BNP Paribas Hedging Emerging Market FX Risk Finance Director Europe

Post on: 26 Май, 2015 No Comment

For corporates seeking to fuel development, foreign investment in high-growth, new-world markets is vital, but it does not come without its risks. As Fabrice Famery, head of BNP Paribas’ Corporate Solutions Group explains, new world markets still engender significant economic, political and currency risks that must be carefully managed to ensure that the balance between risk and return is in line with a company’s objectives.

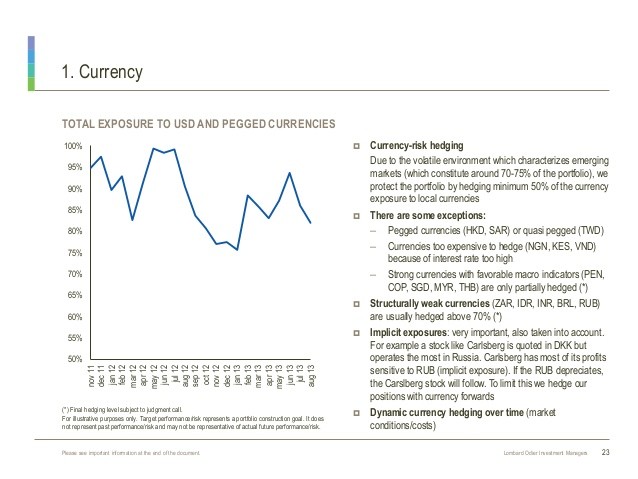

Emerging market currencies tend to exhibit cyclical market behaviour due to interest rate differentials with foreign currencies. They often appreciate steadily during normal market conditions but depreciate violently in times of crisis as investors retreat to the safe haven of low-yielding currencies. High volatility and the unfavourable interest rate differential means currency risk hedging can be costly. Given the poor average performance of such hedges, many corporates question their long-term benefit.

In figure 1 (below), we illustrate the historical performance of a rolling forward hedge in EURBRL (buy EUR/sell BRL) by comparing the 1Y outright forward rate with the spot rate 1Y later over a nine-year period. Back-testing shows an average return of -5.2% and positive returns only 29% of the time, indicating that 71% of the time the final spot rate failed to attain the level of the outright forward. The maximum return is +67% and the minimum return is -40%, further illustrating the tendency of emerging market currencies to appreciate steadily during normal market conditions but depreciate violently in times of crisis.

A cost-benefit analysis should be undertaken in order to design a risk management framework that best reflects the level of FX stress a corporate is prepared to tolerate.

This poor historical performance makes the risk management decision a tricky one. The expected higher return on new-world investments justifies a higher weighted average cost of capital and therefore higher hedging costs, but only up to a point. Corporates usually solve this dilemma by: defining the maximum level of emerging market currency debt the business can sustain, taking equity risk on the rest, hedging cash flow risk, and leaving balance sheet risk partially unhedged. But the resulting translation risk can affect the key performance metrics of a company, most notably the equity to book value for shareholders and credit metrics and covenants for debt holders. A cost-benefit analysis should be undertaken in order to design a risk management framework that best reflects the level of FX stress a corporate is prepared to tolerate.

Local knowledge

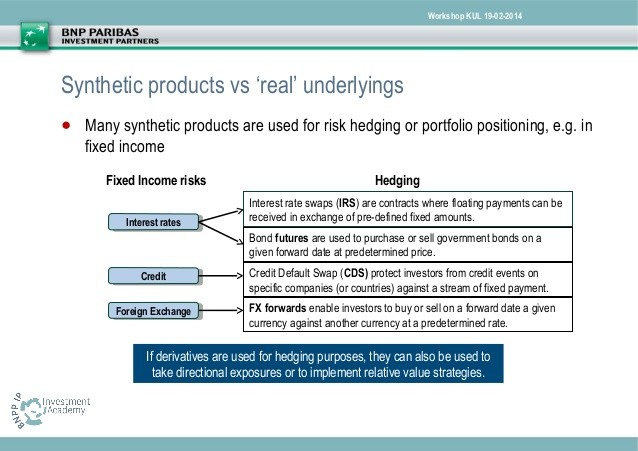

In the past, the underdevelopment of local markets has made it difficult for corporates to effectively manage their exchange rate exposure. Where markets were illiquid, liability managers managed their exposure by using other regional currencies as a proxy hedge. As local markets have developed and the number of tradable currency pairs has increased, liquidity has improved, spreads have narrowed and a range of more sophisticated option-based products has emerged. While local markets remain more prone to market disruption in times of crisis, these developments have undoubtedly helped corporates to better manage their exposure to financial market risks.

