Bitcoin Liquidity What The Stakes Are_2

Post on: 17 Апрель, 2015 No Comment

Bitcoin Liquidity: What The Stakes Are

The judgment of liquidity has many facets to it. One approach of defining liquidity is a ability of an object to be converted into money straightforwardly on demand. Another approach of looking during it is when any object can be bought or sole during a satisfactory price. Liquidity so means that there aren’t discounts or premiums trustworthy to it during buy or sell and it’s easy to enter and exit a asset. It is believed as some-more of an object is bought and sold, a chances of charging premiums or giving discounts reduce and such an object customarily trades around ‘what it is worth’. The forex market is mostly tangible as a glass marketplace with an normal turnover of some-more than $5 trillion daily according to the Bank for International Settlements (BIS) while real estate is a classical instance of an illiquid asset. Property as an object is reduction liquid, requiring outrageous investments into earthy form, vapid procedures and smaller market.

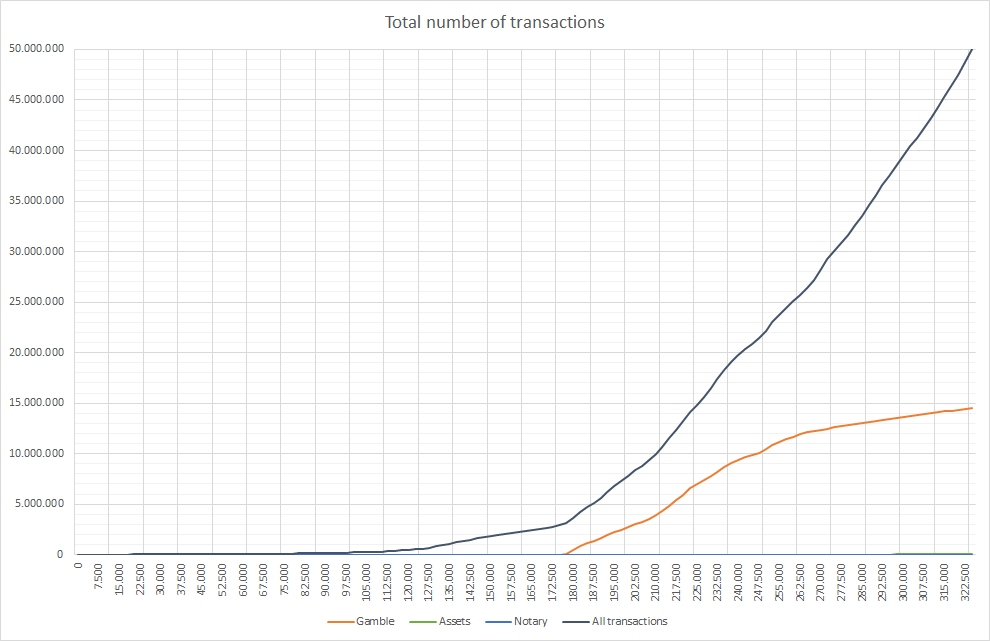

Liquidity is critical for any tradable asset. that includes a math formed banking Bitcoins as well. Liquid markets are deeper and smoother while illiquid marketplace can put traders in a mark from where it’s tough to navigate a approach out. Bitcoins have seen a poignant grown in a final 5 years of a existence from 50 Bitcoins in 2009; a dissemination is some-more than 13,000,000 today. The graph above depicts a expansion of Bitcoins in terms of circulation. However, a practical banking has witnessed episodes of illiquidity. Let’s take a demeanour during a categorical factors that change a liquidity of a Bitcoins.

The boost in a series of devoted Bitcoin exchanges will yield event to some-more people to trade their coins. The boost in magnitude and volume of trade helps to raise liquidity. There are people who are holding their Bitcoins, some-more event in terms of secure exchanges can make many to trade their Bitcoins and supplement some-more buyers and sellers to a marketplace place. (See: A Look At The Most Popular Bitcoin Exchanges )

The augmenting acceptance of Bitcoins during brick and mortar stores, online shops, bookings, etc can assistance to boost a usability along with shortening a sensitivity as some-more will come into circulation. The some-more it is used as a middle of payment, a some-more glass they become. There is already a flourishing trend in a usability during several stores, both online and offline. The augmenting use will assistance to also comprehend a satisfactory cost for this asset. (See: Stores Where You Can Buy Things With Bitcoins )

The network of Bitcoin ATMs is quick increasing; new ones (as of Nov 2014) have non-stop in Virginia, Pennsylvania, Oregon, and Massachusetts. The Bitcoin ATM’s are of good significance for a wider acceptance (both means and effect) as they also promote shopping of Bitcoins. There are many people who are not gentle with an online sell transaction; these ATMs are a good apparatus in such cases. However, this mode of creation purchases is most some-more dear than online exchanges. In further to ATMs, withdraw cards and credit cards have also started to strike a Bitcoin world, creation it easier to lift out exchange and purchases. The launch of Bitcoin-to-cash remuneration cards and ATMs are a step brazen in augmenting a usability and acceptance of Bitcoins. These will promote squeeze and withdrawals during a marketplace cost of Bitcoins and assistance to boost liquidity while progressing security. (See: Ways To Earn Bitcoins )

Regulations directly and indirectly have a really essential purpose to play. The position of countries on Bitcoins is as opposite as a countries themselves – it is criminialized in a few, authorised in some and in brawl everywhere else. Authorities in many countries are watching a conditions and many are even operative on a regulations. Despite a ambiguity on this front, a practical banking is flourishing during a quick pace. There is an augmenting participation of Bitcoins in a form of ATMs, exchanges, exchange in shops, casinos and so on; transparent mount by authorities on issues like consumer insurance and taxation could move out some-more people in a open to use and trade Bitcoins, that will impact a liquidity. (See: Bitcoin IRS Tax Guide For Individual Filers )

Many people might have listened a word “Bitcoins” though are most unknowingly of what a practical banking is or how it works. Among these people can be many impending buyers, investors, traders of these digital coins. Limited believe and miss of transparent discipline by authorities has singular it to enthusiasts compartment now. As a Bitcoin universe is expanding, a recognition and acceptance is flourishing alongside, that will move in many some-more to try it out. (See: How Bitcoin Works )

If we demeanour during Bitcoin as an asset, it positively has given remunerative returns. Bitcoin has a issues, sensitivity in cost being one of them. The liquidity problem is one of many factors that lead to a remarkable transformation in a Bitcoin prices, and so an softened liquidity can assistance fight a same. The approach brazen for this banking is tough to envision though a foothold is augmenting with time. (See: The Risks Of Buying Bitcoin )