Benefits of Investing in Unit Trusts

Post on: 14 Июнь, 2015 No Comment

Unit Trust Investment in Malaysia

Today there are about 42 Unit Trust management companies, both conventional and Islamic ones, that offer Unit trust investment services in Malaysia and about 370 billion units in circulation. These numbers are clearly indicative of the popularity of the investment mode; Unit Trust investments have enjoyed this popular reputation not just in Malaysia but also in other parts of the world, where investors seek gains with some risk mitigation assurance.

How does a Unit Trust work?

A sum of money collected from people interested in investing, is broken down into units. The investing members are then assigned units, commensurate with their invested amount. This collected sum, is then invested by an investment manager for returns, that are shared with the unit holder. The more the units, the more an investor stands to gain from the returns. The trustee in the arrangement is responsible for monitoring the managers performance and in seeing that the trust is run as per the guidelines laid by the Securities Commissions and the Capital Markets & Services Act 2007.( “CMSA”)

The fact that a Trust is formed by a group of people offers a certain amount of safety in numbers, that investing in the market privately doesnt, and that perhaps is a definitive character of a Unit Trust arrangement.

Benefits of Investing in Unit Trusts

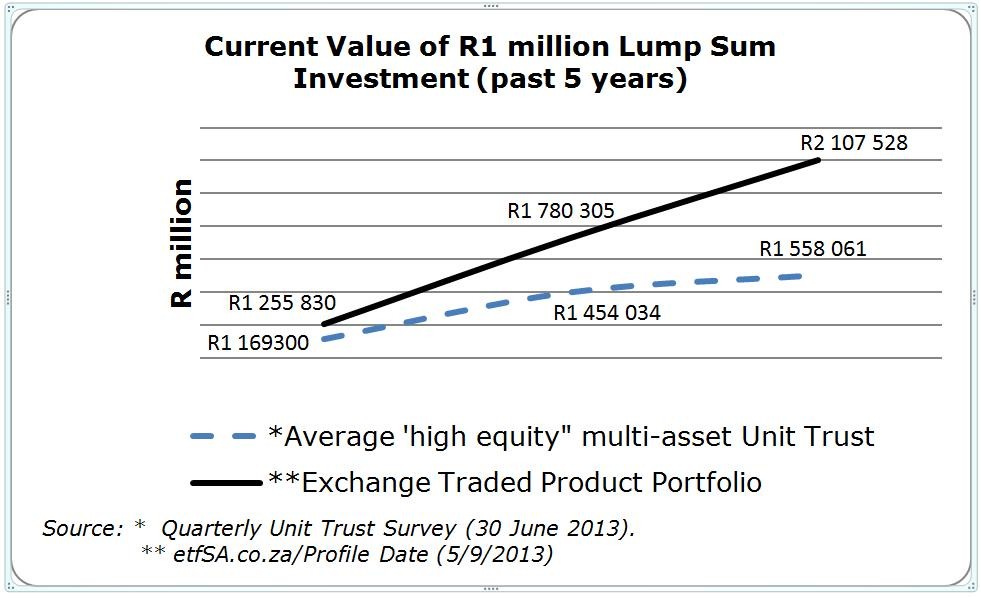

Unit Trusts investments are usually profitable over longer terms but are not without their ups and downs. Like any other market product their value at a given time will reflect the market condition prevailing. Still the benefits of a Unit Trust investment make them quite a product in the market. Here is a list of why you should consider a Unit Trust, if at all you are planning for an investment-

- Ease of Liquidation- Unlike many other instruments Unit trusts enjoy a certain degree of greater liquidity, that makes them easy to convert into cash at a short notice. They can sold ( wholly or in parts) at whatever the unit buying price is at that time. Also a unit trust manager has to buy back units from a unit holder on request.

- The collective advantage- With a substantial amount pooled in collectively the Unit Trust investor is able to access areas and sectors that otherwise would disqualify smaller amounts. This gives the investor a piece of the action in the market, which for him or her would otherwise be offlimits, given his funds and his expertise.

- The Professional angle- For someone starting for the first time, investment can be quite confusing; in most cases it leads to considerable losses before they begin to make profits. But as a part of a Trust, the investor has the advantage of professional expertise, professional research and market watch, that comes to him or her,by virtue of just being a unit holder. The investor doesnt have to do anything if he or she chooses to, to invest. Typically units cost lesser than other investment and for that lesser price, a first time investor can get a whole bouquet of professional help.

- The strict regulations-In Malaysia Unit Trusts are strictly regulated, so you can rest assured that there will be absolute transparency and honest dealing. Something that makes a big difference, especially in a situation when you are starting off without knowing head from tail of investment.