The options market allows corporates to manage local currency risk by purchasing low-delta options as a form of catastrophe cover against extreme market moves. A comparison of the distribution of daily returns for a selection of emerging market currencies over the last 20 years (Figure 2) shows that the probability of significant depreciation (more than 2.5% per day) is much greater than that indicated by the normal (Gaussian) distribution of returns. This makes emerging market currencies stand out from G3 currencies (EURUSD and GBPUSD are shown for comparison) and gives rise to a much fatter-tailed distribution.

Corporates investing across multiple emerging markets have a more diversified exposure that can provide a natural hedge for currency risk.

Corporates investing across multiple emerging markets have a more diversified exposure that can provide a natural hedge for currency risk. For example, a company reporting in EUR or GBP with investments in emerging markets and the US would have benefited from an offset in their currency risk during the recent crisis. This raises an interesting question about the merits of a portfolio approach to hedging emerging market currency risk. Corporates investing in the new world usually have investments in G12 currencies, which means that currency movements affect the corporate on a basket basis. Basket options can be a cheap way of protecting against adverse currency moves on an overall basket basis. The buyer of the option has the right to sell (or buy) a predefined amount of each currency against a fixed amount of the reference currency at expiry. The discount on the basket over the corresponding strip of vanilla options is because the holder can no longer cherry-pick those currencies which he chooses to exercise. The size of this discount will therefore be dependent on the correlation between the component currencies in the basket.

Prioritising currency pairs

An alternative approach is to hedge only those currencies where the reduction in risk justifies the cost of hedging. This can be done by performing a simple portfolio analysis in which the currency pairs are ranked by the ratio of one-year interest rate differential to the weighted one-year historical volatility. The results of the analysis can help the liability manager prioritise those currency pairs worth hedging. By introducing an additional correlation input into the analysis, it is also possible to identify suitable proxy hedges and assign a greater hedging proportion to those currency pairs with a lower hedging cost. For example, lets consider a simple basket of Euro-Polish złoty (EURPLN) and Euro-Hungarian forint (EURHUF), two highly-correlated currency pairs that may act as good proxies for each other. Since EURPLN has a lower hedging cost, the liability manager may decide to assign a greater hedging proportion to EURPLN knowing that it acts as a good but cheaper proxy for the EURHUF exposure.

Emerging market currencies are susceptible to adverse moves during times of crisis.

To conclude, the surge in foreign direct investment in emerging market economies since the 1990s is a reality, but the cyclical nature of their currencies makes it a difficult risk for corporates to manage. The high interest rate differential makes it costly to hedge but the carry trade tends to force local currencies to appreciate during normal market conditions, which calls into question the long-term benefit of hedging currency risk. But emerging market currencies are susceptible to adverse moves during times of crisis, whose resulting impact on a companys financial ratios means that the subject of emerging market currency hedging may not be dismissed lightly. Whereas local financial markets were previously characterised by illiquidity, wide spreads and a limited product offering, recent advances mean that liability managers now have a more comprehensive range of solutions to help them manage their emerging market currency risk.

The development of the options market is one such advance, and given the tendency for emerging market currencies to depreciate by more than that suggested by the normal distribution, liability managers are increasingly purchasing low delta out-of-the-money currency options as insurance against adverse market moves. Corporates should be encouraged to view emerging market currency risk on an overall basket basis. Basket options should be considered as a cheaper alternative to strips of vanilla options and a simple portfolio analysis should be undertaken to ensure that corporates only hedge those currencies where the reduction in risk justifies the cost of hedging.