Big bad BABA The rise of Alibaba in China

Post on: 8 Апрель, 2015 No Comment

September 23, 2014

On September 19, Alibaba (BABA) became the largest IPO ever, and its founder Jack Ma, is now worth about $26 billion. How did this company, a virtual unknown outside of its native China, rocket 38% on its first day of trading to achieve a mega capitalization of $230 billion overnight? Why is there all this excitement for Alibaba?

20Pun/BABA%20Roadshow.jpg.jpeg /%

This is where some background information is helpful. In North America, the retail landscape is very well developed. If we want to purchase merchandise, we have many different options. We have a multitude of physical retail (offline) options. Or, for even more options, we can access an ever-expanding number of e-commerce options from large to niche online retailers. These e-commerce giants have become household names over the past decade: Amazon.com is the world’s largest online retailer; eBay runs a large consumer-to-consumer sales site and owns a payment network (PayPal); and Google helps small businesses advertise via its search engine. You can use these platforms to search for consumer goods, pay for them and have them delivered to you in a seamless manner. These companies are well-established in North America, generate $150 billion in annual revenue, and have a cumulative market capitalization of $600 billion.

In China, the retail ecosystem has developed quite differently. While there has been growth of retail stores in the country’s major cities, the market outside of these Tier 1 cities is underserved. The reason is size. In addition to an enormous land mass, China has more than 100 cities with a population of over one million people. In contrast to the U.S., where there is one retail store for every 1000 people, in Asia-Pacific, there is one store for every 90,000 people. So even if you wanted to find a store, it likely doesn’t exist. Add the problem of horrible inter city traffic congestion, and it is no wonder why Chinese consumers prefer to shop online where they can access millions of products at competitive prices easily from the convenience of their smartphone.

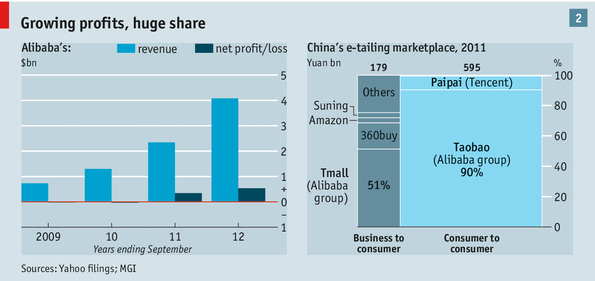

Jack Ma had the vision to create an e-commerce platform that could address this consumer demand and champion smaller business trying to sell online. Alibaba created Taobao, the eBay of China, to put small business on the same playing field as larger enterprises and Tmall.com was created to allow brands to effectively sell deep into China. Alipay was established to create a PayPal-like payment system to facilitate the transfer of funds within China. The challenge with that is that most domestic consumers do not have credit cards. The other issue is that most Chinese consumers prefer cash-on-delivery as they typically do not trust the seller to deliver the goods. Alipay’s solution to gain the trust of the consumer is to escrow the funds until delivery has been confirmed. Alibaba has also acquired or created other e-commerce business based on other globally proven internet businesses. The acquired assets have been integrated into a powerful vertical business model. So while Google and others struggled to address the Chinese market, Jack Ma was able to create a super internet company (e.g. Amazon+eBay+Google) that dominates that landscape.

The future retail sales growth looks bright for Alibaba. China is expected to become the largest consumer market in the world by 2017, surpassing the U.S. We are already seeing this in Alibaba’s numbers. Last year, Alibaba generated $5.7 billion in sales during the largest shopping day in China (Singles’ Day), which was three times larger than the equivalent online retail sales in the U.S. during Thanksgiving weekend. Given this growth outlook and market structure, we believe that Alibaba is on a path to overcome Walmart in sales: it is growing 10 times faster with seven times the profitability.

So let’s compare the race to $500 billion in retail transactions between Walmart and Alibaba. It will take Walmart over five decades and thousands of retail outlets to achieve $500 billion in sales. Jack Ma has ambitions to become bigger than Walmart. Alibaba will reach its goal in retail transactions without opening a single store, relying on online e-commerce platforms combined with its extensive logistics network and get to this milestone in less than two decades.

This should explain our excitement in the investment opportunity in Alibaba. At Signature, we were happy to purchase shares of the IPO. We have been following the development of this platform for some time during our visits to China and have had indirect investments in companies that have held stakes in Alibaba. The IPO of Alibaba gives us the opportunity to invest directly in this incredible asset. Time spent with the company in San Francisco during the IPO road show gave us a better understanding of the opportunities and challenges that lie ahead for Alibaba. We value the management team’s long-term vision for Alibaba and have confidence in their ability to generate shareholder value. Alibaba has a slogan: “To make it easy to do business anywhere.” This company is truly transforming the way to do business in China. We also believe Alibaba will transition its business in a material way beyond China’s borders longer term.

This juggernaut — China’s combination of Amazon / eBay / Google / Walmart — is going to be an interesting company to watch.