Bond yield curve holds predictive powers

Post on: 18 Апрель, 2015 No Comment

If you invest in equities, you should keep an eye on the bond market. If you invest in real estate, you should keep an eye on the bond market. If you invest in bonds, you should definitely keep an eye on the bond market! The bond market is a great predictor of future economic activity and future levels of inflation, both of which directly affect the price of everything from stocks and real estate to household items. In this article, we’ll discuss short-term versus long-term interest rates, the yield curve and how to use the study of yields to your advantage in making a broad range of investment decisions.

Interest rates and bond yields are highly correlated, and sometimes the terms are used interchangeably. When speaking of interest rates (or yields), it is important to understand that there are short-term interest rates, long-term interest rates and any number of points in between. While all interest rates are correlated, they don’t always move in step. For example, short-term interest rates might decrease, while long-term interest rates might increase, or vice versa. Understanding the current relationships between long-term and short-term interest rates (and all points in between) will help you make educated investment decisions.

Short-term interest rates worldwide are administered by the nations’ central banks. In the United States, the Federal Reserve Board’s Open Market Committee sets the federal funds rate, the benchmark for other short-term interest rates.

While short-term interest rates are administered by central banks, long-term interest rates are traditionally determined by market forces, though in recent years central banks, including the U.S. Federal Reserve have also targeted long-term interest rates. In the absence of central bank targeting, long-term interest rates are largely a function of the effect the bond market believes current short-term interest rates will have on future levels of inflation.

For example, if the bond market believes that the FOMC has set the fed funds rate too low, leading to excessive borrowing and risk taking, expectations of future inflation increase, which causes long-term interest rates to increase in order to compensate for the loss of purchasing power inflation causes on the future cash flows of a long-term bond or the principal and interest payments on a loan. On the other hand, if the market believes that the FOMC has set the fed funds rate too high, the opposite happens — long-term interest rates decrease because the market believes future levels of inflation will decrease.

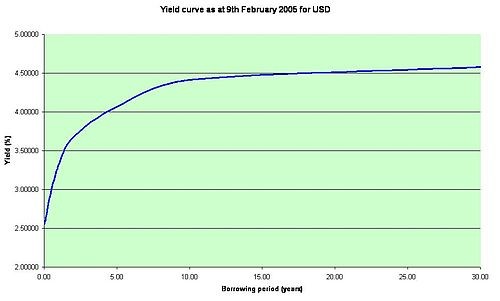

The term yield curve generally refers to the yields of U.S. Treasury bills, notes and bonds in sequential order from shortest maturity to longest maturity. It is frequently displayed graphically. Attached is an example of the current yield curve.

The slope of the yield curve tells us how the bond market expects short-term interest rates (as a reflection of economic activity and future levels of inflation) to move in the future.

Interpreting the slope of the yield curve is a very useful tool in making top-down investment decisions. For example, if you invest in equities, and the yield curve says to expect an economic slowdown over the next couple years, you might consider moving your allocation of equities toward companies that perform relatively well in slow economic times. On the other hand, if the yield curve says that interest rates are expected to increase over the next couple of years, an allocation toward cyclical companies which out-perform in a strong economic environment might make sense.

If you invest in real estate, you can use the slope of the yield curve to help in your investment decisions. For example, while a slow-down in economic activity might have negative affects on current real estate prices, a dramatic steepening of the yield curve (indicating an expectation of future inflation) might be interpreted to mean future price increases.

When the yield curve inverts, meaning that short-term interest rates are higher than longer-term interest rates, it is very strong indication that the economy is headed toward recession. Yield curve inversions have preceded each of the last seven recessions, including the most recent one in 2008.

As a word of caution, never before in the financial history of the United States has the Federal Reserve played such a large role in both short-term and long-term interest rates. And, arguably, never have interest rates played such a large role in asset valuations, including equities and real estate. As discussed, traditionally a steepening yield curve has been an indication of a strengthening economy. However, it can be argued that in the current environment, a rise in future interest rates could have a dampening impact on housing activity, as well as stock prices.

In conclusion, bond market studies shouldn’t be left to just the fixed-income investors. The yield curve can help make a wide range of financial decisions. The yield curve reflects the bond market’s consensus opinion of future economic activity, levels of inflation and interest rates. It’s very difficult to outperform the market, so prudent investors should look to employ valuable tools like the yield curve whenever possible in their decision-making processes.

Barry Nielsen, CFA, is a mortgage secondary marketing officer at American Federal Savings Bank. Contact him at 457-4012 or bnielsen@amfedsb.com.