Berkshire Hathaway Determining Intrinsic Value Berkshire Hathaway inc (NYSE BRK B)

Post on: 16 Март, 2015 No Comment

Berkshire Hathaway: Determining Intrinsic Value

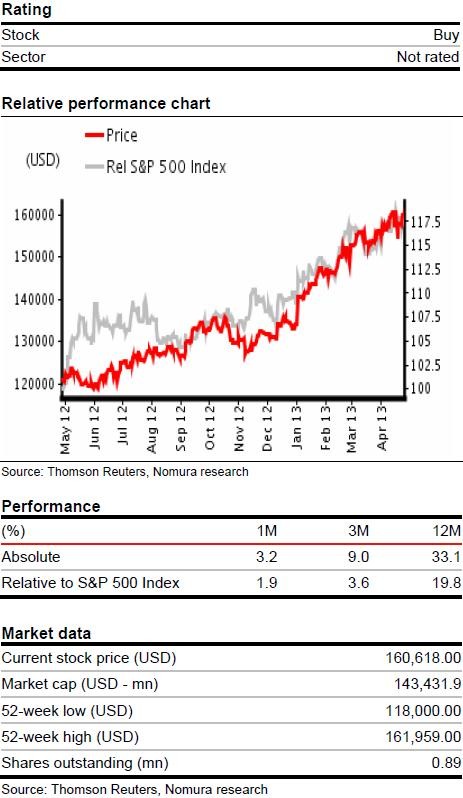

Over the weekend, Warren Buffett published Berkshire Hathaway’s highly informative annual letter to shareholders, 10K and annual report. It’s always great reading, and not only have I read his stuff religiously over the past decade, but I have also been a shareholder off and on for years. On the surface, earnings last year were quite good. Berkshire Hathaway (NYSE:BRK.B ) increased its per-share investments by 4% (better than the S&P’s return), and pre-tax earnings from non-insurance/non-investments also increased by 18%.

Intrinsic Value and Share Buybacks

Berkshire announced a share buyback last September 26, and it appears it managed to repurchase a meager $67mm of stock. The buyback level limit is easily determined — it is 110% of stated book value. It’s important to understand that Buffett wants to buy back his stock, at a price that is below intrinsic value. The implication is that 110% of book value (or $73.23 on the B shares) is well below intrinsic value.

Charlie and I have mixed emotions when Berkshire shares sell well below intrinsic value. We like making money for continuing shareholders, and there is no surer way to do that than by buying an asset — our own stock — that we know to be worth at least x for less than that — for .9x. 8x or even lower.

So, the obvious takeaway is that Buffett believes that $73.23 per share is 10%, 20% or perhaps 30% below intrinsic value. So, with book at $66.57 per B share, the simple range of equity values is:

This shows that Buffett likely views his stock as worth somewhere between $81 and $95 per B share. With such a buy back in place, there is good support for Berkshire equity at $73 or lower. And good reason to own it around $79.

In total Buffett is authorized to use up to $17BB of cash ($37BB total cash today less a $20BB limit) to repurchase stock. That could sop up almost 10% of the shares outstanding at $73. Note that above I also added in the cash that will be earned over 2012, to get a one-year target range of $85 to $100 per B share.

One of my simplistic measures of intrinsic value is to use a FCF yield on his stock. If $12BB in cash and dividends is rolling into Omaha, every year, then taking that on a per share basis (approximately $5.00 per B share) implies that the stock trades at a 6.3% FCF yield. Given the growth in earnings of 16% last year, this is a better than the S&P 500’s EPS growth last year, and at the same price (ie same P/E multiple).

In fact, if you strip out the capex spending in excess of its depreciation, then 2011 FCF looks like $20.5BB less $4.7BB = $15.8BB, or $6.38 per share. At current stock prices, that is an 8.0% FCF yield. I think 7% on this is pretty close to where a lot of blue-chip companies trade, which implies $91 per share as another means of looking at intrinsic value. This 8% that you are essentially getting today for owning this stock is quite attractive (especially with treasuries at 2%). Especially on what I deem as somewhat depressed earnings. More on that below.

Succession Planning

Buffett has finally named a CEO to replace him. At age 82, one of the biggest overhangs on the stock is his age and his as yet unidentified replacement. Plenty of headlines made the rounds here. I would add that recent hires Todd Combs and Ted Weschler each will manage around $1.75BB of the float for now, and likely to assist the new CEO in making business acquisitions given their excellent minds. I think they had a lot to do with Berkshire buying Mastercard (NYSE:MA ) and IBM for example, as well as encouraging the buyback.

Other Means of Valuing Berkshire

Between 2002 and 2008, Berkshire Hathaway historically traded at a fairly large multiple, averaging 1.6x book value. Since 2009 however, the stock has fallen to a steady level of 1.2 to 1.3x book. Put differently, BRK has actually underperformed the S&P 500 (NYSEARCA:SPY ) over the past 3 years. Lots of things going against the company can be cited:

- Housing has continued to be a drag on Berkshire earnings, with the company’s five housing related businesses contributing only $513mm of earnings last year, well down from the $1.8BB generated in 2006. As Buffett points out, housing starts are below new household formations, meaning this level cannot persist for too long.

- Insurance underwriting continues to worsen almost every year. In fact, the company’s four primary insurance company’s pretax earnings since 2006 have been: