Bond Spread definition

Post on: 18 Апрель, 2015 No Comment

There is a sort of inter-connectivity between the currency market, the commodity market and the equity market. As such, any change in one of them is likely to affect the movement in the others. Therefore a change in the commodities market would exert influence over the currency market. A similar connection can be observed between currencies and bond spreads. First of all, we need to understand what a bond spread is. It is the difference in the interest rates of different countries. According to Macroeconomic principles, inflation and the strength of a currency are directly proportionate. A currency which is weak in nature will always lead to inflation whereas a strong currency often reduces inflation, sometimes even causing the process to be arrested. On one hand we see that the monetary policies of the countries all over the world are influenced by the price of a currency. On the other hand, these very monetary policies, together with the interest rates, have an effect in controlling the prices of currencies. A trader should understand the impact of these happenings on the currency market in order to gain an insight into the movement of the market. This in turn will help him to predict the movement of the currencies in the trade scenario.

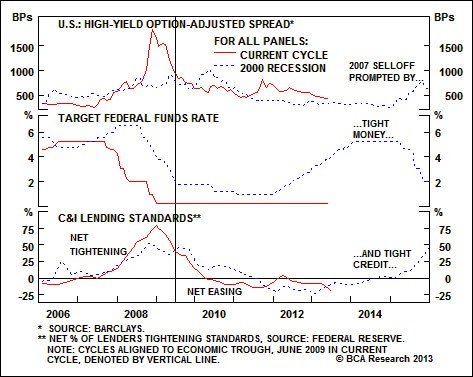

A look at the tech bubble burst of 2000 will help us to understand the impact of interest rates on the currency market. With the setback, traders became more involved in safeguarding their capitals instead of looking for high returns. The US interest rate at that time was 2%, whereas the Australian Interest rate was 5%. This fact opened up a promising pathway for the hedge fund managers and other institutions that had the capability of trading overseas. These people could make a profit of 3% in the Australian market. This remarkable difference leads to the concept of carry trade, which means an interest rate arbitrage. The difference between the interest rates of two economies is used to make a profit and a profit is also made from the overall trend of the currency pair in question. The method is not complicated at all; it is a matter of buying one set of currencies and funding it with another. Usually currencies offering a low interest rate are used for this purpose, for instance, the Japanese or Swiss currencies, and these are then paired off with currencies offering a high rate of interest. For example, you could pair off the Australian dollar with the Japanese yen, thus balancing the difference with your forex bond spread .

However, it is difficult for an individual investor to take advantage of this process. It is not possible for them to access the global market in search of currencies with low interest rates. It is only possible for the financial institutions to take advantage of this strategy. Only they can shift their assets in search of the highest returns with the lowest risks, and properly use forex bond spreads.

There is a way in which the small individual trader can benefit from such a situation. Yield spreads may help in determining the direction of the flow of cash and may also help to predict changes in the interest rates. These predictions may be utilised by the individual investor to work out an advantage for himself. When the yield spread increases in favour of a currency, there will be an appreciation in the value of that currency in comparison with the other currency in the pair. A knowledge of this situation will help to predict the way the in which the currency market may move and make profits accordingly, not only from capital appreciation, but also from annual interest rate differential.