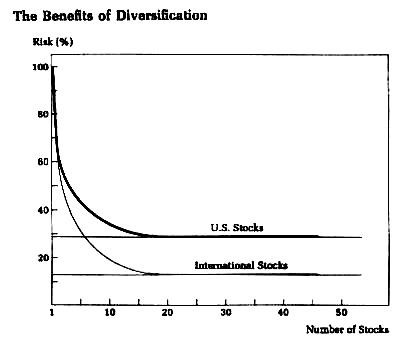

Benefits of diversification

Post on: 12 Июнь, 2015 No Comment

To reduce the risk of losing capital when investing, you should diversify your investment portfolio.

Diversification means spreading your capital across different investments to reduce your overall investment risk. So, if one investment performs poorly over a certain period, other investments may perform better over that same period, reducing the overall losses of your investment portfolio.

Diversification is a vital strategy for all investors. Generally, particular investments or asset classes will perform better than others over a specific period depending on a range of factors including:

- current market conditions

- interest rates, and

- currency markets.

No particular investment consistently outperforms other investments.

For example, during periods of increased sharemarket volatility, your share portfolio may suffer losses. If you also hold investments in other asset classes such as fixed interest or direct property that may perform better over the same period, the returns from these investments will smooth the returns of your overall investment portfolio.

Diversification within an asset class, such as investing across sectors in Australian shares, also reduces your overall losses for a specific period, as one sector may outperform another over the same period.

So, by diversifying your investments, you can achieve smoother, more consistent investment returns over the medium to longer term.

Diversifying your investment portfolio

Diversifying your investment portfolio means spreading risk by investing:

- across different asset classes such as cash, fixed interest, property, Australian and international shares

- within asset classes such as purchasing shares across different industry sectors

- across different fund managers if investing in managed funds, and

- into different investment structures. such as inside and outside of superannuation.

Listed investment companies

Listed investment companies (LICs) offer a simple way to spread your investments across a wide range of assets including Australian and international shares, fixed interest, unlisted companies and property. LICs are similar to managed funds, however LICs can be traded on the ASX, so you can buy and sell your investments at any time. Generally, LICs have a lower management expense ratio (MER) than managed funds.

Exchange traded funds

Another option is to invest in exchange traded funds (ETFs). ETFs are open ended investments that provide exposure to a portfolio of investments that make up a particular index such as the S&P/ASX 200 Index.

Like LICs, ETFs offer a simple way to diversify your investments and can be traded on the ASX.