Best Shortterm CD Rates

Post on: 3 Май, 2015 No Comment

Compare Best Short-term CD Rates

Term:

The Benefits and Drawbacks of Short-term CD

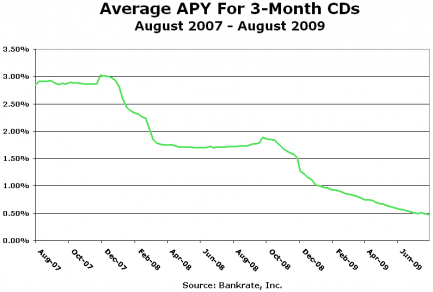

When you have plans of penetrating the market, it is important that you understand and are able to interpret customer behaviour when interest rates rise. This is the actual scene when rates go high: the consuming public is seen to be saving their money but when rates are down, they would start spending it. This exactly what happens when it comes to CD investment. When rates are high, consumers take advantage it expecting a high return.

The rate is very important but this though should not be the only factor that you have to look for when you’re planning on investing on CD’s. You too should study whether a long or short term CD is what best works for you. To help one decide better between his choice of long or short term, it is important that you understand interest rates.

Here is a rule that you could live up with and this could be very helpful to you when deciding for a long or short-termed CD. If you feel that the current interest rate could rise over time then go for the short term CD. Then you just have to invest again after. But if the existing rate could likely go down then a long term CD is the better option.

More often than not, long term CD’s are preferred by many since banks offer higher rates for longer terms. When you have to invest on CD’s, make sure that you find a bank which is an FDIC member. This way, you are sure that you can have your money back in case some undesirable things happen like a bank’s declaration of bankruptcy.

One of the biggest advantages with short term CD is that you see your profit in a very short period of time. Thus you can access your money when you needed it. The only thing that can discourage most investors is that the interest rates for short-termed CD’s are lower. Thus if you are after a more lucrative investment then go for the long term CD, but then again the pitfall is that you can’t just access it when you need it. One should wait for the maturity date until cash can be withdrawn. So now, if you believe that you might need the money very soon then you’ll just have to opt for shorter CD terms.

One cannot predict the market trend so it could very hard to determine when would be the best time to buy a certificate of deposit. But one way to make your decision a little easier is asking yourself how long you can keep the money. If your money is the last cash you have in your savings, better go for short term so you don’t have to wait long in case the need arises.

Before you finally decide, try to shop around until you get the best deal. Having the best deal does not only mean finding the best and highest rate but also having the best rates with the best and most credible banks.

ONLINE SAVINGS ACCOUNT

- No minimum balance

- Competitive rates, No risk