Berkshire Hathaway to acquire Lubrizol Speciality Chemicals Magazine

Post on: 19 Июнь, 2015 No Comment

Berkshire Hathaway to acquire Lubrizol

Published: April 12, 2011

Warren Buffetts firm is to buy the lubricant additives and speciality chemicals firm Lubrizol

Berkshire Hathaway, the investment vehicle of multi-billionaire Warren Buffett, is to acquire lubricant additives and speciality chemicals firm Lubrizol for $9.7 billion in an all-cash deal, including $700 million in Lubrizol debt. Ironically, though, the acquisition has cost Buffett his right hand man and potential successor, who had bought shares in Lubrizol before recommending the company to him.

At $135/share, the offer price is 28% over the closing price on the day before the deal and 18% above Lubrizols all time high. Both boards have already approved the agreement but it remains subject to approval by Lubrizol shareholders and customary closing conditions. A break-up fee of $200 million would be payable to Berkshire Hathaway if it does not go through. Closing is anticipated in Q3.

Lubrizols chairman, president and CEO James Hambrick said that the deal provides compelling value to our shareholders and is a clear endorsement of the growth and diversification success Lubrizol has achieved. The company added that after completion, its top management would work with Buffett to review acquisition targets and proposed deals in the chemicals field.

Buffett, who is the worlds third richest man, described Lubrizol as exactly the sort of company with which we love to partner — the global leader in several market applications run by a talented CEO. He added: Our only instruction to James — just keep doing for us what you have done so successfully for your shareholders. The firm will continue to be run by its existing management and no change of strategy is planned.

According to the Wall Street Journal. Lubrizol would have had a long list of attractions to Buffett. Fuel additives are a lucrative and technically advanced niche, while the company is a market leader with 1,600 patents in the field, pricing power and stability, plus huge growth potential in emerging markets. Moreover, the fuel additives industry itself is unglamorous and unlikely to attract venture capital.

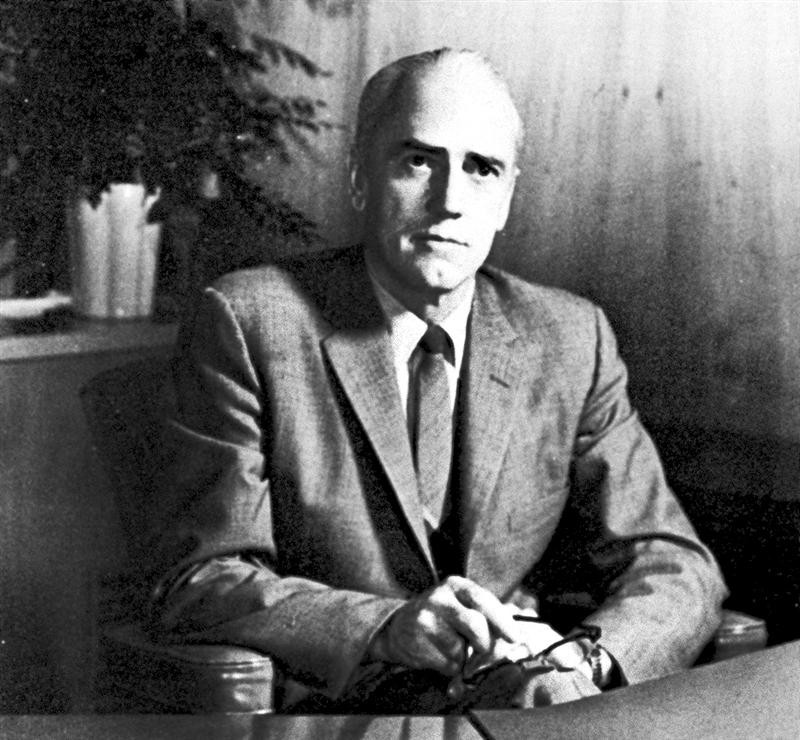

Buffett — No intention to change how Lubrizol is run

Investment website Seeking Alpha also highlighted Lubrizols pricing power, having raised its product price 18 times since 2004 and generally having a superb ability to pass on input costs. Buffett has in the past been quoted as seeing pricing power as the single most important decision in evaluating a business.

