Basel III liquidity requirements and implications Governance and control of liquidity EY

Post on: 16 Март, 2015 No Comment

Assess your liquidity strategy in light of the existing legal and regulatory structure of your organization and identify whether the systems, data and management reporting are adequate to meet the requirements.

Regulators are tightening oversight and requirements with respect to the governance and control of liquidity.

The Basel Principles for Sound Liquidity Risk Management and Supervision sets out a number of fundamental requirements in the area of governance, starting from the top of the organization, and the guidelines in the US interagency guidance are essentially the same.

Establish a robust liquidity framework

Specifically, a robust liquidity management framework must be established, and a liquidity risk tolerance, appropriate to the business and the strategy, must be clearly articulated. This means that both the board and senior management need to have a thorough understanding of the risks and strategy, and the board must ensure that senior management translates this into a clear control environment with stress testing playing a key role.

The guidelines also focus on management of intra-day liquidity positions and risks, which poses systems challenges in many banks. Contingency planning is another area of regulatory focus. This requires planning in advance for how the bank would respond to a severe stress and the actions that would be taken. The contingency planning has to be activated well in advance of any stress to ensure that the actions are achievable.

Better liquidity contingency planning is also a theme in the recovery and resolution plans or “living wills” currently being developed by banks and other major financial services firms. The thinking behind a living will encompasses actions that banks could take to recover from a severe stress event that goes beyond those considered when establishing liquidity and capital buffers, as well as the final resolution if recovery proves not to be possible.

Liquidity contingency planning

Liquidity contingency planning is a key part of this process. However, there is recognition that it must be done in conjunction with contingency planning for capital. This reduces the risk that, for example, a bank’s contingency funding plan would call for asset sales that may generate liquidity, but may impair the firm’s capital.

There are also guidelines regarding incentive structures. The costs and risks of liquidity should be incorporated into internal pricing, performance management and new product approval. This raises fundamental concerns with regard to the operation of the business and the allocated liquidity costs that have an impact on its financial performance.

While most of the largest and most sophisticated financial institutions are working to integrate liquidity premiums within their funds transfer pricing frameworks, costs must be allocated at a granular level, considering contingent risk, to the entities that are the source of liquidity risk. Very few firms have internal charging mechanisms for liquidity risk, as defined in the Basel guidance, to the cost of funding.

More recently, US regulators have been increasingly focused on pricing for liquidity and linkage with economic capital, as well as the performance management process, metrics and reporting. The industry is clearly taking action to improve liquidity governance, spurred in part by the regulatory changes, but also by the concern in many banks about the damage caused by the liquidity crisis.

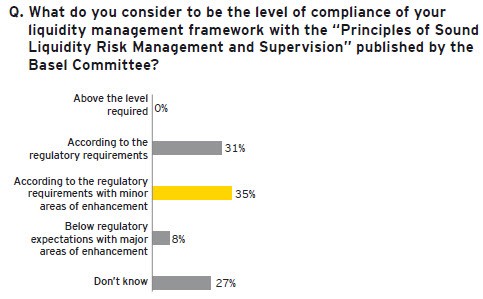

In 2009, we surveyed 38 of the largest banks across 20 countries regarding the changes banks are making to enhance risk governance and to implement the July 2008 Final Report of the Institute of International Finance Committee on Market Best Practices: Principles of Conduct and Best Practices Recommendations .

The findings revealed that 61% of all banks surveyed were changing their approach to liquidity governance and, among the G10 banks surveyed, the figure was 73%. In these early actions, many banks made their liquidity risk tolerance more explicit and began to enhance board reporting.

Banks also set more explicit limits regarding liquidity risk to communicate risk tolerance, and in some, the entire governance structure has been changed to move away from a solely asset-liability committee (ALCO) governance line toward greater involvement of the CRO’s independent risk organization.

Consider the interplay between assets, liabilities, liquidity and capital

Today, a growing number of large institutions are establishing a balance sheet management committee, chaired by a senior executive, to consider dynamically the strategic interplay between assets, liabilities, liquidity and capital. Within this structure, the asset-liability and capital committees (to the extent they exist) report to the balance sheet management committee.

This helps address the fact that in many institutions, the primary focus of the ALCO has been on funding and liquidity — ALCOs typically have taken their lead from the asset side of the business (lending or trading). While this approach may have worked in an environment where there was easy access to inexpensive wholesale funding, that is no longer the case.

Financial services firms recognize that funding is a binding constraint, and it must be closely aligned with business strategy, capital and financial planning. Modeling and enhanced stress testing have also been key areas of focus. But many banks are finding that systems and data are proving to be impediments.

A number have recently expressed the need for better consolidated data and also better information about contingent liabilities. Systems and data are said to be slowing down necessary improvements to internal management information, particularly in the wholesale banks.

The effects on your data and technology infrastructure

The new liquidity rules will require significant enhancements to the data and technology infrastructure of most institutions. While local supervisors will define specific requirements, such activities as producing detailed contractual cash flows over multiple time dimensions by currency, legal entity and potentially, line of business, as well as aligning contractual and behavioral cash flows to books and records, will require new approaches to data sourcing and management.

The SSG report, Observations on Developments in Risk Appetite Frameworks and IT Infrastructure ,issued on 23 December 2010, states that “to makeeffective business and risk management decisions, itis critical that they [firms] be able to aggregate timelyand accurate reporting on credit, market, liquidityand operational risks.”

The report emphasizes theimportance of implementing a comprehensive risk datainfrastructure that includes “consolidated platforms anddata warehouses that employ common taxonomies.” Thereport notes that data should be aggregated on a legal entity,as well as line-of-business basis.

The findings of the SSG report are consistent with experiences observed at global financial services institutions as they have worked to comply with the UK FSA cash flow reporting requirements, as well as with the emerging liquidity reporting requirements of other global supervisors.

Data to support regulatory reporting

Specifically, it is critical for there to be a single source of high-quality data to support both regulatory reporting and internal liquidity risk management. This is a significant departure from the historic approach, in which multiple groups generally sourced their own data, resulting in a complex array of databases holding similar data of inconsistent quality and granularity.

Adopting a single data-source strategy requires strong sponsorship from executive management and robust data governance. Another important leading practice is to ensure there is a well-defined treasury data model for liquidity risk management that allows for analysis, and for reporting that includes product, line-of business and legal-entity dimensions.

The SSG report also observes that “while many firms have devoted significant resources to infrastructure, very few can quickly aggregate risk data without a substantial amount of manual intervention.” Given that supervisors expect liquidity positions to be reported daily, significant continued investment in this area is necessary.

Most large financial institutions continue to leverage internally developed liquidity risk engines to perform stress testing and other analyses that support activities such as funds transfer pricing and strategic funding plan development.

However, an increasing number of firms are implementing vendor systems that provide a single platform for dynamic balance sheet projections, scenario analysis and stress testing. This approach allows the combined impact on liquidity, capital, earnings and solvency to be assessed within a single analysis based on common assumptions, time horizons and risk factors.

This is consistent with the recognition by the Basel Committee that capital and liquidity are equally important, and that both must be addressed to strengthen the resilience of the banking sector. Outputs from the risk engine(s) are captured in datamarts that support specific activities, such as liquidity reporting, capital management and funds transfer pricing.