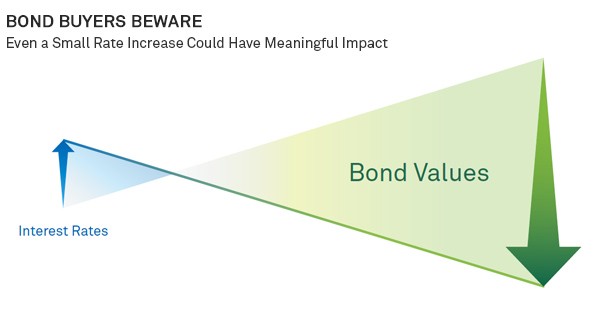

Beyond Bonds Buyer Beware

Post on: 24 Июль, 2015 No Comment

NEW YORK ( TheStreet ) — As we exit the low interest rate era and return to rising rates, bonds and other fixed income instruments will come under selling pressure. This means in 2014 investors will be hunting for bond replacements in order to help safeguard their portfolio without having to account for falling bond prices and volatility.

Some investors will migrate to one or more of the hybrids — floating rate securities, step-up bonds and Treasury inflation protected securities. However, I’m seeing sophisticated investor moving into some questionable alternatives (in my mind) and I just want to highlight the downside and risks associated with those instruments.

In particular, I’m seeing investors discussing master limited partnerships, interest rate linked structured notes and bank loan products as if they were interchangeable with bonds. They’re not and here’s why.

Master Limited Partnerships

Master limited partnerships have become increasingly popular with investors seeking high yield investments in a low-interest rate environment. Generally, most, although not all MLP earn the majority of their income from energy related activities — think oil or natural gas pipelines and you’ve pretty much got it.

To date, these have been investor darlings. Two of the largest, the Kayne Anderson MLP (KYN ) and JPMorgan Alerian MLP ETN ( AMJ ) are up significantly this year. Each is trading at a premium to its net asset value.

MLP investors, like any other partnership, are considered unit holders. MLP investments receive different tax treatment than ordinary income producing investment. As such, MLP investors receive a K1 instead of a 1099, potentially negating certain tax deductions. Most significantly, MLP income is typically a combination of actual income and return of the investors’ own principal. As such, the true MLP yield can be significantly lower than their cash-flow implies.

The takeaway: Given the lower real yield that is produced, as interest rates rise, the attractiveness of the MLP income potential is likely to decline.

Interest Rate Linked Structured Notes

Interest rate linked structured notes provide investors and speculators the ability to bet on the direction of a specific benchmark interest rate, for instance LIBOR or the ten-year Treasury. In November, Goldman Sachs (GS ) alone sold $1 billion of these floating rate instruments.