Beware of high yield mutual funds Independent Financial Advice

Post on: 17 Апрель, 2015 No Comment

Beware of high yield mutual funds: Independent Financial Advice

Mutual fund bond fund investors should avoid chasing after high yield

In the search for yield investors could get lazy and accept superficial information about investment yields. Even sophisticated expensive databases may contain errors about mutual fund dividends. To be clear about dividends versus distributions one must read the mutual fund’s literature directly and not rely on only a database service. One must determine what are dividends that have been paid out consistently and what are unsustainable temporary capital gains distributions.

For example, a fund with a value of $100a share might payout a quarterly dividend of $1 which is 4% a year, plus on December they would pay out an annual distribution of $2 a share for a total annual yield of 6%. By looking at each payment one may see a pattern of steady even payments in the first three fourths of the year. This is usually the true dividend rate when extrapolated to a full 12 months and the huge annual December payout is the distribution. The fund company’s literature will explicitly tell you, so be sure to read it and clearly understand how much is the recurring dividend and how much was a temporary capital gain distribution.

In the case of mutual funds that are engaging in risky speculative short term trading they could, if lucky, make a profit from short term trading and pass on this profit to the fund’s investors in the form of a distribution and if the mutual fund investors were not diligent they could assume the annual payout from the mutual fund of distributions and dividends was the same as a dividend, which is wrong. This could delude fund investors into a chase for yield when in fact the alleged yield was really a temporary unsustainable capital gain. This type of income could easily become a capital loss next year if the fund manager gets shareholder redemption requests in a declining market.

If you are considering buying a bond fund with investment grade credit quality holdings then you should assume the mutual fund’s yield will be less than 3% (after netting out fund manager’s fees), and maybe even below 2%. If the yield is more than 3% it probably is a blend of recurring dividends that are based on interest income and non-recurring capital gains that are paid out as “distributions”. This is particularly a problem in the Closed-End mutual fund industry where in many cases a return of principal is paid out to investors in addition to a taxable distribution. This misleadingly puts more cash in the investors’ hands in the short run but that is because a piece of the mutual fund is being sold off and paid out to the shareholders and is not income. Ultimately the value of the shares will go down if assets are sold off and the cash from the sale is distributed to shareholders.

Open the secrets of investing

Even if your mutual fund is not inflating yields by a tax-free return of your principal there is the risk that you could be misled by a mutual fund distribution that is actually taxable income but which is a one-time temporary capital gain made by the fund manager when the fund’s assets were sold in a rising market. So whenever you see a mutual fund claiming that its yield is higher than its peers you should assume either they are investing in dangerous junk bonds, paying out unsustainable capital gains distributions, or simply returning your own principal which is not income.

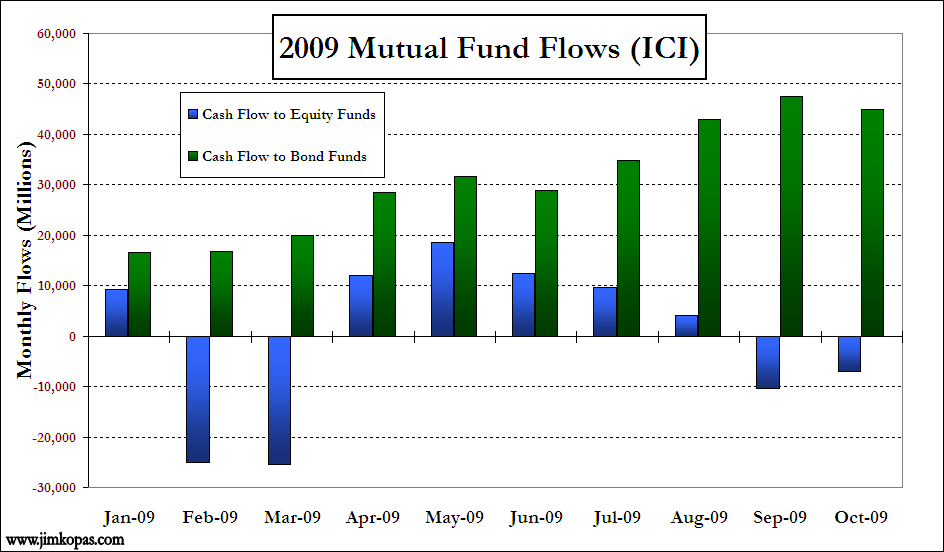

During a time of dropping interest rates bond prices go up allowing a mutual fund manager to sell its assets at a capital gain, thus further boosting total return. The more that investors get frustrated with low rates the more they may flock to this type of mutual fund during a bond market rally. Investors should be very careful not to be like a man who is delirious from extreme thirst in the desert who panics and grabs the highest “yielding” mutual fund without carefully reading the fine print to find what is the routine, continuous, sustainable yield as opposed to a temporary flash in the pan gain from the fund manager’s short term trading.

Investors should seek independent financial advice.