Lubrizol employs about 6,900 people and has manufacturing facilities in 17 countries. Last year, it saw sales increase by 18.1% to $5,417.8 million and gross profit by 18.2% to $1,791.0 million. Net income was up 46.2% to $732.2 million. Cash flow from operations fell by 27.5% to $689 million, primarily due to having to hold higher and costlier inventory levels, though it did improve its cash balance.

About 72% of the companys sales come from lubricant additives for engine oils, other transportation-related fluids and industrial lubricants, plus fuel additives for gasoline and diesel fuel. The remainder is the Advanced Materials business, which makes ingredients and additives for personal care products and pharmaceuticals, plus speciality materials, including plastics technology and speciality resins and additives.

Lubrizol has issued full-year earnings guidance for 2011 in the range of $11.05-11.55/diluted share, a 12-17% increase on pro forma earnings in 2010. This assumed, among many other things, consolidated volume growth of about 4-5% and consolidated gross margins of about 33%, plus spending of $300-320 million, mostly on a new additives facility in China.

Our earnings target for 2011 places us on the proper trajectory to achieve our longer-term goal of $13.50/share by 2013, Hambrick said. We expect continuing, gradual economic recovery in 2011, so we are projecting a more moderate volume growth rate this year compared with 2010, which benefitted from a strong rebound in several product lines.

In January, Lubrizol acquired the Nalco Performance Products Group, a supplier of value-added speciality polymers and formulation additives for personal care and household care which had sales of about $45 million last year. It will be added to the existing Noveon Consumer Specialties product line within the Advanced Materials segment. Earlier, it had lost out to BASF in the battle for Cognis.

The transaction is one of the largest in Berkshire Hathaways history and its largest since Burlington Northern Santa Fe for $26.5 billion in late 2009. The company had accrued funds of $38 billion by the end of last year and was clearly ready to spend. In late February, Buffetts annual letter to his shareholders said: Our elephant gun has been reloaded and my trigger finger is itchy.

This is Berkshire Hathaways largest incursion so far into chemicals but not its only one. Earlier, the $3 billion stake it built up in Dow Chemical enabled Dow to finance the acquisition of Rohm and Haas. Some websites have speculated that Buffett might be interested in acquiring DuPont, though probably not while uncertainty remains over its takeover of Danisco remains in the balance and the fact that CEO Ellen Kullmann is relatively new to the job. Certainly, though, the acquisition has sparked share price hikes for some other companies in similar fields, notably Innophos.

Some see the acquisition of Lubrizol by Berkshire Hathaway as the shape of things to come in the US speciality chemicals sector. According to one analyst, Omnova, Huntsman and Solutia are all potential targets for leveraged buyouts, with Albemarle, W.R. Grace and Cytec Industries also attractive.

In the wider world, the Lubrizol deal has become best known for the fall out. It emerged in late March that one of Buffetts top lieutenants, David Sokol, has acquired some 96,000 Lubrizol shares in January, less than two weeks before recommending that Berkshire Hathaway acquire the company.

All this raised the spectre of insider dealing, sullied Berkshire Hathaways hitherto squeaky clean image and, according to credit agency Moodys pointed to governance challenges that may affect its credit quality. Sokol denied wrongdoing but resigned shortly afterwards. He had widely been regarded as Buffetts most likely successor as CEO, having served as a dealmaker for the company for some ten years.

Buffett himself later said that Sokol came to him on about 14 January with the proposal and that he was initially lukewarm, but came around to it after hearing reports of Sokols discussions with Hambrick. Most observers believe that it was the positive impression Hambrick made on him that ultimately swung the deal.

From Online Issue: April 2011