Better Alternatives to Money Market Funds

Post on: 25 Апрель, 2015 No Comment

Marginally Increase Risk, Greatly Increase Reward

Comments ( )

By Joseph Cafariello

Tuesday, August 19th, 2014

Yesterdays market rebound was both a surprise and a relief to most investors. After Fridays sharp mid-day decline in which the S&P 500 lost some 1.2% in about an hour and a half, investors went home for the weekend a little nervous.

Would Russia retaliate against Ukraine for its strike on Russian troops? Would ISIS press on into the Iraqi capital of Bagdad? Had the much anticipated summertime correction finally begun?

With the anti-climactic weekend come and gone, equities thundered forward Monday morning right from the opening bell like stallions out of the gate and never looked back, the S&P ending the day up 0.85%. The markets had dodged the bullet this time.

However, analysts are cautioning investors that there is still a bullet with equities name on it, and its only a matter of time before it finds its target. To see us through the inevitable correction, advisors recommend a portion of our portfolio be held in cash. But where?

Money market accounts and funds are popular choices in which to stash our cash. But as we considered in yesterdays article, not all money market vehicles are as safe as many believe, as they sometimes break the buck by falling below the $1 per share par value from massive withdrawals during times of market upheaval.

Yet even if we are invested in a tried and tested money market fund that has proven its safety and reliability over many years, investors in money market funds still face a costly risk: we may be taking on more safety than we need, sacrificing more profit than we should.

In todays follow-up article, well examine why too much safety can be more harmful than good. Well then consider some alternative funds that offer a more balanced mix of risk and reward.

Too Much Safety is Risky

It has already been two years since the last moderate pull-back in 2012, three years since the last sizable correction in 2011. Thats a long time to spend earning next to nothing on our cash, especially as we look on at stock markets that just keep on climbing higher and higher, leaving us behind.

Lets begin with a most obvious example of how money market funds are quite the overkill when seeking protection. The graph below comparing the S&P 500 to the three largest money market ETFs by asset value is not intended to insult anyones intelligence. Trust me, theres a point to it.

Source: BigCharts.com

The money market funds are hard to spot on the graph, arent they? Theyre along the bottom near 0%.

Yet any intelligent investor will quickly protest: Competing with the S&P is not what money market funds are for. They are designed to preserve cash positions and even provide a little interest. They do quite fine at the job for which they are designed.

Absolutely, they do. And here is how they do it:

PIMCO Enhanced Short Maturity ETF (NYSE: MINT): This $3.79 billion portfolio is an actively managed exchange-traded fund (ETF) that seeks greater income and total return potential than money market funds, and may be appropriate for non-immediate cash allocations. MINT will primarily invest in short duration investment grade debt securities that will not normally exceed one year, PIMCO explains. It pays monthly distributions of 5 to 6 cents per share, with an annual yield of some 0.72%. Had these disbursements been included in the graph above, MINTs plotline would register just over 2% over the graphs three year period.

iShares Short Treasury Bond ETF (NYSE: SHV): This $2.05 billion portfolio seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities between one month and one year, BlackRock Inc. describes its fund. As such, its annual return is generally less than 0.1%.

SPDR Barclays 1-3 Month T-Bill ETF (NYSE: BIL): This $1.02 billion fund seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Barclays 1-3 Month U.S. Treasury Bill Index, SPDR outlines. Comprised of U.S. Treasuries almost exclusively, it pays negligible interest.

The Best Free Investment You’ll Ever Make

Stay on top of the hottest investment ideas before they hit Wall Street. Sign up for the Wealth Daily newsletter below. You’ll also get our free report, Gold & Silver Mining Stocks.

Enter your email:

While these three funds perform exceptionally well at preserving our cash, the point of this exercise is to illustrate how money market funds provide too much safety for our own good. The red lines in the graph above show just how much protection investors really needed during the largest five pullbacks of the past three years ranging from 10% to around 18%.

Storing our cash reserves in the three funds above would have been overkill. Investors could have optimized their returns over the years by tweaking their safety-reward ratio a little. Clearly, the 0-1% risk of money market ETFs was way too costly when factoring-in the lost profit potential.

If, though, we increase the risk side of the equation by a little, we could raise the return side of the equation by much more. As long as our losses during those pullbacks are less than the markets 10-18% losses, were fine. We have a lot of wiggle room in the risk department. We dont need to stay right on the zero risk line. We can afford to risk a few percentage points in exchange for higher returns that make a cash position a little more profitable.

Here are some replacement funds that would have accomplished just that.

