Best way to invest your money and why I hate financial advisors…

Post on: 16 Март, 2015 No Comment

This is a symbolic picture of what investing is. Didnt know if you would know that.

www.barringtonlewis.com/. who is notable for being a very insightful writer and having a cool name.

Have you ever noticed that even with all of the financial advice out here being advertised in the media that we unfortunately have an extraordinary amount of people that still can’t retire? I suppose this is partially due to the problem caused by too many financial advisors (approximately 300,000 to 400,000 of them seeking and competing for wealthy clients (who also get the “best” advice) when the majority of Americans are respectfully, “less than wealthy” and cannot afford the “best” services. In addition, the other part of this problem to blame is due to taxes, debt, and a devaluing currency (thanks Feds!).

What upsets me is that most advisors promote the amount of $1 Million as the goal to achieve for retirement. We see it everywhere – “skip on that latte for 30 years and you’ll have a million dollars!” Or don’t forget the ING commercials of these people carrying around an orange number with $1 Million +, or those who skip out on small purchases (like a bbq grill) and instead count their few orange dollar bills. It’s a joke.

Time Value of Money

Let’s do some simple math – everyone knows (or should know) that the value of money depreciates over time. So if you’re going to retire 40 years from now – how much would $1Million be worth to you 40 years from now? We can figure this out by understanding the time value of money formula – which is:

PV= FV/(1+R) t and FV=PV(1+R) t

These two formulas represent the present value (PV) of money, and the future value (FV) of money. The variable “R” is just the estimated interest rate…and “t” represents time.

Don’t worry – I won’t get into too many details but basically $1Million 40 years from now will only be worth $208,289 ($1,000,000/(1+4%) 40 …assuming that we average 4% growth after taxes and inflation. Either way – ask yourself how long could you last with this amount of money in retirement? 5 years? 10 years? 15 years? Hopefully you don’t have a mortgage or car note in retirement! Not to mention high healthcare costs (it pays to be healthy).

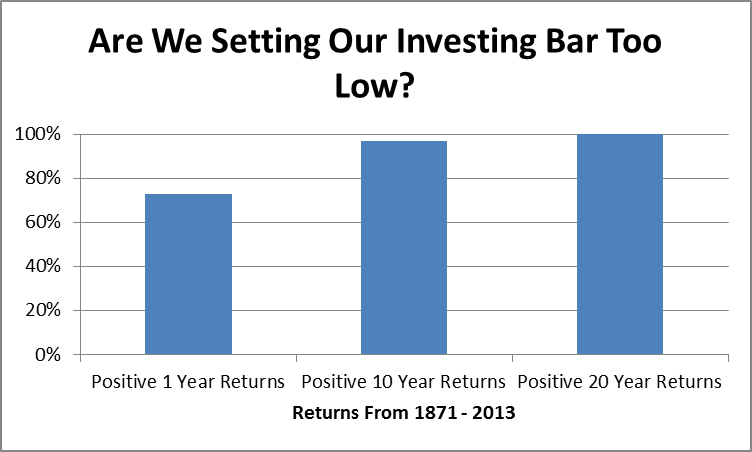

The point I’m trying to make is that you can’t store money – money is just a medium to purchase goods and services. It cannot be stored, or in this case, saved. Ever notice that America is in a Retirement Crisis. Mainly because everyone follows the same advice (put money in savings and contribute to your 401K). Not the best advice! These are just ways to build supplemental retirement plans. The best advice is to build cash flow and/or multiple streams of income.

So what are the best ways to invest nowadays?

The best way to invest your money is to invest in items that produce an income for you today…not tomorrow.

- Invest in high yield dividend stocks, & REITs (most of which pay between 10%-20% in annual yield – better than that 1% your savings account offers)

- Invest in businesses(buy bonds) and invest in business startups

- Invest time writing eBooks, creating iPhone Apps, etc and selling it on the internet

Passive income is taxed the least and your tax bracket doesnt begin to increase as you begin to make more money. Taxes may soon increase (its inevitable) but I bet that this type of income tax will be the last to see an increase. Think about it.

BE FREE

Like this article? Well then be sure to follow Snarkfinance on Twitter, like us on Facebook and join the emailing list (buttons below); all cool people do!

You can also hire me for staff writing positions or freelance gigs, see the Hire Me section.

Other insane, amazing and must-read financial articles: