Basics of Financial Ratios

Post on: 16 Март, 2015 No Comment

Income Statement Ratios

Income statements display sales, expenses and income for a given period of time. Analysts often look at these results and compare them to the stock price of the company. For example, the price to earnings ratio compares a company’s stock price to the company’s net income per share. The ratio tells investors what the market is willing to pay for earnings. Price to sales measures what investors are willing to pay for revenues. Analysts will also forecast earnings and then extrapolate a future share price based on industry average price to earnings ratios.

Tips and Tricks

Many websites have stock screeners that allow investors to filter companies by ratio performance. Google Finance, Yahoo Finance and many other premium investment sites let users search for companies based on ratio performance using queries. Many sites allow users to save queries and test strategies. Saved queries allow investors to quickly assemble a group of stocks to compare. Another useful site is Insidercow, which tracks inside sales and purchases by company management. This is a good way to test the faith of a company’s management in the stock’s future.

Warnings

References

Resources

More Like This

List of Financial Ratios

What Are the Three Most Important Financial Ratios?

How to Calculate Financial Ratios

You May Also Like

Financial statements provide the critical function of measuring the pulse of a business, controlling the operation and managing the financial aspects of.

If anyone could predict the stock market with any high and consistent degree of accuracy, such a person would be fabulously wealthy.

Personal-finance experts advise clients to periodically check their assets and liabilities, so they can spot instances of high indebtedness or the possibility.

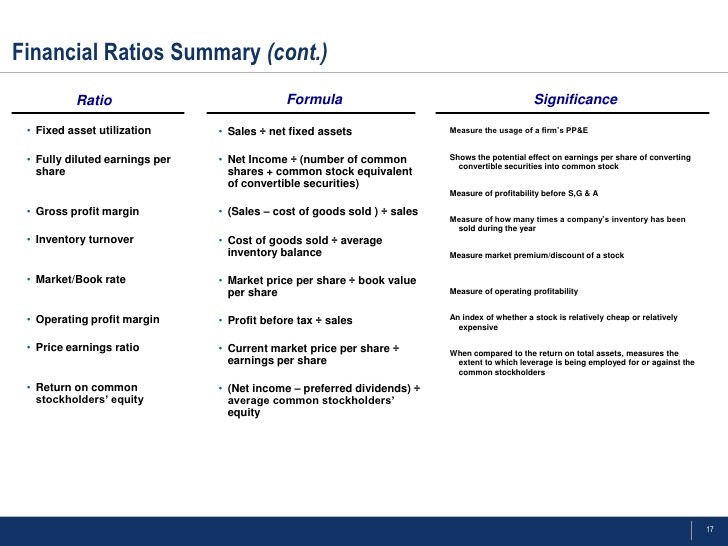

Financial ratios are relationships between one or more financial statement items. They are used by stock analysts and investors to compare companies.

Problems Associated With Using Financial Ratio Analysis. Analysts, investors and lenders analyze the financial health of a business by calculating financial ratios.

Investors purchase stocks to build financial resources over the long term. Tracking the stock market is part of monitoring the status of.

Financial accounting ratios make it easier to interpret complex financial data at the end of an accounting period, and give firms the.

Debt to equity is one of the most popular measures of debt and credit risk. This is because, in terms of ownership.

Industry financial ratios let you compare a company's performance against its industry average. Industry financial ratios are valuable to investors as they.

Business managers often use ratios to determine if their firms have healthy levels of debt, equity and assets. The debt-to-asset ratio measures.

Liquidity is defined as the ease and ability by which an asset or security can be converted into cash. For a business.