Making Risk Affordable

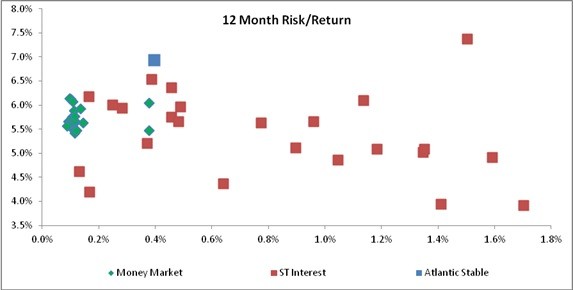

Swapping our money market funds for something a little more risky — and more profitable actually makes taking on some risk affordable. Plot these replacement funds on a graph and now were faring better.

Source: BigCharts.com

During each of the five largest pullbacks over the past three years, these slightly higher risk funds fell from half as much as the market in the worst cases to less than a fifth as much as the market in the best cases. When the market fell 10%, they fell from 2 to 5%.

These funds still preserve most of your cash during a correction, and will still allow you to withdraw cash quickly to snap up cheap stocks at a bargain — which is what the cash portion of your portfolio is supposed to do. But they also generate decent distributions while you wait.

Because the funds dividend distributions are not accounted for in their plotlines above, each funds returns are actually higher than depicted. Lets take them one by one in reverse order of performance.

iShares Floating Rate Bond ETF (NYSE: FLOT): This $3.87 billion bond fund seeks to track the investment results of an index composed of U.S. dollar-denominated, investment-grade floating rate bonds with remaining maturities between one month and five years, explains iShares. Floating rate is important going forward, as floating rate bonds will adjust more quickly to rising interest rates than locked-in rate bonds. With distributions of just under 2 cents per month, FLOT generates an annual yield of some 0.44%, raising its plotline to just over 3% over the past 3 years (including capital appreciation).

SPDR Short Term High Yield Bond ETF (NYSE: SJNK): This $4.22 billion high yield corporate bond fund seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Barclays US High Yield 350mn Cash Pay 0-5 Yr 2% Capped Index, SPDR describes its short duration bond fund. Its distributions of around 13 cents each month are currently generating an annual yield of some 5.71%. If its plotline were adjusted to include the disbursements, the line would point to nearly 20% total gains over the past 3 years.

PIMCO 0-5 Year High Yield Corporate Bond ETF (NYSE: HYS): This $4.31 billion high yield corporate bond ETF is designed to capture, before fees and expenses, continuous exposure to the short maturity segment of the high yield corporate bond sector, PIMCO explains. Its distributions of around 37 cents each month are providing an annual yield of some 3.86%, adjusting its plotline to some 21.5% growth over the past three years.

SPDR Barclays High Yield Bond ETF (NYSE: JNK): This $9.02 billion high yield corporate bond ETF seeks to provide investment results that, before fees and expenses, correspond generally to the price and yield performance of the Barclays High Yield Very Liquid Index, highlights SPDR. Its monthly distributions averaging 19 cents are currently adding some 5.62% in annual yield, raising its plotline to some 26% over the past three years.

Accounting for Rising Interest Rates

By not playing it so extremely safe with the cash portion of our portfolios which in many cases amounts to as much as 20 to 30% of our total value we can greatly enhance our cashs performance while taking on only a little more risk. Reward is directly proportional to risk. Buying into a money market funds total safety can be more expensive than we think when factoring-in the dividends and appreciation our cash could be getting if stored in slightly riskier funds.

However, we mustnt go overboard here either. Perhaps beginning in mid-2015 to early-2016, the U.S. Federal Reserve will begin raising interest rates; slowly at first, but steadily for some five years until reaching some 5 to 6%. The higher cost of money will increase the yield of new bonds, but will decrease the price of older bonds. When interest rates rise, bonds fall.

Because the last four ETFs noted above are heavily invested in bonds, these future interest rate hikes will impact their asset values, which would push the funds down several percentage points in quick order. Yet once the higher rate bonds start appearing on the market, these bond ETFs will start generating higher dividend payouts, increasing their yields for the current 3 to 5% per year to as much as 6 to 10% per year by 2020.

For added protection, one might consider shorter duration bond funds such as the SJNK which holds mostly 2 to 5 year bonds, and FLOT which holds floating rate bonds. Shorter duration bonds will roll-over into higher paying bonds much more quickly, while floating rate bonds will have their interest income adjusted even before reaching maturity.

Yet these are only a few examples, with dozens more viable options to consider. Remember that while preservation of cash is important, safety comes at a cost of profit potential. There is nothing wrong with increasing risk a few percentage points to gain even more percentage points in dividends and appreciation over time.

Joseph Cafariello