Barbell investing beefing up risk adjusted returns

Post on: 7 Август, 2015 No Comment

Investing and weight lifting? I must have lost it. No, not quite yet. Bear with me. My latest post on cash as the ultimate diversification tool got me thinking about a very underused investment strategy, barbell investing. The term and strategy come from the bond world of investing. It is also a strategy used by professional investors in other asset classes to enhance returns and/or reduce risk in investment portfolios. Lets see how it works.

Barbell investing is often used in the bond world. It is often used as an alternative to a market bond portfolio made of mainly intermediate bonds. Instead of a market bond portfolio with intermediate risk and duration, a bond manager can implement a portfolio that is a combination of very short term bonds and very long term bonds with the same return of the market portfolio but with lower risk, or a portfolio with the same risk but higher returns. This is where the term barbell strategy comes from. Think of a barbell with the market portfolio representing the center of the barbell. The leftmost portion of the barbell would be the lower risk, lower return side, and the rightmost portion would be the higher risk, higher return side. In the end the barbell approach gives the investor better risk adjusted returns than the market portfolio. More recently barbell investing is being used with other asset classes especially stocks.

Lets take a look at an example of a barbell strategy that seeks to produce higher risk adjusted returns than the market stock portfolio represented by the S&P500 index. For the two sides of the barbell Im going to use cash as the low risk investment and Annaly Mortgage (NLY) to represent the high risk side of the barbell. NLY is just a proxy here for any high risk high return investment, just one that I think is a great choice for a barbell strategy in todays environment. The NLY portfolio can be a diversified investment in a group of high yielding mortgage REITS like NLY, CIM, AGNC, HTS, and IVR. Below is a table with the investment choices and two barbell portfolios; one that matches the return of the S&P500 and one that matches the risk of the S&P500.

The first part of the table shows the important parameters of the 3 asset classes; risk (volatility) and total return (div + div growth). The market portfolio, represented by SPY, has a risk of 18%, current dividend yield of 1.8%, and expected future growth of 4% (2% inflation plus 2% real GDP growth), for a total return expectation of 5.8% going forward. It is definitely not your 10% annualized stock return world any more. Then using the other 2 asset classes, cash and NLY, we produce two barbell portfolios. one that matches the return of SPY and one that matches its risk.

In the Barbell I portfolio, in order to match the SPY return we end up with an allocation of 61.3% to cash and 38.7% to NLY. The overall portfolio then has the same return of SPY, 5.8% but a risk factor of 14% or 21% less than the market portfolio. In addition, the overall portfolios return is composed mainly of dividends, with a portfolio yield of 5.42% vs the markets 1.8%. Overall barbell I has higher risk adjusted returns than the market portfolio. I think many investors would sleep better at night with the barbell I portfolio vs a portfolio of 100% in the SPY.

In the Barbell II portfolio, we match the risk of the SPY, and get an allocation of 50% to cash and 50% to NLY. Now the overall portfolios return increases to 7.5%, made up primarily of the 7% dividend yield, for the same risk as the market portfolio. Again, higher risk adjusted returns for the barbell strategy.

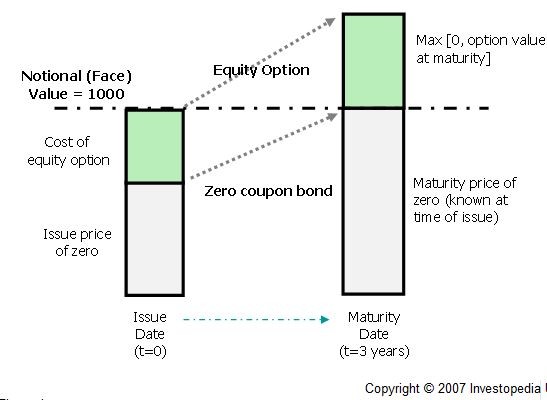

I grant that the example I used here is a bit extreme. But I just wanted to show what is possible. For example, there is no reason the low risk part of the barbell needs to be a zero return vehicle like cash. The low risk part of the barbell could be a portfolio of short duration bonds that at least provide some interest. At the other end of the barbell an investor can go more conservative, dividend yielders like MLPs for example, or even more aggressive, like options strategies with very high risk reward payoffs. The point is that with this approach an investor can construct a market beating portfolio in terms of risk adjusted returns.

Also, as I point out every so often volatility is not a great measure of true risk in many ways. Looking at different measures, like drawdown, gives you some different conclusions. For example, the maximum drawdowns for NLY and SPY are about the same, 50%. So, on this metric NLY and SPY are the same risk. The makes either barbell portfolio much less risky than the market portfolio. Also, from a risk perspective the barbell portfolio is much easier to manage than the market portfolio. For that risky investment in NLY, I can watch interest spreads, book values, etc and determine when it makes sense to reposition the barbell. For example, it turns out that when net interest margins are above 1% for mortgage REITS, their volatility is about 1/3 of the SPY.

In summary, barbell investing is a better option than standard asset allocation in many respects. Higher risk adjusted returns are achievable while attaining risk profiles that can be adjusted to fit many individual investor types. Now if I could only figure out how to combine investing and weightlifting.

Full Disclaimer — Nothing on this site should ever be considered advice, research or the invitation to buy or sell securities. These are my personal opinions only.