Bond investors rewarded for riskHighyield emergingmarket funds boost broad fixedincome gains

Post on: 17 Апрель, 2015 No Comment

High-yield, emerging-market funds boost broad fixed-income gains

By Rachel Koning Beals

CHICAGO (MarketWatch) — During a quarter that marked the one-year anniversary of Wall Street’s washout, investors shrugged off painful historical reminders and stuck with riskier investment categories such as high-yield corporate bond funds.

Lower-rated company-issued bonds continued their powerful rally in the third quarter, a move corresponding with fresh 2009 stock-market highs. Investors snatched up investments they believed to be trading at an attractive discount and that stood to benefit once the economy turned the corner. On cue, improving — if still sketchy — economic data fired on several fronts outside of the lagging job market.

The quarter also brought extended U.S. dollar pressure, sending commodities on a tear. Valuable commodities are a boon to emerging-market funds — another risk play turned solid performer.

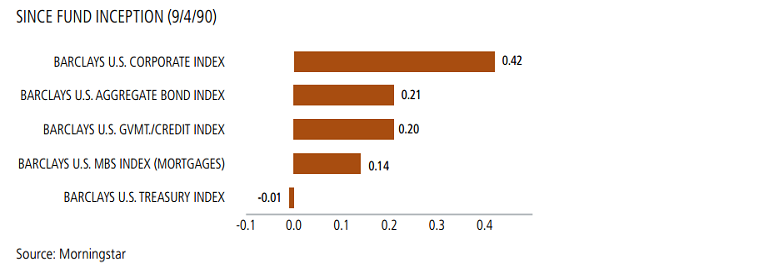

It’s a shift that began early in the year but picked up steam in the third quarter, said Lawrence Jones, senior mutual-fund analyst at investment researcher Morningstar Inc. We saw investors re-embrace risk and capital flow away from relatively low-yielding, if secure, Treasurys.

High yield, high-quality rally

High-yield or junk bond funds led the quarter with a 13.4% return, according to preliminary data from Morningstar. The fund category is up nearly 39% in the first nine months of the year. Emerging-market bond funds followed closely with a more than 11% return for the period, and are up 29% so far this year.

Lower-risk corporate bonds put up a solid performance in the latest quarter as well; so-called multi-sector bond funds returned 9.2%.

Even as government debt lagged the corporate side, modest gains were evident across the fixed-income category. This was in part due to Federal Reserve purchases and surprisingly sustainable foreign government demand for newly auctioned Treasury debt. The Treasury’s $43 billion sale of two-year notes on Sept. 22 attracted bids for more than three times the available securities, the most since September 2007.

With this customer base boosting the value of Treasurys, longer-dated government bond funds advanced 5.6%, paring their year-to-date loss to 9.6%. Short U.S. Treasury funds moved 1.4% higher. Bank loan funds gained 8.9% in the period.

Treasurys were also supported because few observers believe the economic recovery will be aggressive enough to undermine bond values and spike inflation in the near term. Demand for bonds raises prices and lowers yields. The yield on a benchmark 10-year note was priced around 3.2% at quarter-end — the lowest level since May. The difference in yields between 2- and 10- year notes is at its narrowest since May.

TIPS funds, which feature Treasury bonds that include an inflation-linked payment, were up nearly 4% in the quarter; they’ve returned more than 8% so far in 2009. The bulk of the TIPS rally happened earlier in the year, when government stimulus initially sparked fears of future worrisome inflation.

Morningstar’s Jones said he still sees some appetite for TIPS among bond fund managers despite the higher price tag. He says managers believe that on a relative basis, the inflation-protected investments represent a better buy than standard Treasurys right now. Read about the outlook for U.S. stock funds.

World bond funds, meanwhile, which primarily hold the lower-risk debt issued by larger, developed nations, returned a solid 7.3%. See the outlook for international and emerging-markets funds.

In the tax-exempt space, the same story played out. Municipal bond funds tracked rose 7.7% over the three months.

Meanwhile, high-yield muni funds jumped 13.9%, plumping a nearly 32% year-to-date return. Long-dated national muni offerings were up 8.8%, and have gained 19% so far this year.

Cash and clash

This lower-risk, higher-risk divergence may hold in coming months.

The next few quarters should see very positive earnings trends given low wage and interest costs and improving revenues, said David Kelly, chief market strategist for JP Morgan Funds, in a research note. A steady trend of improvement, however, should be more ominous for Treasurys, as super low real yields (such as 1.6% on a 10-year TIP) seem out of whack given the prospect of an improving economy and ballooning government debt.

Other observers, including Morningstar’s Jones, suggest investors will be pickier with their corporate bond choices, which as a broad category has lost some of its price allure. Corporate bond defaults are also expected to remain elevated as the economy bumps along through its uncertain recovery period.

For sure, fund managers have their work cut out for them in coming quarters, weighing economic data against bets for the scope of the Fed’s response to what’s likely to be a spotty recovery.

In its official meeting statement, the Federal Reserve reiterated that inflation would remain subdued and said it would leave rates low for an extended period of time.

But uncertain times may call for unprecedented Fed reaction instead of a gradual approach that has been favored in the past. Fed Governor Kevin Warsh used a Sept. 25 Wall Street Journal op-ed to prepare financial markets with what he says may have to be an aggressive central bank response once members opt to begin to remove overly accommodative stimulus.

[P]olicy likely will need to begin normalization before it is obvious that it is necessary, possibly with greater force than is customary, he wrote. We are at a critical transition period, of still unknown duration, and we must prepare diligently for an uneven road race ahead. If policy is not implemented with skill and force and some sense of proportionality, the success of the overall endeavor could suffer. In this environment, market participants and policy makers alike should steer clear of ironclad policy prescriptions.

Opinions on Fed policy seem as varied as the alphabetical choices tossed about to describe the charted economic recovery.

Some think that we are, as an economy, on the mend and far too much pessimism has been baked into others’ outlooks. They think we’ll see a pretty sustained V-shape recovery, said Jones. Others are more pessimistic, suggesting it will look like an L recover, modestly upward sloping, or a W, in which another shoe drops and brings more pain.

As such, bond bulls and bears, those favoring corporates versus those keen on government debt, remained locked in their own debate heading into year-end.

That’s an argument that Bill Gross and colleagues at bond giant Pimco appear are happy to mostly sit out, Jones said.

The flagship Pimco Total Return Fund (PTTAX 10.94, -0.01, -0.09%) is up more than 10% year to date. Jones reports that Pimco is booking some of those gains, preserving them in the event of another leg to this downturn.

Rachel Koning Beals is a freelance writer, based in Chicago.