Balance Sheet The Foundation for Value

Post on: 2 Июнь, 2015 No Comment

Balance Sheet: The Foundation for Value

Let’s talk balance sheets… how exciting! Most people would rather hear nails scratching against a chalkboard or pour lemon juice on a fresh paper-cut, rather than slice and dice a balance sheet. However, the balance sheet plays a critical role in establishing the foundational value of a business. As part of my financial statement analysis series of articles, today we will explore the balance sheet in more detail.

It’s not just legendary value investors like Warren Buffett and Benjamin Graham who vitally rely on a page filled with assets and liabilities. Modern day masters like Bill Ackman (CEO of Pershing Square Capital Management LP – read more about Bill Ackman ) and Eddie Lampert (CEO of Sears Holdings SHLD) have in recent years relied crucially on the balance sheet, and specifically on real estate values, when it came to defining investments in Target Corporation (TGT) and Sears, respectively.

Balance Sheet Description

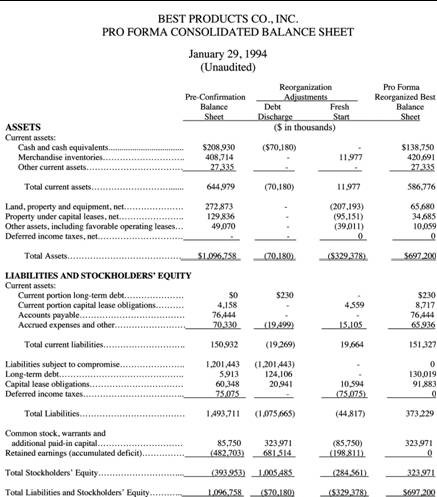

What is the balance sheet? For starters, it is one of the three major financial statements (in addition to the “Income Statement” and “Cash Flow Statement”), which provides a snapshot summary of a company’s assets, liabilities, and shareholders’ equity on a specific date. One of the main goals of the balance sheet is to provide an equity value of the corporation (also called “book value”).

Conceptually the balance sheet concept is no different than determining the value of your home. First, a homeowner must determine the price (asset value) of the house usually as a function of the sales price (estimated or actual). Next, the mortgage value (debt) is subtracted from the home price to arrive at the value (equity) of the homeowner’s position. The same principle applies to valuing corporations, but as you can imagine, the complexity can increase dramatically once you account for the diverse and infinite number of potential assets and liabilities a company can hold.

Many key financial analysis metrics are derived directly from the balance sheet, or as a result of using some of its components. Here are a few key examples:

- ROE (Return on Equity): Derived by dividing the income from the income statement by the average equity value on the balance sheet. This indicator measures the profitability of a business relative to shareholders’ investments. All else equal, a higher ROE is preferred.

- P/B (Price to Book): A ratio comparing the market capitalization (total market price of all shares outstanding) of a company to its book value (equity). All else equal, a lower P/B is preferred.

- Debt/Equity or Debt/Capitalization: These ratios explain the relation of debt to the capital structure, indicating the overall amount of financial leverage a company is assuming. All else equal, lower debt ratios are preferred, however some businesses and industries can afford higher levels of debt due to a company’s cash flow dynamics.

There are many different ratios to provide insight into a company, nonetheless, these indicators provide a flavor regarding a company’s financial positioning. In addition, these ratios serve a valuable purpose in comparing the financial status of one company relative to others (inside or outside a primary industry of operation).

Balance Sheet Shortcomings

The balance sheet is primarily built upon a historical cost basis due to defined accounting rules and guidelines, meaning the stated value of an asset or liability on a balance sheet is determined precisely when a transaction occurs in time. Over time, this accounting convention can serve to significantly understate or overstate the value of balance sheet items.

Here are a few examples of how balance sheet values can become distorted:

- Hidden Assets: Not all assets are visible on the balance sheet. Certain intangible assets have value, but cannot be touched and are not recognized by accounting rules on this particular financial statement. Examples include: human capital (employees), research & development, brands, trademarks, and patents. All these items can have substantial value, yet show up nowhere on the balance sheet.

- Lack of Comparability: Comparability of balance sheet data can become fuzzy when certain accounting rules and assumptions are exercised by one company and not another. For instance, if two different companies purchased the same property, plant, and equipment at the same time and price, the values on the balance sheets may vary significantly in the future due to the application of different depreciation schedules (e.g. 10 years versus 20 years). Share repurchase is another case in point that can alter the comparison of equity values – in some cases resulting in a negative equity value.

- Goodwill & Distorted M&A Values: Companies that are active with mergers and acquisitions are forced to reprice assets and liabilities upwards and downwards (inflation, or the lack thereof, can lead to large balance sheet adjustments). Goodwill (asset) is the excess value paid over fair market value in an acquisition. Goodwill can be quite substantial in certain transactions, especially when a high premium price is paid.

- Write-offs and Write-ups: In 2001, telecom component maker JDS Uniphase (JDSU) slashed the value of its goodwill by a massive $44.8 billion. This is an extreme illustration of how the accounting-based values on the financial statement can exhibit significant differences from a company’s market capitalization. Often, the market value (the cumulative value of all outstanding market-priced shares) is a better indicator of a company’s true value – conceptually considered the present value of all future cash flows.

Some balance sheets are built on shaky foundations. A risky, debt-laden balance sheet can resemble a shoddy home foundation built on sand, along an earthquake fault-line. In other words, a small shock can lead to financial collapse. In the credit-driven global bubble we are currently working through, many companies that were built on shaky foundations (i.e. a lot of debt) are struggling to survive. Survival may be dependent on a company restructuring, selling assets, paying down debt, merging, or other tactic with the aim of shoring up the balance sheet. Using the balance sheet value of a company in conjunction with the marketplace price of the same business can be a valuable approach in establishing a more reliable valuation. Before you make an investment or valuation conclusion about a company, do yourself a favor and dig into the balance sheet to verify the condition and soundness of a company’s financial foundation.

Wade W. Slome, CFA, CFP®

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients own certain exchange traded funds, but at time of publishing had no direct positions in TGT, SHLD, or JDSU. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC “Contact” page.