Berkshire Hathaway class B stock is cheaper but that s all

Post on: 19 Июнь, 2015 No Comment

Q: Now that Berkshire Hathaway ‘s Class B shares (BRKB) are cheaper, does that mean they’re a good deal? Also, how do you make money on the investment if it doesn’t pay a dividend?

A: Shares of Berkshire Hathaway are on sale. Well, not really.

At first blush, it would seem there’s a fire sale on Berkshire Hathaway’s class B shares. The shares, which started the year around $3,500 each, are now trading for about $75, as you can see here .

The shares didn’t just fall 98% and present the buying opportunity of a lifetime. In January, in connection with Berkshire’s acquisition of railroad company Burlington Northern, Berkshire conducted a 50-for-1 split in its class B shares. That means each shareholder now owns 50 shares for each single share owned before the split; the share price was divided by 50 as the number of shares was boosted 50 times.

The result is a lower share price, which makes the stock more attractive to smaller investors. The class B shares were first offered in 1996 to ward off efforts by third parties to create mutual funds that would buy Berkshire stock. But since that time, the value of Berkshire’s B shares ran up to levels that put them out of reach again for small investors.

Remember this, though: Just because the stock price is lower, doesn’t mean the stock is a bargain. As part of a stock split, a company also increases the number of shares outstanding. As a result, the company is worth same before and after the stock split.

It’s also another reminder to investors that a stock’s share price is meaningless by itself. It needs to be compared with the number of shares outstanding and with fundamentals such as earnings and revenue.

If you’d like to know whether Berkshire is a good stock to buy, the analysis is the same as it was before the split. You can go here to read my most recent analysis of Berkshire as an investment.

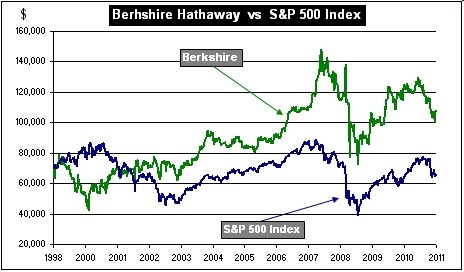

The second part of your question is even more interesting. You bring up a valid point. Unlike most companies in the Standard & Poor’s 500 stock index, Berkshire does not pay a dividend — the periodic cash payment by companies to their shareholders. Instead, Berkshire retains the cash it brings in from its businesses. That cash is then reinvested in other business opportunities or held to preserve liquidity. That liquidity was a big advantage for Berkshire during the financial meltdown, and allowed it to get lucrative deals lending to companies like General Electric.

But as with any stock that pays no dividend, you’re at the mercy of the stock market to generate all your returns. The way you will gain will be when other investors decide to pay more for shares of Berkshire than you did.

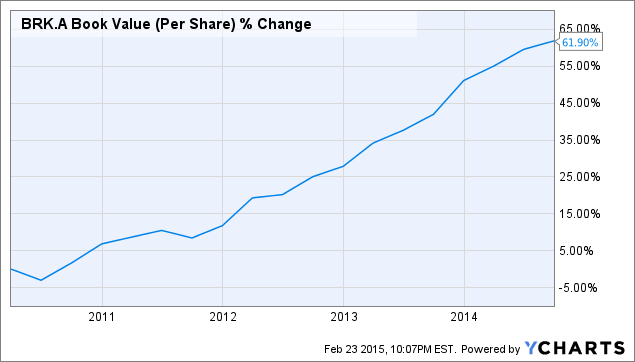

If the company makes wise investment decisions, and drives up revenue and earnings, other investors will gladly pay a bigger price for the shares, and you will have a paper profit.

If investors sour on Berkshire for whatever reason, you’ll need to be extremely patient during the downturn, since you won’t get any dividends to cushion the fall.

Matt Krantz is a financial markets reporter at USA TODAY and author of Investing Online for Dummies and Fundamental Analysis for Dummies. He answers a different reader question every weekday in his Ask Matt column at money.usatoday.com. To submit a question, e-mail Matt at mkrantz@usatoday.com. Click here to see previous Ask Matt columns. Follow Matt on Twitter at: twitter.com/mattkrantz