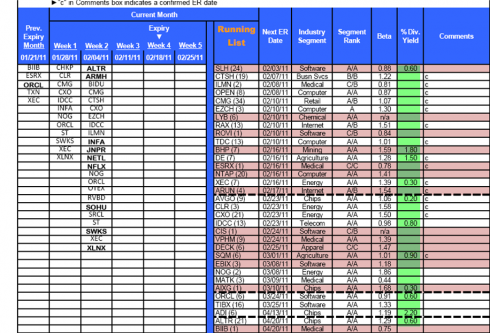

A few companies are going ex-dividend in the coming weeks that have options trading with their common stock shares.

KCAP Financial, Inc. (NASDAQ:KCAP ) goes ex-dividend on October 10th. This financial company doesn’t report earnings until November 5th, but appears to consistently report positive results. On September 17th they announced they will continue the 24 cent per share dividend. Investors wishing to make the ex-dividend trade should consider the commissions on the trade as part of the return on investment calculation. Assuming an investor pays modest commissions for both the purchase of the shares of common stock and the sale of October 2012 $7.50 call options, it is possible to collect the dividend and have a break-even price around $7.27 on this trade, with the stock currently trading around $9.34. This 3.1% return over the next 23 days represents an annualized return of 47.94%.

Kimco Realty Corp (NYSE:KIM ) recently announced a $0.19 per share dividend payable to investors holding the stock on October 1st. The October $20 strike price call could be sold for around $0.35. If shares hold above $20 by expiration, the trade yields a profit of 1.4% over 23 days, or 21.2% annualized.

Bristol Myers Squibb Co. (NYSE:BMY ) goes ex-dividend on October 3rd with a quarterly dividend of $0.34 per share. This stock actually trades weekly options contracts. So, a $33 strike price call option can be sold with an expiration two days after the ex-dividend date. Over a 9 day period, the covered call ex-dividend trade yields about 1.0%, including the cost of modest commissions, which represents and annualized 40.11% return. The break-even price on the trade is $32.67.

Other stocks going ex-dividend in the beginning of October include Dynex Capital, Inc. (NYSE:DX ), Darden Restaurants, Inc. (NYSE:DRI ), UDR, Inc. (NYSE:UDR ), Verizon Communications Inc. (NYSE:VZ ), Abbott Laboratories (NYSE:ABT ), Ennis, Inc. (NYSE:EBF ), Foot Locker, Inc. (NYSE:FL ), and General Growth Properties, Inc (NYSE:GGP ).

The calculations provided above were computed using the Options Industry Council’s Covered Call Calculator. These calculations are hypothetical and don’t represent all of the risks and details of the trade. Do your own due diligence.

Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.